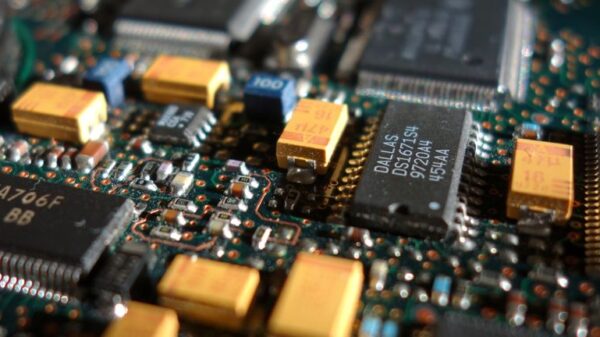

Investors are closely monitoring Monolithic Power Systems ahead of its earnings release set for mid-February 2026. Recent analyst assessments have highlighted robust revenue trends and healthier inventory levels, underscoring expectations for significant year-on-year revenue growth and improved earnings per share. The spotlight is particularly focused on the surging demand from automotive and artificial intelligence applications, alongside strong revenue streams linked to enterprise data and electric vehicle (EV) sectors, which could bolster the company’s standing in the highly competitive power management chip market.

To hold a stake in Monolithic Power Systems, investors must believe that the company’s power management chips will remain integral to the long-term demand landscape in data centers, AI servers, and increasingly electronics-intensive vehicles. Analysts have indicated that the recent pre-earnings news, which points to solid revenue trends and improved inventory management, supports existing catalysts rather than altering the narrative. With expectations set for double-digit year-on-year revenue growth and solid earnings per share, all eyes will be on whether the anticipated Q4 results and future guidance can validate the recent surge in share price and justify a modest premium to consensus fair value. A significant near-term risk now revolves around execution challenges against elevated expectations, particularly if there is any slowdown in enterprise data orders or EV-related demand.

Monolithic Power Systems’ share price has experienced a decline, which may position it deeper into value territory. Investors are encouraged to assess whether the stock is a bargain at its current levels. Recently, twelve members of the Simply Wall St Community have placed MPWR’s fair value between approximately US$410 and just under US$1,200, showcasing a broad range of personal valuation models. The near-term investment narrative hinges on the company’s ability to sustain its recent performance, driven by AI and automotive demand.

As the market anticipates strong earnings and robust demand from key sectors, contrasting perspectives on the company’s fair value are emerging. Some analysts suggest that the stock could be worth significantly less than its current market price, prompting a deeper examination of the various viewpoints before making investment decisions.

For those who may disagree with the prevailing assessments, the opportunity exists to formulate an independent narrative, underscoring that extraordinary investment returns often come from diverging from mainstream thought.

In a broader context, the ongoing scrutiny of Monolithic Power Systems comes at a time when industries are increasingly reliant on advanced technologies, like AI and electric vehicles, which are expected to drive demand for power management solutions. Staying informed about evolving market dynamics is essential for investors looking to navigate these trends effectively.

To further enhance their investment strategies, individuals are encouraged to explore daily scans that reveal stocks with breakout potential. It’s crucial to note that the analysis provided by Simply Wall St is general in nature, based on historical data and analyst forecasts, and is not intended as financial advice. The publication does not hold positions in the stocks mentioned and emphasizes that it does not account for individual investment objectives or financial situations.

As the earnings release approaches, the anticipated performance of Monolithic Power Systems could serve as a bellwether for the broader tech sector, particularly for companies engaged in power management and related technologies. Investors will be closely watching to see if the company can meet elevated expectations in an increasingly competitive environment.

For investors interested in tracking their portfolios, Simply Wall St offers a free tool to manage multiple stock portfolios, enabling users to stay updated on fair value assessments and market changes in real-time.

For more information on Monolithic Power Systems, visit their official website at Monolithic Power Systems.

As the technology landscape continues to evolve, keeping abreast of developments in demand for components like power management chips will be pivotal for investors aiming to capitalize on future growth opportunities.

See also Dunkirk School District Cuts Chronic Absenteeism from 38% to 22% Using AI Attendance Program

Dunkirk School District Cuts Chronic Absenteeism from 38% to 22% Using AI Attendance Program Alphabet Reports Q4 Revenue of $114B, Plans $175B AI Capital Expenditure Increase

Alphabet Reports Q4 Revenue of $114B, Plans $175B AI Capital Expenditure Increase Microsoft’s AI Integration and Zero-Trust Security Overhaul Transform Enterprise Computing

Microsoft’s AI Integration and Zero-Trust Security Overhaul Transform Enterprise Computing Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT