Oracle Corporation (NYSE:ORCL) has solidified its place among the top software stocks favored by Wall Street analysts. On January 29, the tech giant unveiled its latest AI platform designed specifically for life sciences companies, an initiative aimed at streamlining drug development and research processes.

The platform addresses the growing challenge of data fragmentation within the industry by integrating extensive datasets and leveraging generative AI to deliver faster insights. Targeting pharmaceutical companies, medical device manufacturers, researchers, and other life sciences organizations, Oracle’s new offering promises to accelerate research and development efforts, thereby expediting clinical trials.

Despite the positive outlook for its AI capabilities, Oracle’s stock faced scrutiny prior to the launch. On January 27, Morgan Stanley analyst Keith Weiss reiterated a Hold rating on Oracle’s stock while reducing the price target from $320 to $213. In a research note, Weiss noted that the market appears to underestimate the significant investments required to fulfill Oracle’s burgeoning order backlog, which has grown by $426 billion over the past four quarters. This brings the total backlog to $523 billion, offering a dual narrative of potential growth alongside substantial investment challenges.

Weiss pointed out that while the increasing backlog is a positive indicator of Oracle’s future growth prospects, it also highlights the capital-intensive nature of AI compute infrastructure that the company needs to address. The investments required to deliver on this backlog may pose risks, particularly in an environment where capital allocations are under close scrutiny.

Oracle Corporation is a globally recognized technology firm specializing in database software, cloud solutions, and enterprise software products. The company’s offerings empower businesses to manage data, conduct analytics, and drive digital transformation effectively. The recent AI platform launch underscores Oracle’s commitment to staying at the forefront of technology innovation, particularly in a sector as complex and rapidly evolving as life sciences.

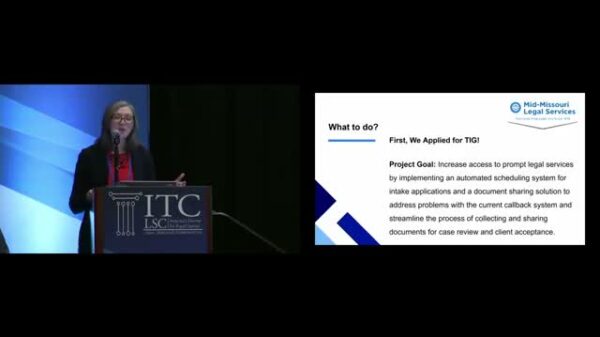

While the potential of Oracle as an investment is acknowledged, analysts caution that several AI stocks might present more favorable upside potential with comparatively lower risks. For investors seeking undervalued opportunities, some analysts have pointed toward stocks that could benefit significantly from trends such as onshoring and tariffs stemming from the previous U.S. administration. In light of Oracle’s recent moves, an analysis of alternative investment options in the AI landscape may be prudent.

The launch of Oracle’s AI platform for life sciences represents not just an advancement in technology but also a step toward addressing pressing industry challenges. As the company navigates its substantial backlog and capital requirements, stakeholders will be keenly observing how these factors influence both its growth trajectory and stock performance in an increasingly competitive market.

As Oracle continues to develop its AI initiatives, the broader implications for the life sciences sector and the technology industry at large remain significant. With the ongoing race for innovation in AI, Oracle’s strategies will likely shape its future as well as influence market dynamics in the crowded tech space.

Disclosure: None. This article is originally published at Insider Monkey.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics