Following a significant strategic transformation completed in late 2025, Healwell AI has repositioned itself as a dedicated healthcare software and artificial intelligence company. The firm has shifted its focus entirely to Software as a Service (SaaS), services, and data science, stepping away from its previous involvement in clinical operations. This pivot has triggered a muted market response, establishing 2026 as a critical year for Healwell AI to showcase tangible growth stemming from its new direction.

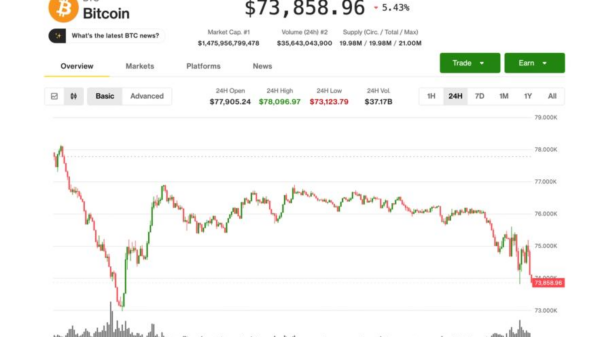

The healthcare AI landscape is rapidly evolving, with providers globally evaluating digital solutions to enhance clinical decision-making and improve data interoperability. However, this evolving landscape puts pressure on companies like Healwell AI to demonstrate commercial viability by converting their technologies into sustainable revenue streams. This impatience is reflected in Healwell AI’s stock performance, which has seen shares decline approximately 52% over the past twelve months, currently trading at 0.57 USD.

Healwell AI streamlined its operations through transactions finalized in November 2025. In an effort to establish itself as a focused “Enterprise” solutions provider for the healthcare sector, the company divested non-core clinical assets to WELL Health Technologies and its subsidiaries. Simultaneously, Healwell AI enhanced its portfolio with the acquisition of Orion Health, an international healthcare intelligence platform, significantly boosting its capacity for large-scale, professional software implementations.

Key details of the restructuring include a refocused core business centered on SaaS, services, AI, and data science; the integration of the Orion Health platform; the divestment of clinical assets to WELL Health Technologies; and the completion of these transactions in November 2025. This strategic shift aims to strengthen Healwell AI’s market position amidst growing competition in healthcare technology.

Should investors sell immediately? Or is it worth buying Healwell AI?

Looking ahead to 2026, the immediate benchmark for investors will be the full-year 2025 financial results, which are typically released in the spring quarter. This report will deliver the first comprehensive insight into Healwell AI’s performance under its new strategy and the progress of integrating Orion Health.

A central focus will be the success of cross-selling Healwell’s proprietary AI technologies within Orion’s existing customer base, which includes public sector clients. Achieving a successful rollout within Orion’s global network is explicitly identified as a key objective. Additionally, the market is keenly watching for concrete developments in the Middle East, particularly stemming from a Memorandum of Understanding signed with Lean Business Services in Saudi Arabia in October 2025. The emphasis here will shift from declarations of intent to evidence of solid commercial contracts or pilot projects.

Ultimately, 2026 is positioned as a year of execution for Healwell AI. The anticipated value of the company’s strategic pivot will be measured by successful integration, sales traction through the Orion Health channel, and demonstrable progress in new geographic markets. The first significant test arrives with the spring release of the 2025 financial figures, which will be scrutinized closely by investors and market analysts alike.

Ad

Healwell AI Stock: Buy or Sell?! New Healwell AI Analysis from February 4 delivers the answer:

The latest Healwell AI figures speak for themselves: Urgent action needed for Healwell AI investors.

Is it worth buying or should you sell? Find out what to do now in the current free analysis from February 4.

Healwell AI: Buy or sell?

Read more here…

Hackers Exploit Hugging Face to Distribute 6,000+ Android Banking Trojans

Hackers Exploit Hugging Face to Distribute 6,000+ Android Banking Trojans Bitcoin Plummets to 2024 Low Amid AI Disruption Fears and Geopolitical Tensions

Bitcoin Plummets to 2024 Low Amid AI Disruption Fears and Geopolitical Tensions Fei-Fei Li Highlights Urgent Need for Spatial Intelligence in Advancing AI Applications

Fei-Fei Li Highlights Urgent Need for Spatial Intelligence in Advancing AI Applications Lincoln County Proposes Year-Long Moratorium on AI Hyperscale Data Centers

Lincoln County Proposes Year-Long Moratorium on AI Hyperscale Data Centers Grok Still Generates Non-Consensual Sexualized Images Despite Promised Safeguards

Grok Still Generates Non-Consensual Sexualized Images Despite Promised Safeguards