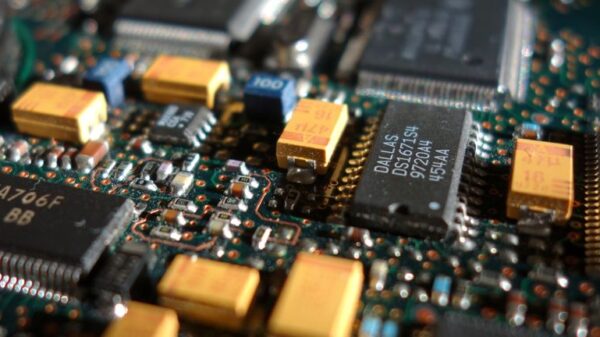

A significant decline in stock prices was observed in the afternoon trading session as uncertainty looms regarding the timeline for major companies to resume large-scale sales of high-end artificial intelligence (AI) chips to China. The U.S. government has reportedly extended its review of export license applications for AI hardware, including Nvidia’s H200 chips, citing national security concerns. This delay has sparked apprehension among chipmakers and dissuaded some Chinese customers from placing orders until more definitive guidance is provided. The situation underscores the continuing geopolitical tensions that are impacting the global supply chain within the semiconductor industry.

Market reactions to such news can often be dramatic, with significant price drops sometimes offering opportunities to acquire high-quality stocks at lower prices. The ripple effects of this uncertainty were felt across the semiconductor sector, which has been a focal point of investment amidst increasing demand for AI technology.

Among the companies affected by this recent turbulence is Semtech Corporation, whose shares are known for their volatility, having experienced 47 price moves greater than 5% in the last year alone. The current market sentiment indicates that this latest news is perceived as significant, yet not transformative enough to alter the long-term outlook for Semtech’s business. Just 20 days prior, the stock gained 5.2% on news that Taiwan Semiconductor Manufacturing Company (TSMC) had reported unexpectedly strong quarterly results, which had initially fueled optimism about sustained demand for AI hardware.

As the world’s largest contract chipmaker, TSMC’s performance is often regarded as a bellwether for the tech sector. Recently, TSMC announced record revenue for the fourth quarter, surpassing analysts’ expectations due to robust demand for advanced chips specifically designed for AI applications. This positive development has contributed to a broader sense of optimism within the semiconductor industry, lifting the shares of other companies such as Nvidia, Advanced Micro Devices (AMD), and ASML. Investors view TSMC’s success, along with its plans to increase capital expenditures, as a strong indicator that the AI-driven semiconductor upcycle remains resilient and likely to continue.

As of now, Semtech has seen its stock appreciate by 8.7% since the beginning of the year, trading at $81.81 per share, which is near its 52-week high of $87.76 from February 2026. Investors who purchased $1,000 worth of Semtech shares five years ago would now find their investment has grown to approximately $1,131, demonstrating a stable performance over time despite the recent market fluctuations.

This scenario illustrates the intricate balance technology companies must maintain amid evolving regulatory landscapes and international relations. As firms navigate through these challenges, the semiconductor industry remains pivotal in shaping the future of AI technology. The ongoing scrutiny over exports to China adds an additional layer of complexity to an already dynamic market, compelling investors to remain vigilant and adaptable.

As companies like Semtech continue to respond to market conditions and regulatory pressures, the long-term implications for the semiconductor sector will become clearer. Stakeholders will be watching closely for any further developments regarding U.S.-China trade policies and their impact on technology exports. The interplay of geopolitical tensions and the robust demand for AI will likely dictate market performance in the months ahead, highlighting the necessity of strategic navigation within an increasingly interconnected global economy.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech