Curvestone AI has announced a strategic partnership with The White Rose Finance Group, aimed at integrating AI-enabled automation into the commercial finance sector. This collaboration is designed to streamline compliance processes within White Rose’s commercial and regulated workflows, significantly reducing file review times from hours to mere minutes while enhancing consistency, auditability, and data security.

According to both companies, this initiative represents one of the pioneering implementations of AI-driven compliance review across the UK commercial finance landscape. The shift from traditional sample-based checks to a near full-file oversight model is expected to provide White Rose’s compliance team with sharper visibility and improved accuracy in managing adviser cases.

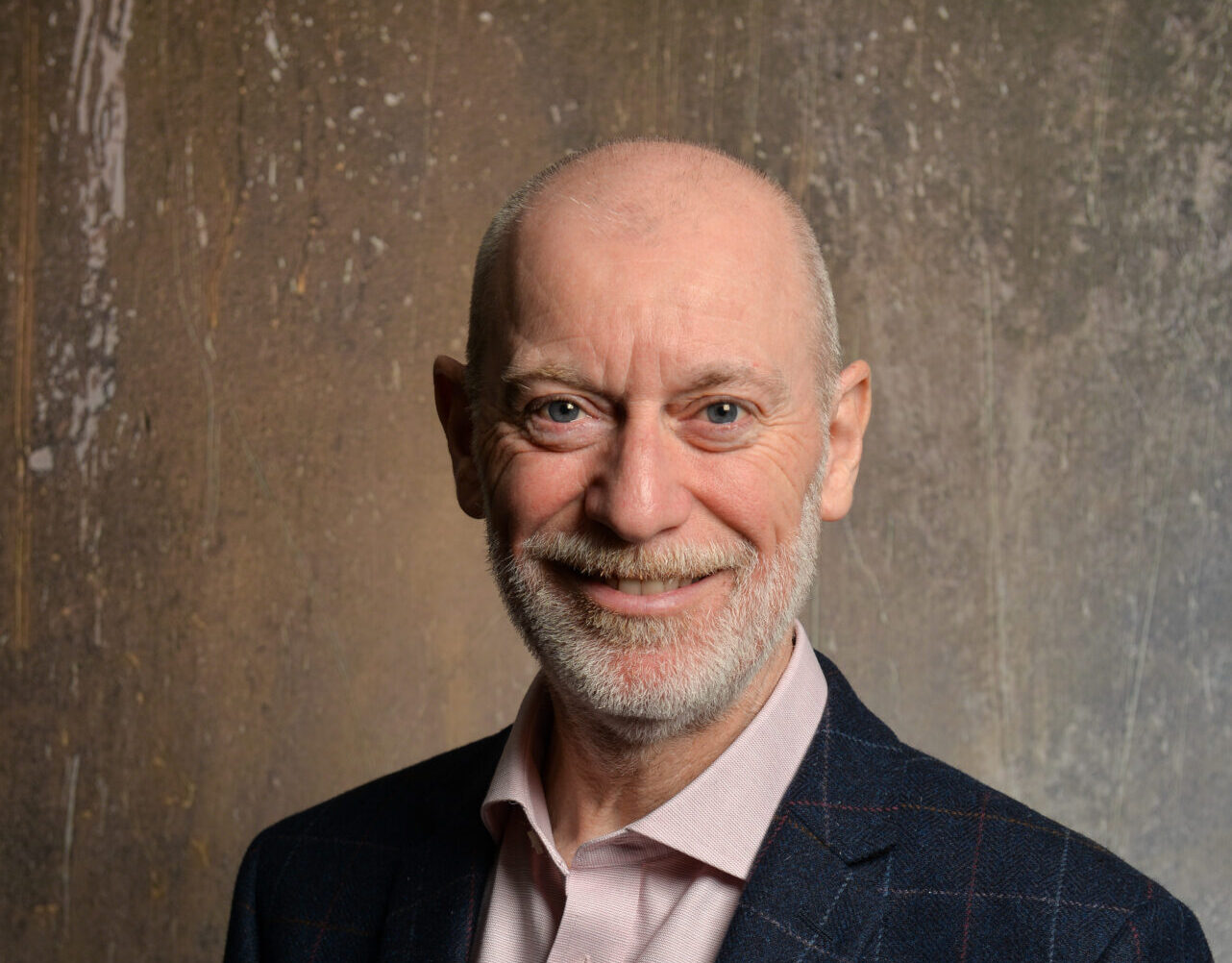

John Kent, managing director of The White Rose Finance Group, remarked on the decision-making process that led to this partnership. “We looked at whether we should continue manually, outsource, or build something ourselves,” he stated. He emphasized that Curvestone’s platform presented the best balance of automation and control, enabling streamlined compliance checks while ensuring that all outcomes remain subject to human review and sign-off.

Kent pointed out that this initiative strengthens their oversight processes and allows the compliance team to dedicate more time to adviser support and quality assurance. This reflects a growing trend in the finance sector where firms seek to leverage technology to enhance operational efficiency while maintaining regulatory compliance.

Dawid Kotur, CEO of Curvestone AI, also shared insights into the partnership’s objectives. “We don’t want to build yet another AI assistant that gives you 80% of an answer,” he said, underscoring the importance of precision in the financial services industry. “Approximation is a deal breaker.” Kotur asserted that this collaboration demonstrates the potential of solving complex compliance issues and automating crucial workflows that compliance teams rely on, rather than merely creating features that look good in demonstrations.

The integration is designed to work seamlessly with existing systems, adapting to individual firms’ processes while supporting both pre-check and post-sale reviews. This capability ensures that the auditability demanded by regulators is maintained, which is increasingly critical in today’s regulatory environment.

The partnership signals a significant move towards the broader adoption of AI technologies in commercial finance, where the ability to automate compliance processes can lead to substantial improvements in operational efficiency. By harnessing AI, firms can not only enhance compliance checks but also free up valuable resources to focus on strategic initiatives that drive business growth.

As AI continues to permeate various sectors, the implications of this partnership may extend beyond just improved compliance. It highlights a larger trend where financial institutions are increasingly integrating advanced technologies to remain competitive in a rapidly evolving market. The collaboration between Curvestone AI and The White Rose Finance Group could serve as a model for other firms seeking to navigate the complexities of compliance and operational efficiency in an era defined by digital transformation.

See also Deloitte Launches AI-Powered Sales Forecasting Box for Swiss Finance Teams

Deloitte Launches AI-Powered Sales Forecasting Box for Swiss Finance Teams Tech Mahindra Launches i.GreenFinance Platform to Streamline Green Loan Compliance

Tech Mahindra Launches i.GreenFinance Platform to Streamline Green Loan Compliance Google Secures $1.8B in TPU Financing, Mirroring Nvidia’s Vendor Model for AI Growth

Google Secures $1.8B in TPU Financing, Mirroring Nvidia’s Vendor Model for AI Growth Edge Hound Launches AI Platform Delivering 2,500 Trade Ideas Daily, Aiming for 10,000 by 2025

Edge Hound Launches AI Platform Delivering 2,500 Trade Ideas Daily, Aiming for 10,000 by 2025 UK Midmarket Finance Leaders Claim 83% AI Adoption, But 32% Gap with Controllers Revealed

UK Midmarket Finance Leaders Claim 83% AI Adoption, But 32% Gap with Controllers Revealed