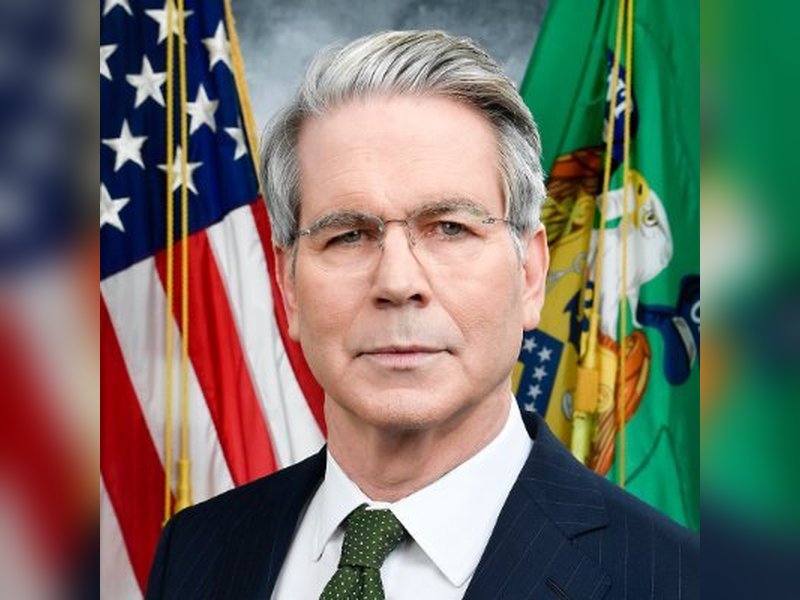

Washington, Feb 6 (IANS) Artificial intelligence (AI) has been identified as a key risk to the U.S. financial system, prompting Treasury Secretary Scott Bessent to inform Congress that regulators will enhance oversight of AI applications across financial markets and institutions. During his testimony before the Senate Banking Committee, Bessent emphasized that AI will be one of the four focus areas in the Financial Stability Oversight Council’s (FSOC) 2025 annual report, underscoring the importance of its responsible use in reinforcing financial stability.

Bessent noted that while AI is increasingly utilized in areas such as compliance, fraud detection, and risk management, it also introduces new vulnerabilities. “AI can be a great tool, but AI can also be a risk through state and non-state actors,” he stated. In light of this, the FSOC is collaborating with both public and private partners, including international entities, to keep a close watch on emerging risks. “We are working with public and private sector partners to enhance system resilience while closely monitoring emerging risk,” he added.

Republican lawmakers welcomed the administration’s focus on innovation. Senator Mike Rounds inquired whether regulatory barriers were hindering the responsible adoption of AI technologies. In response, Bessent indicated that regulatory agencies are taking a “gradual” approach to implementation, which aims to balance innovation with oversight.

The report further identifies cybersecurity as an escalating threat, particularly alongside AI. Bessent pointed out that nation-state actors and criminal organizations continue to target financial institutions and critical infrastructure. “To address this risk, the council is supporting expanded information-sharing, joint monitoring, and scenario-based exercises,” he explained.

Democrats expressed trepidation that regulators might be underestimating the risks associated with AI and financial innovation. Ranking Member Elizabeth Warren cautioned that unchecked innovation could amplify shocks across the financial system. Bessent reassured lawmakers that the council’s goal is to identify vulnerabilities early, aiming to mitigate risks before they escalate into crises. He stated, “FSOC should aim to identify vulnerabilities that could lead to systemic crises and encourage the private sector to mitigate those risks before recommending additional regulation.”

Furthermore, Bessent mentioned that the FSOC is reassessing supervisory frameworks to ensure they adequately address “material risk” while alleviating unnecessary burdens on institutions. The growing role of AI in finance has also attracted global attention, particularly in countries like India, where banks and fintech firms are rapidly adopting AI-driven tools for lending, compliance, and customer service. U.S. regulatory signals are being closely monitored by Indian tech companies and financial institutions involved in cross-border operations.

The Senate hearing highlighted the shift of AI from a niche concern to a fundamental focus for financial regulators. Lawmakers expect to receive further updates as the FSOC’s work on AI continues to evolve. Established post the 2008 financial crisis, the FSOC monitors systemic risks within the financial system, and its annual report serves as a critical roadmap for identifying emerging threats.

As the intersection of AI and finance advances, the implications for regulatory practices and financial stability are significant. With AI technologies proliferating, the ongoing dialogue between innovation and regulation will be pivotal in shaping a resilient financial environment.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025