Artificial intelligence (AI) is increasingly dominating financial markets, with investors channeling significant capital into AI chips, software, and data centers. Company leaders are touting AI as a crucial growth engine, while governments see it as a means to enhance productivity and bolster long-term economic strength. However, the surge in interest raises questions about whether this enthusiasm signals the dawn of a lasting transformation or if the markets have surged too far too quickly.

The reality is likely a combination of both optimism and caution. Market bubbles often form when asset prices escalate faster than actual business performance. This optimism can lead investors to buy stocks in anticipation of future buyers willing to pay even more. Certain sectors within the AI landscape are starting to exhibit signs of this behavior. While investments have surged, tangible improvements in profits and productivity remain elusive for many businesses outside a select group of large technology firms. A significant number of companies are still at the nascent stage of integrating AI into their operations, with few translating this potential into higher earnings.

The mistake is not believing in the technology, but assuming early winners and high prices will last forever.

This scenario echoes the late 1990s, when investors flocked to internet companies before many had established sustainable business models. The subsequent bubble burst led to the collapse of numerous firms. Yet the internet itself endured, fundamentally reshaping shopping, work, communication, and entertainment. The lesson from that era is clear: transformative technologies often emerge amidst financial exuberance. The challenge lies not in doubting the technology’s potential but in overestimating the durability of early successes and inflated valuations.

Market booms typically dissipate not due to a loss of interest in the narrative but when investor confidence wanes or access to capital tightens. Historically, rising interest rates have catalyzed such shifts. However, this cycle appears distinct, as central banks are shifting towards potential rate cuts rather than increases, which has contributed to a more stable market environment.

Nonetheless, long-term borrowing costs have risen, particularly in the United States, subtly tightening financial conditions. Additional risks that could alter investor sentiment include disappointing earnings from major AI firms, stricter regulations, or signals of a slowdown in corporate spending on new technologies.

Holding a modest overweight in shares and other higher risk assets still makes sense for many.

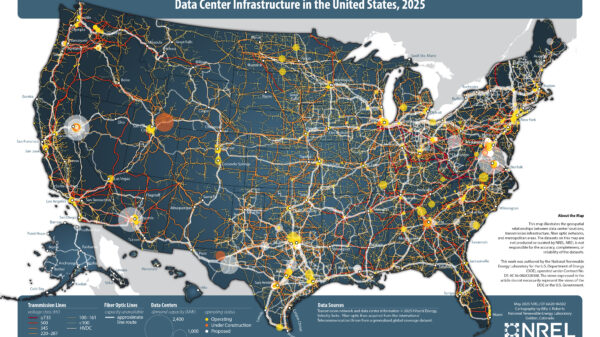

As long as confidence remains intact, investments linked to AI are likely to keep flowing. Substantial funding continues to be allocated to long-term projects, and much of the necessary infrastructure is still under construction. Economic growth has outperformed expectations, government expenditure is ongoing, and central banks are anticipated to continue easing policies, supporting risk appetite.

High-yield bonds have gained favor among investors as they provide income during uncertain times. These bonds offer relatively attractive yields, low default rates, and robust balance sheets among issuing companies. They are also generally less sensitive to rising interest rates compared to long-term government bonds. However, investors must remain vigilant, as weaker firms may face greater vulnerabilities should economic conditions deteriorate.

Government bonds, once viewed as the cornerstone of safety in investment portfolios, now appear less reliable as inflation risks loom due to high public debt and ongoing budget deficits. In the United States, political pressures to bolster household income and economic growth could result in looser fiscal policies, potentially maintaining inflationary pressures even as interest rates decline. Consequently, many investors are moderating their exposure to longer-dated bonds.

Market leadership is gradually expanding. While major U.S. technology firms continue to dominate the spotlight, opportunities are emerging in other regions. Shares outside the U.S. are generally more affordable, with Europe poised to benefit from increased defense and infrastructure spending, while Japan attracts interest due to improved corporate governance. Although China faces challenges, its export capacity and role in global technology supply chains remain critical. U.S. smaller companies are also becoming more appealing, particularly if lower interest rates boost domestic growth.

If companies reduce spending on AI projects, U.S. growth could weaken and affect markets globally.

Currency markets add an additional layer of complexity, with different nations contending with varying growth and inflation pressures, resulting in ongoing volatility. Although the U.S. dollar has weakened recently, it continues to serve as a defensive asset in times of uncertainty, offering relatively higher interest rates. While selective investment opportunities exist elsewhere, prudent choices are essential.

Looking ahead, the most significant risk is not the disappearance of AI but the potential for a sharp decline in investment. Should companies cut back on AI initiatives, it could lead to weakened economic growth in the U.S., affecting global markets. Other threats include rising unemployment, the return of inflation, tighter financial conditions, and geopolitical tensions. In an environment of high optimism, markets can react sharply to even minor shifts in expectations.

Artificial intelligence is poised to influence the global economy for years to come. However, the current excitement bears familiar hallmarks of excess. For investors, the goal should be to find a measured balance between opportunity and risk, recognizing that while enthusiasm can drive markets, prudent assessment often yields the most sustainable outcomes when moods inevitably shift.

Yoram Lustig is the head of global investment solutions, EMEA, at T Rowe Price.

See also Enhance Your Website”s Clarity for AI Understanding and User Engagement

Enhance Your Website”s Clarity for AI Understanding and User Engagement FoloToy Halts Sales of AI Teddy Bear After Disturbing Child Interactions Found

FoloToy Halts Sales of AI Teddy Bear After Disturbing Child Interactions Found AI Experts Discuss Vertical Markets: Strategies for Targeted Business Growth

AI Experts Discuss Vertical Markets: Strategies for Targeted Business Growth Law Firms Shift to AI-Driven Answer Engine Optimization for Enhanced Marketing Success

Law Firms Shift to AI-Driven Answer Engine Optimization for Enhanced Marketing Success Anthropic Disrupts State-Sponsored Cybercrime Using Claude AI, Reveals Key Insights

Anthropic Disrupts State-Sponsored Cybercrime Using Claude AI, Reveals Key Insights