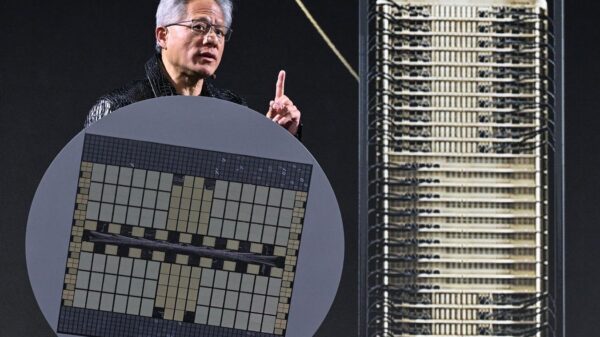

Intel’s stock has experienced a remarkable resurgence, doubling in value over the last six months, largely propelled by significant investments from the U.S. government and tech giant Nvidia. Despite this upward momentum, the company remains substantially behind its rival, Taiwan Semiconductor Manufacturing Corporation (TSMC), which has established itself as a dominant force in the semiconductor manufacturing sector.

After years of underperformance in the market, Intel (INTC +11.04%) has found a new lease on life. The company’s shares soared following a 9.9% stake acquisition by the U.S. government last August, complemented by Nvidia’s $5 billion investment in September. These financial boosts provided Intel with the necessary capital to invest in its foundry business and develop new artificial intelligence (AI) products. Furthermore, under the leadership of new CEO Lip-Bu Tan, Intel aims to streamline operations, reduce costs, and shift its corporate culture to be more agile and startup-like.

However, despite the recent stock rally, Intel’s fourth-quarter earnings report revealed underlying challenges. The company reported a 4% decline in revenue to $13.7 billion and a GAAP loss of $591 million, although it was profitable on an adjusted basis. Looking ahead, Intel projects revenue between $11.7 billion and $12.7 billion for the first quarter, indicating a sharp sequential decline, with adjusted earnings per share anticipated to break even.

While investors may be tempted to view Intel’s stock as a way to benefit from the booming AI infrastructure market, TSMC emerges as a more reliable option. As the world’s leading contract semiconductor manufacturer, TSMC (TSM +1.14%) boasts a market capitalization of $1.8 trillion, underpinning its indispensable role in the global economy. The company serves as a primary chip supplier for industry giants, including Apple, Nvidia, AMD, and Broadcom, manufacturing over half of the world’s contract chips and an estimated 90% of advanced contract chips.

TSMC’s robust growth and strong profit margins during the AI boom are noteworthy. In its fourth quarter, the company reported a 25.5% increase in revenue to $33.7 billion, achieving an operating margin of 54%, equivalent to $18.2 billion in operating income. Currently, 77% of TSMC’s revenue is generated from advanced chips, defined as those produced with 7 nanometer (nm) technology or smaller. The stock trades at a price-to-earnings ratio of 32, slightly higher than the S&P 500, reflecting its competitive advantages and investor confidence despite concerns about geopolitical tensions in the region.

In contrast to TSMC’s growth trajectory, Intel’s challenges are evident. The company operates primarily through its products and foundry divisions. While Intel has restructured its business model to open its foundry to external customers, including Amazon, the results have yet to bear fruit. The company’s foray into advanced manufacturing processes, such as the recently launched 18A (18 angstroms or 1.8nm), holds promise but faces significant hurdles. Intel has incurred substantial losses annually on its foundry business as it seeks to establish itself in third-party manufacturing.

Currently, Intel’s stock appears more expensive than TSMC’s, despite the former’s flat revenue and ongoing GAAP losses. Analysts anticipate TSMC’s revenue growth will compound at around 25% annually through 2029, with the company maintaining high operating income margins. While Intel’s narrative of a turnaround might attract interest, TSMC remains the safer investment option, especially in a market increasingly driven by AI developments.

As the semiconductor landscape evolves, the contrast between Intel and TSMC underscores the varying trajectories of major industry players. While Intel aims for a significant comeback, TSMC’s established position and performance metrics suggest it will continue to lead the market as long as the demand for AI technologies remains strong.

See also AI Hardware Demand Surges as TrendForce Projects 134% Growth in Memory Sector by 2026

AI Hardware Demand Surges as TrendForce Projects 134% Growth in Memory Sector by 2026 Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse