HSBC has announced a strategic partnership with French AI start-up Mistral AI, aiming to bring generative artificial intelligence tools into its global operations. This collaboration is set to enhance automation and productivity while improving customer service. As the financial landscape evolves through technological advancements, HSBC’s decision highlights its commitment to leveraging AI to transform banking processes.

Founded in 2023, Mistral AI has quickly established itself in the generative AI sector, developing advanced large language models. This partnership grants HSBC access to Mistral’s commercial models and future updates via a self-hosted platform, allowing for seamless integration within HSBC’s existing infrastructure. The collaboration will see teams from both organizations working closely together, including engineers, data scientists, and product leads, to create tailored AI solutions for banking operations.

HSBC intends to deploy these AI capabilities across various areas, significantly improving efficiency. For instance, financial analysis and document-heavy tasks often require extensive manual labor. AI can assist by parsing, analyzing, and summarizing lengthy documents, thereby reducing the workload on staff. Furthermore, the global nature of HSBC’s operations necessitates handling communications in multiple languages. Mistral’s models will facilitate multilingual reasoning, streamlining translation and validation processes.

Risk assessment and compliance, crucial areas in banking, will also benefit from AI’s capabilities. The technology can enhance fraud detection and anti-money laundering checks, tasks that require extensive data processing and pattern recognition. Additionally, client-facing teams can utilize AI to develop personalized communications and tailored offers, ultimately improving customer experience and satisfaction.

This partnership is viewed as a strategic advantage for both HSBC and Mistral. For HSBC, it supplements its technology strategy amid global competition among banks to embed AI solutions. Mistral gains credibility as a trusted enterprise AI provider by working with a major financial institution. The collaboration may also serve as a blueprint for other banks seeking to integrate advanced AI technologies to streamline operations and enhance customer service.

The partnership underscores a critical shift in the banking industry towards responsible AI adoption. HSBC and Mistral have emphasized their commitment to strict standards for transparency and data protection, which is vital as they deploy AI at scale. This collaboration may mark a significant turning point in how financial institutions integrate AI into their core operations, evolving from an occasional add-on to a fundamental component of their business model.

Since its inception, Mistral AI has quickly emerged as a notable player in the AI field, providing a range of large language models designed for enterprise use. The company has garnered attention for its high-quality open-source models and its focus on enterprise-grade solutions, appealing to various clients including national agencies and large firms. Partnering with HSBC further solidifies Mistral’s position as a key player in the global AI landscape, demonstrating that its technology is robust and scalable enough for the demands of international banking.

For investors, the HSBC-Mistral partnership signals important trends in the AI sector and the broader financial market. Banks that adopt generative AI may unlock competitive advantages through improved efficiency and enhanced client services. This development could lead to increased market interest in companies that provide AI infrastructure and tools, further accelerating the transformation of the banking industry.

As financial institutions like HSBC continue to embrace AI, the landscape may shift significantly, encouraging legacy banks to pursue digital transformation across core functions such as banking, lending, and compliance. The market for enterprise-grade AI solutions is likely to expand, presenting new opportunities for investment in AI-related stocks and technologies.

In conclusion, HSBC’s partnership with Mistral AI exemplifies a significant advancement in the integration of generative AI within global banking. By merging HSBC’s extensive experience in finance with Mistral’s cutting-edge technology, the collaboration has the potential to redefine banking operations, enhancing efficiency and customer service while setting new standards for productivity and innovation in the industry. This initiative may serve as a pivotal example of how financial institutions can responsibly incorporate AI into their operations, paving the way for eventual widespread adoption.

See also OpenAI Launches GPT-5: Enhanced Multimodal Reasoning and Workflow Management

OpenAI Launches GPT-5: Enhanced Multimodal Reasoning and Workflow Management James Cameron Calls Generative AI ‘Horrifying’ in Latest Interview on Film Technology

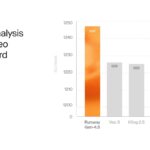

James Cameron Calls Generative AI ‘Horrifying’ in Latest Interview on Film Technology Runway Launches Gen-4.5 Video Model, Achieves 1,247 Elo Points in AI Leaderboard

Runway Launches Gen-4.5 Video Model, Achieves 1,247 Elo Points in AI Leaderboard Rockstar Co-Founder Dan Houser Warns Generative AI May Degrade Game Quality

Rockstar Co-Founder Dan Houser Warns Generative AI May Degrade Game Quality DeepSeek Launches V3.2 Models to Rival GPT-5 and Gemini 3 Pro with Advanced Reasoning

DeepSeek Launches V3.2 Models to Rival GPT-5 and Gemini 3 Pro with Advanced Reasoning