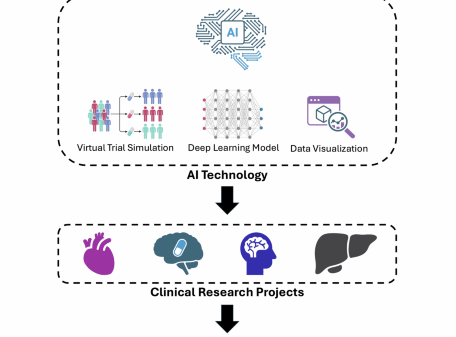

ASTANA — Financial institutions across Central Asia are rapidly embracing artificial intelligence, with 36% already integrating AI technologies and 56% planning to implement them within the next year, according to a report released on February 13 by the National Bank of Kazakhstan. The study, which surveyed 232 financial organizations across Kazakhstan, the Kyrgyz Republic, and Tajikistan, provides the region’s first comprehensive evaluation of AI integration in financial markets.

Despite the strong interest in AI, its implementation is still in the early stages. The report indicates that 38% of respondents are conducting research, while 28% are running pilot or partial projects; only 2% have fully deployed AI solutions. National Bank Governor Timur Suleimenov highlighted that in 2026, the bank will focus on transitioning to practical implementations of a digital asset market and integrating it into Kazakhstan’s existing financial system. Plans to develop a unified AI ecosystem and collaborate on AI solutions regionally are also in the works.

This approach aims to manage risks and ensure institutional readiness while adhering to regulatory requirements as AI systems become increasingly complex. The digital asset initiative is part of a broader move toward AI-supported supervision that automates analytical and monitoring functions within the financial sector.

The report shows a shift in AI adoption in Central Asia from basic operational automation to predictive analytics and risk-focused applications. While early implementations concentrated on enhancing operational efficiency, financial institutions are now applying AI to areas such as fraud detection, credit assessment, and customer data analysis to bolster decision-making. In Kazakhstan, for instance, 75% of banks utilize AI, and 88% plan to expand its applications, although deployment remains largely focused on transactional and customer-facing areas, particularly credit scoring and anti-fraud systems.

However, the use of AI in strategic planning, compliance oversight, and comprehensive risk management is still limited and in its initial implementation stages. The report also underscores the increasing importance of generative AI and AI agents capable of performing semi-autonomous tasks. Internationally, research firm Gartner predicts that agent-based AI systems will grow at an annual rate of 45% over the next five years. By 2027, AI agents are projected to assist in or make 50% of business decisions, with McKinsey data suggesting that restructuring workflows around AI agents can decrease task execution times by up to 90%, depending on the application.

The findings place Central Asia in a rapidly expanding global AI landscape, where corporate investment in AI reached $252.3 billion in 2024, an increase of 26% from the previous year. Over the past decade, investment has grown nearly thirteenfold. Global surveys indicate that 78% of organizations now utilize AI in at least one business function, up from 55% in 2023. However, despite these advancements, Central Asian countries continue to lag in AI readiness, with Kazakhstan ranked 76th globally, Uzbekistan at 70th, Tajikistan at 131st, and the Kyrgyz Republic at 134th in 2024. The report identifies technological maturity and human capital development as key barriers to regional progress.

A significant challenge across these nations is the shortage of specialists who possess the requisite expertise in finance, data analytics, and risk management. Effective AI integration requires not only robust computing infrastructure but also institutional readiness, which includes reliable data systems and coordinated governance frameworks. Data fragmentation, inconsistent quality standards, and limited access to advanced computing resources hinder scaling beyond preliminary pilot programs. In Tajikistan, for instance, while 65% of financial executives view AI as crucial for future competitiveness, only 33% of institutions currently implement AI solutions, resulting in limited overall impact.

In the Kyrgyz Republic, regulators are focusing on AI applications in payment monitoring, compliance automation, and supervisory analytics. Institutional readiness, including unified risk management strategies and secure cross-border data exchange, presents a regional challenge. As the regulatory landscape evolves alongside technological advancements, more than ten countries have established AI Safety Institutes aimed at developing standards for secure deployments. Frameworks such as the European Union’s AI Act call for labeling AI-generated content, although only 38% of AI systems globally employ watermarking mechanisms.

The rising cybersecurity risks are another pressing concern. A survey mentioned in the report found that 68% of organizations in the United States and the United Kingdom experienced data leaks associated with employee use of AI tools, while only 23% had comprehensive AI security policies in place. Additionally, the environmental impact of AI technologies cannot be overlooked; global data center energy consumption surged by 72%, and annual water usage reached 560 billion liters. Conversely, AI-enabled technologies are being utilized to enhance efficiency in sectors such as agriculture, logistics, and energy management.

The report indicates that AI adoption within Central Asia’s financial markets has moved beyond mere experimentation. The growing adoption rates, coupled with planned expansions, signal a structural shift, yet challenges in infrastructure, human capital, and regulatory capacity continue to hinder large-scale integration. For foreign investors and international partners, the data portray a region in transition—actively aligning with global AI trends and investing in supervisory capacities and digital infrastructure, yet facing significant constraints in talent, scale, and technological sophistication.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025