Artificial intelligence (AI) has transformed from a theoretical notion into a critical component driving growth in various sectors, particularly in financial technology (FinTech). In recent years, AI has become integral to enhancing customer experiences and streamlining operations, proving essential for firms aiming to optimize their profitability.

The integration of AI in financial services has accelerated, leading to significant advancements in decision-making and customer interactions. AI-powered analytics enables FinTech companies to process vast amounts of data in real time, delivering personalized insights that enhance user engagement and tailor services to individual needs.

AI-Powered Analytics in FinTech

Among the most notable advantages of adopting AI in FinTech is the generation of predictive insights. By examining customer behavior and historical trends, AI systems can forecast market fluctuations and provide crucial recommendations for investment strategies. This enables firms to implement proactive measures in financial planning.

Additionally, AI fosters personalized experiences, allowing financial technology firms to offer customized product suggestions, spending analyses, and tailored financial advice. These enhancements are vital in building customer loyalty and satisfaction. AI also plays a crucial role in enhancing fraud detection and risk management. Machine learning algorithms can identify anomalies in data, flagging suspicious transactions to mitigate fraud before it impacts customers.

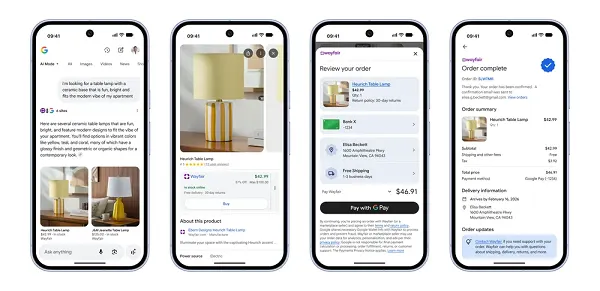

AI’s impact extends to revolutionizing customer support within FinTech. Companies are increasingly deploying AI-driven chatbots that provide round-the-clock assistance, addressing routine inquiries and reducing customer wait times. As these systems learn from interactions over time, they refine their responses, personalizing engagement based on user preferences.

FinTech companies are leveraging AI to offer personalized financial planning services as well. By analyzing users’ spending habits and financial goals, AI algorithms generate tailored financial advice, empowering customers to make informed decisions. This personalized approach not only enhances the user experience but also solidifies the relationship between consumers and service providers.

As the digital footprint of customers expands, so do the risks associated with online transactions. FinTechs face heightened challenges in safeguarding user data against cyber threats. AI-powered tools are essential for identifying these risks in real time. The ability of AI to detect patterns allows companies to quickly identify fraudulent activities, such as unusual spending behaviors or unfamiliar login attempts.

AI-driven risk management systems continually adapt, learning from new data to enhance their detection capabilities. This proactive stance enables FinTechs to stay ahead of emerging threats, fostering customer trust—a cornerstone for success in a competitive landscape.

Moreover, AI is instrumental in promoting financial inclusion. By employing AI-driven lending platforms that utilize alternative data sources—such as utility bill payments and mobile usage—FinTechs can assess the creditworthiness of individuals who lack traditional financial histories. This innovation opens new avenues to financial services for underserved populations, enhancing access to capital for small business owners and entrepreneurs in developing regions.

In addition to financial services, AI is improving access to financial literacy tools. Virtual assistants and personalized educational programs are increasingly assisting users in understanding budgeting, saving, and investing. This democratization of financial knowledge is crucial for empowering underserved communities and fostering long-term economic growth.

The marketing strategies employed by FinTech firms are also evolving due to AI’s capabilities. Organizations that significantly invest in AI report a 10% to 20% increase in return on sales, attributed to AI’s ability to create hyper-personalized marketing campaigns that resonate with specific customer segments. By analyzing transaction data, AI not only identifies high-value customers but also tailors financial products to meet unique needs, enhancing engagement and loyalty.

Despite the promising outlook, challenges persist in the widespread adoption of AI within FinTech. Concerns surrounding data privacy remain paramount, as firms must ensure compliance with regulations such as GDPR while managing vast amounts of customer information. Transparency in data handling practices is essential for fostering customer trust.

Investment hurdles also pose a challenge; the integration of AI requires significant upfront costs in technology and talent. While larger FinTech firms may navigate these expenses more smoothly, smaller startups often struggle to compete. Demonstrating the tangible value of AI solutions is crucial for securing funding and ensuring ongoing success.

AI has already reshaped the FinTech landscape, and its influence is poised to expand further. By investing in appropriate technologies and talent, while simultaneously addressing issues such as data privacy and regulatory compliance, FinTech companies can harness AI’s power to enhance customer experiences and drive business growth. Ultimately, the strategic integration of AI will continue to revolutionize financial services, positioning firms at the forefront of the evolving market.

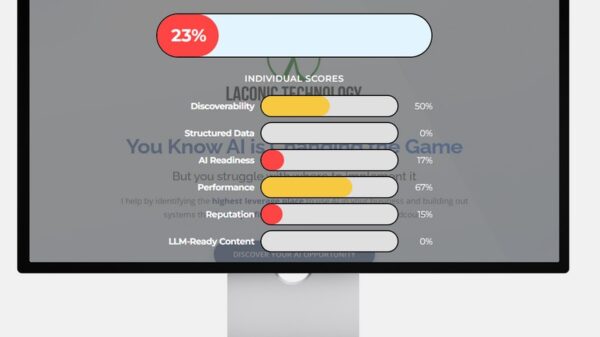

See also Enhance Your Website”s Clarity for AI Understanding and User Engagement

Enhance Your Website”s Clarity for AI Understanding and User Engagement FoloToy Halts Sales of AI Teddy Bear After Disturbing Child Interactions Found

FoloToy Halts Sales of AI Teddy Bear After Disturbing Child Interactions Found AI Experts Discuss Vertical Markets: Strategies for Targeted Business Growth

AI Experts Discuss Vertical Markets: Strategies for Targeted Business Growth Law Firms Shift to AI-Driven Answer Engine Optimization for Enhanced Marketing Success

Law Firms Shift to AI-Driven Answer Engine Optimization for Enhanced Marketing Success Anthropic Disrupts State-Sponsored Cybercrime Using Claude AI, Reveals Key Insights

Anthropic Disrupts State-Sponsored Cybercrime Using Claude AI, Reveals Key Insights