Three U.S. senators are urging federal regulators to investigate potential antitrust violations associated with “acquihires” by leading artificial intelligence (AI) firms. In a letter sent on February 4 to the Federal Trade Commission (FTC) and the Department of Justice (DOJ), Senators Elizabeth Warren, Ron Wyden, and Richard Blumenthal expressed concerns that major technology companies might be circumventing antitrust laws to reduce competition in the sector.

The letter shines a spotlight on practices termed “reverse acqui-hiring,” wherein large firms employ tactics to recruit top talent and intellectual property from startups without engaging in formal acquisitions. This strategy, the senators argue, could undermine competition and innovation within the tech landscape. “These deals function as de facto mergers, allowing the companies to consolidate talent, information, and resources, all while apparently attempting to bypass the scrutiny typically applied to mergers and acquisitions,” the letter states.

The lawmakers pointed to three specific deals as examples of these potentially problematic arrangements. First, in December, Nvidia announced it would acquire assets from AI chipmaker Groq for approximately $20 billion to secure its senior leadership. Second, in June, Meta invested $14.3 billion to attract Scale AI CEO Alexandr Wang to spearhead its global AI strategy. Lastly, in July, Google entered into a $2.4 billion “nonexclusive licensing agreement” with Windsurf, effectively transferring key leaders from the coding startup to Google’s payroll.

The senators caution that such deals could further entrench the dominance of Big Tech, potentially leading to higher prices for consumers and stifling innovation. They argue that the FTC and DOJ must not allow these companies to evade the customary reviews that accompany mergers and acquisitions. “The FTC and DOJ should carefully scrutinize these deals and block or reverse them should they violate antitrust law,” the letter reads.

This call for scrutiny comes on the heels of a statement by FTC Chairman Andrew Ferguson in January, indicating a renewed focus on examining such transactions. Both lawmakers and regulators are increasingly concerned about the rising power and influence of tech giants, especially in the rapidly evolving AI sector. The senators believe that by examining these arrangements more closely, the agencies can ensure fair competition and protect consumer interests.

The implications of this scrutiny extend beyond the immediate concerns raised by the senators. If the FTC and DOJ take action against these types of deals, it could alter how tech companies pursue talent and innovation in the future. With AI playing a pivotal role in shaping various industries, the regulatory landscape for tech firms may see significant changes aimed at fostering competition and preventing monopolistic practices.

As the discussion around antitrust regulations heats up, the actions taken by the FTC and DOJ in response to these senators’ requests could set important precedents for how tech companies navigate the complex intersection of talent acquisition and competitive practices in the AI realm.

See also Global Leaders Urge Collaboration to Bridge $1.6 Trillion Digital Infrastructure Gap Amid AI Transformation

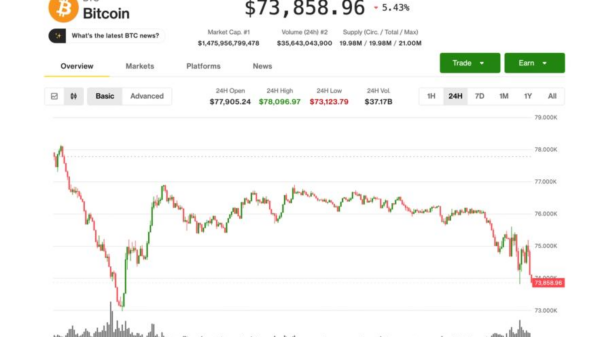

Global Leaders Urge Collaboration to Bridge $1.6 Trillion Digital Infrastructure Gap Amid AI Transformation Bitcoin Dips Below $74K as Tech Stocks Plunge, Mining Firms Face Double-Digit Losses

Bitcoin Dips Below $74K as Tech Stocks Plunge, Mining Firms Face Double-Digit Losses DeepMind Launches AlphaGenome, a Tool Decoding 98% of Non-Coding DNA for Disease Insights

DeepMind Launches AlphaGenome, a Tool Decoding 98% of Non-Coding DNA for Disease Insights Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT