The global finance system is at a pivotal juncture as artificial intelligence (AI), advanced analytics, and high-quality trusted data increasingly dictate market dynamics. These technologies are evolving from peripheral tools into foundational principles that transform how capital is allocated and economies are interconnected. Within this global landscape, India is not just a participant but is emerging as a key influencer in shaping the future of financial markets.

One of the most notable shifts is the fundamental reconfiguration of market infrastructure. Digital technologies are revolutionizing trading, clearing, and settlement processes, enhancing transparency, resilience, and speed. Since 2024, the issuance of distributed-ledger-based fixed income instruments has surged to nearly ₹4.7 billion globally, indicating a significant movement towards digital market frameworks.

This momentum is translating into practical applications within market infrastructure. For instance, the London Stock Exchange Group’s (LSEG) Digital Market Infrastructure showcases how a blockchain-powered system can scale operations and facilitate more effective capital formation. Such innovations underscore a broader transformation in how global markets function.

Simultaneously, India’s financial markets are evolving in step with these global trends. As the country strides toward becoming the world’s third-largest economy, its financial system is gaining considerable depth and sophistication. Equity, derivatives, and alternative asset markets are on the rise, with participation broadening among both institutional and retail investors. The inclusion of Indian sovereign bonds in global benchmarks, such as the FTSE Emerging Markets Government Bond Index, reflects not only growing accessibility but also increasing investor confidence in India’s prominence in global capital allocations.

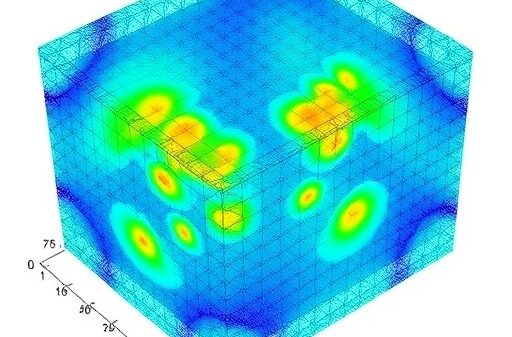

At the core of this evolution lies a fundamental principle: as AI becomes woven into trading, surveillance, risk management, and investment workflows, its efficacy hinges on the availability of accurate and timely data, coupled with responsible governance. Markets investing in robust data foundations will be better positioned to manage volatility, identify emerging opportunities, and attract long-term capital. The challenge lies in ensuring that innovation bolsters both transparency and stability while accelerating operational efficiency.

LSEG is actively contributing to this shift by enhancing the data foundations that make AI scalable and reliable in the financial sector. Through collaborations with institutions worldwide, including those in India, the focus is on enabling access to high-quality data and advanced analytics. This strategic approach is grounded in the belief that trusted data, responsible AI, and modern market infrastructure must develop in concert.

The pertinent question is not whether AI and digital technologies will reshape global finance, but rather how effectively and collaboratively this transformation can be managed. Regulators, market operators, and financial institutions each play a vital role in ensuring that innovation fuels growth while simultaneously enhancing operational effectiveness and market stability. It is a delicate balance that demands concerted efforts across the financial landscape.

In this context, David Schwimmer, CEO of the London Stock Exchange Group, is set to address these critical issues at the upcoming ET NOW Global Business Summit 2026, scheduled to take place at the Taj Palace in New Delhi. His insights will likely shed light on how India can further leverage its strengths in this transformative era, positioning itself as a leader in the global financial landscape.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025