By Niket Nishant, Kanchana Chakravarty and Joel Jose

Jan 5 (Reuters) – As concerns over a potential AI bubble grow, global investors are expected to actively seek opportunities in undervalued segments of the financial markets this year. Analysts suggest that traders are becoming more selective, moving away from highly valued technology stocks.

The U.S. stock market faced significant volatility in 2025, nearing bear market territory in April following sweeping tariffs imposed by President Donald Trump, before eventually rebounding to record highs. Analysts anticipate this upward momentum will extend into 2026, although they caution that investors should be discerning in their asset selections.

“This environment is ripe for active investing,” strategists at the BlackRock Investment Institute remarked.

In 2025, metal prices emerged as notable winners, buoyed by a weakening dollar and expectations of interest rate cuts from the Federal Reserve, which also spurred growth in emerging market assets. Strategists believe several asset classes will gain traction in the coming year.

One area of focus is U.S. small-cap stocks, which may regain attention after years of underperformance. As earnings prospects improve and borrowing costs decline, these stocks could see a resurgence. “The big difference going into 2026 is that we finally are seeing earnings growth come back into small caps,” noted Oren Shiran, portfolio manager at Lazard Asset Management. Traders are predicting two 25-basis-point cuts from the Federal Reserve in 2026, which typically benefits small-cap companies that carry higher debt.

Jefferies equity strategist Steven DeSanctis projects that the Russell 2000 index, which tracks small-cap stocks, will rise to 2,825 points by the end of 2026, reflecting a nearly 14% increase from 2025.

Gold also had a historic run in 2025, marking its best year since the 1979 oil crisis. Major financial institutions including J.P. Morgan and Bank of America forecast that gold prices could reach $5,000 per ounce in 2026, up from $4,314.12 in 2025. Analysts at the Wells Fargo Investment Institute expect favorable conditions to persist, albeit at a slower pace, with potential support coming from central bank purchases as they diversify their reserves beyond dollar assets.

The healthcare sector is expected to experience growth driven by policy advancements, with Morgan Stanley highlighting the potential impact of expanding weight-loss drug markets. Meanwhile, the financial sector, especially banks, is poised for a robust performance as merger and acquisition activity picks up and loan growth rebounds. This sector remains attractive due to its valuation, bolstered by deregulation and efficiency gains from AI, with mid-cap banks providing compelling early-cycle investment opportunities.

In the currency markets, analysts predict the U.S. dollar will face additional weakness in 2026, with the Fed expected to cut interest rates to support a cooling labor market. Political uncertainties, including the upcoming appointment of a new Fed chair, could further exacerbate volatility. This may enhance the appeal of emerging market currencies, such as China’s yuan and Brazil’s real, as currency dynamics shift in response to diverging policy paths. The Czech crown may also gain support due to rate hikes by the Czech National Bank, according to economists at ING.

Commodity-linked currencies, like the Australian and New Zealand dollars, could benefit from an improving global growth outlook, as indicated by analysts at MUFG. Among G7 currencies, the euro is expected to find support from fiscal stimulus, while Japan’s yen may remain vulnerable in the short term but is forecasted to recover later.

Emerging markets are anticipated to continue attracting strong inflows, driven by a weaker U.S. dollar and attractive valuations. Strategists at BofA Global observed that emerging markets have become less volatile than their developed counterparts. “There is too much focus on the fact that emerging market growth is not as high as in the ‘good old times’. That’s true, but then again, macro stability indicators are better than in a long time,” they noted, although domestic political factors in countries like Brazil and Colombia could introduce uncertainties.

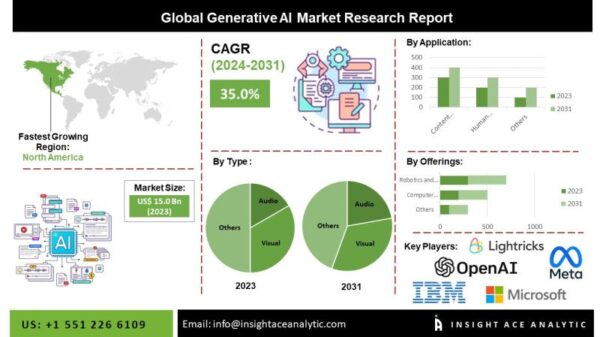

High-yield and corporate bond markets are expected to remain active in 2026, driven by robust demand for buyout financing and continued capital needs from AI-focused companies for data center investments. As of mid-December 2025, high-yield issuance amounted to $325 billion, marking a 17% increase from 2024 and the strongest issuance since records began in 2021, according to data from PitchBook. Portfolio managers at Janus Henderson expressed a constructive outlook for high-yield bonds in 2026, noting strong demand amidst a relatively high supply year.

Meanwhile, event contracts, which allow users to wager on real-world outcomes across politics, sports, and financial markets, are anticipated to emerge as one of the fast-growing asset classes, fueled by surging retail investor interest. Robinhood CEO Vlad Tenev stated, “We’re in the early stages of a supercycle for this burgeoning asset class,” highlighting the company’s substantial presence in the field. Analysts at Citizens Financial estimated that prediction markets currently generate nearly $2 billion in revenue, with potential to quintuple by 2030 as institutional participation increases. However, this rapid growth is drawing scrutiny from regulators, who have raised concerns about the contracts resembling sports betting and promoting speculative behavior.