Embedded finance, propelled by Artificial Intelligence (AI), is rapidly reshaping the financial landscape by integrating financial services into everyday non-financial platforms. This paradigm shift is enhancing accessibility, personalisation, and convenience for consumers, marking a significant evolution in how individuals interact with their finances.

Traditionally, financial services have been dominated by banks and specialized institutions. However, the rise of embedded finance allows users to access services such as payments, lending, insurance, and investments directly through platforms they already engage with. For example, a ride-hailing app may offer instant micro-loans or insurance, while travel portals can bundle investment opportunities with currency exchange. This integration not only streamlines user experience but also fosters financial inclusion, particularly in emerging markets where traditional banking infrastructure is limited.

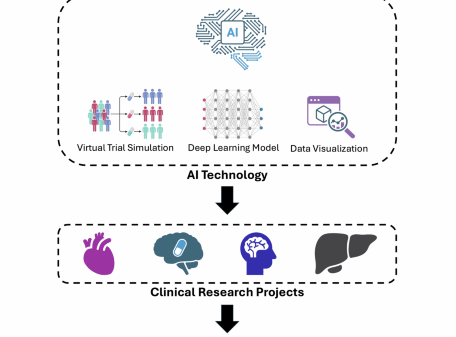

Central to this movement is AI, which is driving the transition from basic financial service integration (Embedded Finance 1.0) to more sophisticated, autonomous ecosystems (Embedded Finance 2.0). In this advanced model, financial transactions occur seamlessly within familiar digital environments, enhancing efficiency and user satisfaction. AI enables real-time personalisation, using Generative AI and Machine Learning (ML) to tailor financial products to individual needs, thereby creating an invisible yet vital financial infrastructure.

AI’s role in enhancing embedded finance is multifaceted. It contributes to personalisation by analyzing user behavior to offer tailored financial products, such as customized credit limits and insurance options. Real-time fraud detection is another crucial advantage, where AI algorithms monitor transactions to reduce risks and increase trust among consumers. Automation of financial guidance through chatbots and robo-advisors further simplifies user interaction, while predictive analytics can forecast user needs, such as suggesting travel insurance during flight bookings.

The benefits of embedded finance extend beyond consumer convenience. Businesses can leverage this integration to create new revenue streams, enhance customer loyalty through seamless experiences, and gain valuable insights into consumer behavior via AI analytics. As financial services become increasingly integrated into day-to-day activities, the operational dynamics for businesses are evolving, placing significant emphasis on adopting these technologies for survival and competitiveness.

In recent years, AI has made significant inroads into finance, beginning with expert systems that simulated human decision-making for trading and risk management in the 1980s. Now, emerging trends signal a promising future for embedded finance. Innovations such as Generative AI are being explored for creating personalized investment portfolios, while the integration of decentralized finance (DeFi) services into mainstream applications is gaining traction. Collaborations among retailers, technology firms, and banks aim to deliver comprehensive financial experiences that serve a wider audience.

Analysts project that by 2030, the global market for embedded finance will reach US$7 trillion, driven by the ongoing digital transformation and the increasing adoption of AI technologies. The anticipated growth is expected to be fueled by partnerships across industries and the integration of decentralized finance solutions. In this evolving ecosystem, financial services will not only be integrated but autonomously managed, leading to innovative applications that adjust to users’ financial behaviors automatically.

As embedded finance continues to redefine the intersection of financial services and everyday life, it signals a broader trend where financial transactions become omnipresent yet unobtrusive. This shift presents opportunities for businesses to embed trust, personalization, and innovation directly into customer journeys, thereby enhancing user experiences while facilitating broader access to financial services. With AI at the helm, embedded finance is transitioning from a supplementary feature to a foundational pillar in digital ecosystems, fundamentally altering how consumers and businesses perceive and utilize financial services.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025