Salesforce (NYSE: CRM) unveiled its upgraded Slackbot on January 13, 2026, marking a significant step in its “agentic enterprise” strategy. However, investor enthusiasm appeared muted, as the company’s shares plummeted nearly 7% during the session, making it the worst-performing stock on the Dow Jones Industrial Average for the week. This immediate downturn underscores a growing rift between Salesforce’s ambitious AI-driven vision and investor concerns about sluggish core revenue growth and the actual returns on investment from generative AI.

This juxtaposition of technological advancement and stock market performance indicates a pivotal moment for the cloud computing giant. The new Slackbot transcends its previous role as a mere notification tool; it serves as a sophisticated conversational interface designed to manage Agentforce 360, Salesforce’s suite of autonomous AI agents. Unlike the assistive “copilots” introduced in 2024 and 2025, these agents are engineered to operate independently, undertaking complex tasks such as qualifying sales leads, resolving intricate customer service issues, and managing interdepartmental workflows without human oversight. Despite this leap in functionality, the financial community remains fixated on the “seat-count paradox,” fearing that AI efficiency may ultimately decrease demand for software licenses.

Salesforce is currently navigating a precarious landscape: it aims to lead the transition into the “Agentic Era” while simultaneously convincing Wall Street of the viability of its business model. The reimagined Slackbot’s launch follows strategic adjustments in late 2025, where Salesforce integrated advanced Large Language Models, including Anthropic’s Claude 4.5 Opus, into the Slack ecosystem. This iteration is “grounded” in Salesforce’s Data Cloud, enabling it to access real-time CRM data and historical conversational context to ensure that its operations are accurate and compliant with corporate guidelines. For Salesforce, this represents the culmination of a multi-year effort to transform Slack from a messaging platform into a command center for AI agents.

However, the initial market response suggests that technological breakthroughs alone may not assuage investor concerns. A 6.5% to 7% decline in Salesforce stock coincided with reports indicating that revenue growth had decelerated to a modest 8.7% for the first nine months of the 2026 fiscal year. Although Agentforce transactions reportedly surged by over 330% year-on-year, the revenue generated from these AI products—approximately $1.4 billion in the most recent quarter—has not sufficiently offset the declining demand for Salesforce’s traditional software-as-a-service (SaaS) offerings.

In the wake of the Slackbot announcement, hardware and infrastructure providers emerged as market beneficiaries, while Salesforce struggled. Market capital flowed into semiconductor giants like Intel Corporation (NASDAQ: INTC) and Advanced Micro Devices (NASDAQ: AMD), viewed as safer bets in an environment where software ROI remains uncertain. Conversely, Salesforce’s challenges serve as cautionary tales for other legacy SaaS companies like Adobe (NASDAQ: ADBE) and ServiceNow (NYSE: NOW), which are also racing to integrate agentic workflows. The traditional per-seat licensing model faces significant headwinds; if a single AI agent can perform the work of five entry-level sales associates, customers may no longer see value in purchasing multiple software licenses.

Despite the stock slump, there are internal gains for Salesforce, notably within the developer ecosystem. With the launch of “Agentforce 2.0” alongside the new Slackbot, the company has empowered non-technical users to create their own agents using “Agent Builder.” This democratization of automation could lead to a surge in third-party integrations, making the Salesforce ecosystem more vital to enterprises, even if per-seat revenues decline.

The situation at Salesforce mirrors a broader industry transition from “Assistive AI” to “Agentic AI.” In 2024 and 2025, the focus was on “copilots” that could perform simple tasks like summarizing emails. By 2026, the industry standard has evolved toward agents capable of planning, utilizing tools, and executing workflows autonomously. Salesforce’s pivot directly addresses competitive pressures from companies like Microsoft (NASDAQ: MSFT), which has aggressively incorporated agentic functionalities into its 365 Copilot and Dynamics suites.

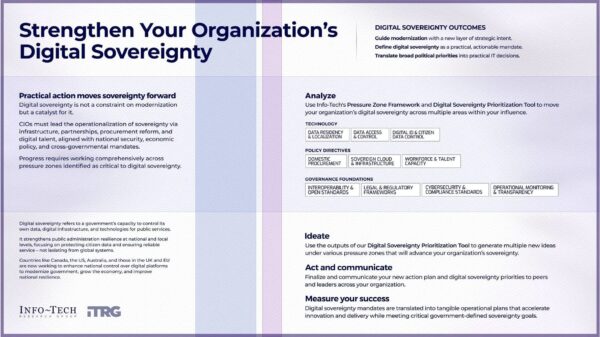

This shift also introduces significant regulatory and policy challenges. As AI agents begin to manage sensitive CRM data and make autonomous customer interaction decisions, the concept of “AI accountability” gains prominence. Regulators are increasingly scrutinizing how these agents are structured and whether they uphold ethical standards, such as avoiding bias and adhering to privacy laws. Salesforce’s focus on its “Trust Layer” and Data Cloud integration is an attempt to preempt these regulatory challenges, yet managing thousands of autonomous agents globally remains daunting for many IT departments.

Looking forward, Salesforce must demonstrate that its Agentforce strategy can drive substantial revenue growth. The company is expected to emphasize “consumption-based pricing” for its AI agents, charging clients based on the number of successful tasks completed rather than the number of users. This approach is critical to mitigate the “seat-count disruption” currently affecting valuations. If Salesforce can successfully implement this transition, it could unlock significant new revenue streams that align with AI productivity rather than headcount.

In the long term, the success of the new Slackbot hinges on its adoption as the primary interface for enterprise work. Should employees start using Slack as their central hub for all corporate AI interactions—including those from competing models—the company could solidify its position as the “operating system” for modern enterprises. Achieving this will require seamless integration with other platforms, potentially necessitating high-profile partnerships with tech giants such as Google (NASDAQ: GOOGL) and OpenAI.

For 2026, a “valuation consolidation” period seems likely as Salesforce refines Agentforce 2.0 and gathers data on its ROI from early customers. However, until AI-generated revenue surpasses losses from its traditional business, Salesforce’s stock may continue to lag in a market increasingly impatient for tangible AI returns. The recent launch of the revamped Slackbot signifies a noteworthy technical advance and heralds the dawn of the “Agentic Era” for the leading CRM provider, yet immediate stock performance reminds investors that innovation does not always translate to market appreciation. The focus is shifting from the potential of AI to demonstrable financial outcomes, emphasizing the need for Salesforce to prove its agents can extend market reach rather than merely automate existing workflows.

See also OpenAI Launches ChatGPT Health, Reaches 200 Million Weekly Healthcare Queries

OpenAI Launches ChatGPT Health, Reaches 200 Million Weekly Healthcare Queries Novee Emerges from Stealth with $51.5M to Transform AI-Driven Offensive Security

Novee Emerges from Stealth with $51.5M to Transform AI-Driven Offensive Security Oakmark Funds Boosts Gartner Shares Amid AI Concerns; Future Trends Highlighted

Oakmark Funds Boosts Gartner Shares Amid AI Concerns; Future Trends Highlighted South African Businesses Must Address Ethical AI to Mitigate Operational Risks, Warns Alkemi CEO

South African Businesses Must Address Ethical AI to Mitigate Operational Risks, Warns Alkemi CEO SAP.DE Stock Closes at €202.15 Amid AI Partnership; Upside Forecasts Signal Potential Growth

SAP.DE Stock Closes at €202.15 Amid AI Partnership; Upside Forecasts Signal Potential Growth