India’s 16th Finance Commission and the Union Budget 2026 indicate a significant transformation in the country’s approach to disaster management. This shift moves from traditional post-crisis relief to a more proactive model emphasizing data-driven prevention, AI-enabled risk intelligence, and climate-resilient development.

Historically, disaster management in India followed a predictable path: an event occurs, relief is provided, compensation is disbursed, and the focus swiftly shifts away. While effective in emergencies, this model has become inadequate in an era where climate change results in more frequent and severe disasters.

The Finance Commission’s recommendations, along with the Budget, represent a structural overhaul of India’s disaster funding system. Central to this vision is a redefined partnership between the Central and State governments, proposing an 80:20 sharing arrangement. This acknowledges that while disaster risks are nationwide, their impacts are felt locally.

A key aspect of this new framework is the distinction between the State Disaster Response Fund (SDRF) and the State Disaster Mitigation Fund (SDMF). The SDRF is designed for immediate response and relief, while the SDMF focuses on long-term preventative investments such as early warning systems, resilient infrastructure, and risk-informed planning. This separation is crucial; it ensures that urgent response needs do not overshadow investments aimed at reducing future risks.

One notable advancement is the formal recognition of heatwaves and lightning as notified disasters, reflecting the realities faced by millions of Indians. Heatwaves have increasingly become deadly climate hazards, affecting productivity and overwhelming health systems, particularly among vulnerable populations like informal workers, the elderly, and urban poor. Similarly, lightning strikes have caused numerous fatalities, especially in rural areas. This acknowledgment allows for better tracking, funding accessibility, and preparedness strategies.

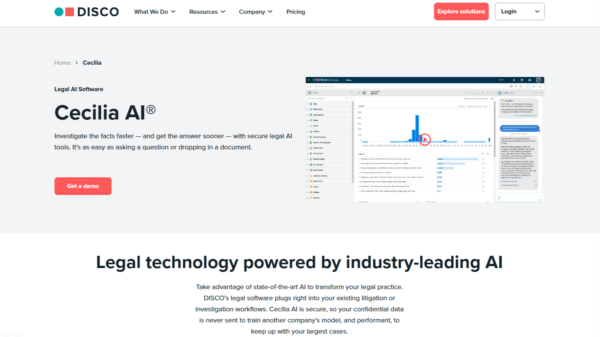

Perhaps the most transformative aspect of the new approach is the introduction of the National Disaster Management Information System (NDMIS). This initiative marks a significant governance shift, linking disaster financing to data quality, transparency, and outcomes. The underlying message is clear: data quality will be a prerequisite for financial support, including future State Finance Commission grants.

Internationally, systems like Indonesia’s Disaster Risk Index illustrate how data-driven strategies can prioritize funding for high-risk areas, thereby enhancing resilience. The NDMIS aims to integrate hazard data, damage assessments, fund utilization, and recovery outcomes into a cohesive and verifiable system. When combined with satellite observations and real-time weather data, this framework could facilitate AI-driven predictive intelligence, enabling anticipatory action and the early release of funds before disasters occur.

The Union Budget 2026 further solidifies this trajectory by embedding climate adaptation and disaster risk reduction across various sectors. Increased allocations for disaster management are paired with risk-informed investments in infrastructure, agriculture, urban development, water systems, and coastal protections. This integration is vital, as disasters often exploit existing development vulnerabilities, such as inadequate drainage and fragile housing. Consequently, building resilience must become part of everyday developmental planning, rather than treating disasters as isolated incidents.

The budget also emphasizes technology-driven governance, incorporating AI-supported forecasting and digital benefit transfers to enhance efficiency and ensure that funds reach those most at risk. The combination of these reforms signals a more mature disaster finance system characterized by a move from mere response to proactive prevention, from discretionary funding to rules-based allocations, from traditional reporting to digital and AI-enhanced intelligence, and from narrow hazard recognition to a broader understanding of evolving climate risks.

As India gears up for the upcoming AI Impact Summit, the field of disaster management illustrates the public value of AI. For AI to be successful, it should be positioned as a tool for risk reduction and public good rather than focusing solely on productivity gains. Investments in data infrastructures like NDMIS need to be viewed as essential for AI capabilities. Furthermore, India has the opportunity to set a global precedent by linking AI-enabled risk intelligence directly to public finance and governance frameworks, with an emphasis on ethical and inclusive design to ensure that early warnings and risk models are accessible to all.

India faces growing disaster risks, yet the capacity to manage these challenges is also expanding. By transitioning from relief to resilience and from reactive to anticipatory strategies, the country is constructing a disaster finance system that is better equipped for a climate-affected future. The focus now shifts to effective implementation, with a promising outlook on the journey ahead.

See also Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed

Finance Ministry Alerts Public to Fake AI Video Featuring Adviser Salehuddin Ahmed Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights

Bajaj Finance Launches 200K AI-Generated Ads with Bollywood Celebrities’ Digital Rights Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September

Traders Seek Credit Protection as Oracle’s Bond Derivatives Costs Double Since September BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users

BiyaPay Reveals Strategic Upgrade to Enhance Digital Finance Platform for Global Users MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025

MVGX Tech Launches AI-Powered Green Supply Chain Finance System at SFF 2025