Small business owners can soon expect finance workflows to be significantly altered by the integration of AI technology. At the checkout step on supplier portals, for instance, a LoanBot may offer trade credit lines with fixed-day terms and dynamic discounting for early payments, all embedded directly in the payment flow. Furthermore, fintech agents could not only compare loan terms across providers but also check the credit history of business owners, process applications, and credit funds into the suppliers’ accounts autonomously.

This capability allows AI agents to execute complex, multi-step decision-making tasks in mere minutes, fundamentally reshaping user behavior and customer experience. However, realizing this potential demands more than just technological innovation; it requires robust digital engineering, regulatory collaboration, and a strong integration of financial and technical expertise across organizations.

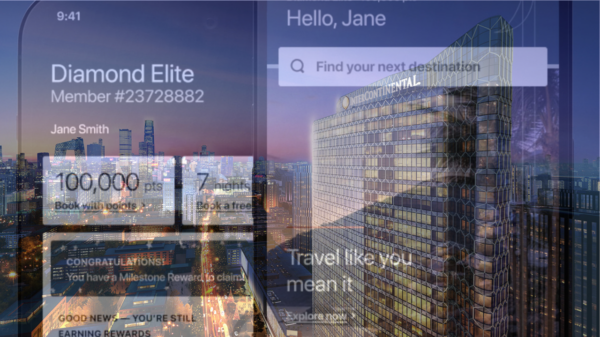

As agents increasingly serve as intermediaries, financial institutions reliant on brand loyalty may find themselves vulnerable. Historically, banks and lenders have benefited from customer “stickiness,” yet the rise of Agentic AI shifts the decision-making landscape from emotional choices to algorithmic optimization. AI agents continuously scan the market for optimal rates, lowest fees, and most favorable terms, executing changes almost instantly. Financial institutions must reassess their value propositions, as competing solely on convenience or brand may no longer suffice. Instead, they need to create products that cater to agent-friendly conditions, featuring transparent metadata and dynamic pricing that appeal to algorithmic decision-making.

Despite the promise of Agentic Finance, significant barriers to growth remain. According to a recent report from Boston Consulting Group, only 27% of banks are deemed future-ready. Many institutions still grapple with outdated technological frameworks, such as fragmented data systems and legacy architectures. Transitioning from prototype to production necessitates a strong digital infrastructure, with a strategic alignment between business outcomes, governance, and data readiness. A global payments leader, for example, has struggled to justify the ROI of AI investments due to siloed pilot programs that led to inefficiencies and governance risks. By adopting a centralized AI framework, the company transformed its scattered pilots into a cohesive enterprise-scale AI ecosystem.

With increasing scrutiny on digital transformation budgets, financial institutions face mounting pressure to demonstrate that their AI initiatives yield measurable impacts. Notable improvements include productivity gains across the lifecycle, operational cost reductions ranging from 30% to 50%, and advancements in cycle time and quality. Institutions employing AI-driven tools have reported enhanced efficiency in software development and data modernization, alongside better compliance scores and improved deployment frequency.

However, trust remains a vital foundation for AI adoption in finance. Most AI solutions are still in nascent stages, rendering them susceptible to errors that could be catastrophic in autonomous finance scenarios. A miscalculation in loan approvals or payment routing could result in significant financial losses or regulatory breaches. These risks are magnified in closed systems where decision criteria are unclear, potentially introducing biases and unfair outcomes. Security concerns further complicate the landscape, as autonomous agents require access to sensitive financial data, making them attractive targets for cyberattacks. Without zero-trust architectures and robust security measures, institutions risk exposing themselves to fraud and data breaches.

As AI regulations continue to evolve, regulators demand comprehensive documentation of decision-making processes, especially concerning credit and compliance workflows. AI systems must provide traceable logs and interpretable outputs to satisfy governance requirements and maintain consumer trust. Moreover, a human-in-the-loop model remains essential; while autonomy is the end goal, human oversight serves to ensure ethical decision-making and mitigate systemic risks. Many institutions are already adopting hybrid workflows, allowing AI to manage routine tasks while escalating exceptions to human reviewers.

Overall, Agentic AI stands at the forefront of fintech innovation, embedding autonomous decision-making into everyday workflows and delivering speed, personalization, and scalability in compliance. The path forward hinges on robust digital engineering, effective governance, and frameworks of trust to transition prototypes into production-ready ecosystems.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025