The rise of artificial intelligence (AI) is reshaping the financial landscape, presenting significant challenges for established firms in wealth management and insurance sectors. Recent findings indicate that major companies like Charles Schwab (SCHW) and Raymond James (RJF) are facing heightened risks as more clients begin to gravitate towards AI-driven advisory tools, which promise lower costs and quicker responses compared to traditional services. This trend threatens their fee-based revenue models and profit margins, exacerbating existing pressures in an industry already characterized by intense competition.

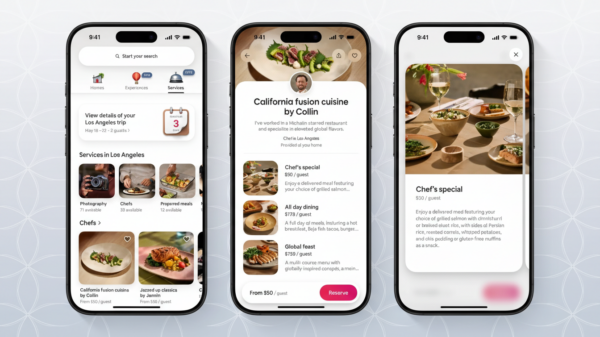

AI’s encroachment into the financial advisory space is not merely a minor inconvenience; it represents a fundamental shift in how investment advice is dispensed. With the advent of sophisticated digital platforms, clients are increasingly opting for these automated solutions, leading to concerns about the long-term viability of traditional wealth management firms. Analyst insights suggest that the introduction of these AI tools could significantly undermine the profitability of established advisory services.

Similarly, the insurance brokerage industry is feeling the effects of AI advancements. Companies like Marsh McLennan (MRSH) and Aon (AON) are at risk of losing their intermediary value as AI-powered comparison engines simplify the process for consumers to choose insurance products directly. This shift threatens to diminish the brokerage model, potentially prompting declines in stock prices as market participants reassess the future profitability of these businesses.

The impact of AI also extends to small banks, which are finding it increasingly difficult to compete against larger institutions that can leverage advanced digital banking technologies. The resources required to implement AI-driven solutions are often beyond the reach of smaller banks, placing their business models in jeopardy. As financial services continue to evolve, these institutions may need to rethink their strategies to survive in an increasingly competitive environment.

Companies such as Nasdaq (NDAQ) and S&P Global (SPGI), heavily reliant on publicly available data for their operations, are encountering vulnerabilities in their business models. Recent stock price declines reflect growing market apprehensions about their future prospects. As the market increasingly values agility and innovation, firms that fail to adapt may find themselves on shaky ground.

Market reactions to these developments have been swift and severe. Last week, stocks in the financial services and consumer discretionary sectors experienced a downturn, with the S&P 500 and Nasdaq Composite falling over 1%. Concerns about AI’s role in driving down traditional advisory fees have contributed to significant declines for firms like Charles Schwab and Raymond James, which saw their stock prices drop by 10% and 8%, respectively. The launch of an AI-driven tax planning tool by Altruist has further fueled these fears, prompting a reevaluation of traditional wealth management strategies.

Despite the current volatility, analysts maintain an optimistic outlook for the broader market, forecasting potential rebounds. The S&P 500 is projected to reach 7,600 by year-end, reflecting confidence in sectors outside of finance. However, investor sentiment remains cautious amid fears of AI disrupting established business models. As the situation evolves, firms must navigate the dual challenges of technological innovation and changing market dynamics.

Amid these upheavals, the future for companies like Charles Schwab hinges on their ability to adapt to AI’s growing influence. With 38.7 million active brokerage accounts and total client assets managed reaching $12.15 trillion, Schwab’s scale provides a competitive advantage. Yet, the firm must also diversify its offerings to retain customer loyalty and drive revenue growth in an increasingly digital landscape.

The ongoing transformation highlights the pressing need for adaptation and innovation within the financial industry. As AI continues to evolve, companies that embrace these new technologies and proactively address emerging market dynamics may emerge as leaders in the next generation of financial services. The potential for disruption remains high, underscoring the need for firms to reassess their strategies moving forward. In a world where the digital realm increasingly dictates consumer expectations, the path ahead will require both resilience and foresight to navigate the uncharted waters of AI integration.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025