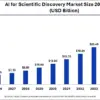

The Generative AI in Oil and Gas market is poised for significant growth, projected to increase from USD 601.83 million in 2025 to USD 2,307.02 million by 2035. This surge represents a compound annual growth rate (CAGR) of 14.38% during the forecast period. The expansion is largely attributed to the industry’s drive toward automation, predictive intelligence, and cost efficiency as companies navigate volatile commodity markets and complex operational environments.

In various segments of the industry—including upstream, midstream, and downstream operations—generative AI is being leveraged to generate geological simulations, optimize drilling strategies, automate reporting, and enhance asset performance. As energy companies confront challenges such as rising exploration costs, aging infrastructure, and stringent safety regulations, generative AI emerges as a key technology enabling data-driven decision-making and operational resilience.

Market segmentation reveals that cloud-based generative AI solutions are becoming increasingly popular, offering scalability, real-time analytics, and reduced infrastructure costs. In contrast, on-premise solutions still hold importance for operations requiring stringent data security. Applications for generative AI encompass exploration and reservoir modeling, drilling optimization, predictive maintenance, supply chain optimization, and safety management. These tailored solutions not only unlock efficiency gains but also improve productivity across complex workflows in the oil and gas sector.

Several key factors are driving this adoption, with operational efficiency and cost optimization at the forefront. The vast amounts of seismic, sensor, and operational data generated within the industry create a fertile ground for AI models to discern patterns, simulate outcomes, and facilitate automated decision-making. As companies increasingly invest in digital oilfields and smart refineries, generative AI becomes essential for maximizing recovery rates while minimizing environmental impacts.

Emerging opportunities within the Generative AI market are also being fueled by energy transition initiatives and the growing integration of advanced analytics. Generative AI allows energy companies to simulate carbon reduction strategies and optimize the integration of renewable energy sources. The intersection of generative AI with digital twins, edge computing, and industrial Internet of Things (IoT) platforms further enhances operational accuracy and fosters autonomous operations. Notably, emerging markets are investing significantly in AI-powered exploration to improve resource discovery while mitigating environmental risks.

The competitive landscape is marked by a diverse group of global technology providers, AI startups focused on the energy sector, and established oilfield service companies. Leading players are heavily investing in research and development to enhance model accuracy and scalability. Strategic alliances between oil and gas operators and AI technology firms are increasingly common, facilitating faster deployment and integration of these technologies. Companies focusing on proprietary algorithms, cloud capabilities, and real-time actionable insights are gaining competitive advantages, particularly in addressing critical concerns related to data integrity and regulatory compliance.

Recent developments illustrate a strong shift toward enterprise-wide AI adoption, as firms deploy generative AI platforms for seismic interpretation, drilling plan generation, and reservoir simulations with minimal manual intervention. Advances in natural language processing are enhancing operational insights and regulatory documentation. The rapid expansion of cloud-based AI solutions is bolstered by investments in high-performance computing and data lakes, while energy firms experiment with generative AI for workforce training through synthetic data generation and virtual simulations.

Regionally, North America leads the Generative AI market due to early technology adoption and robust digital infrastructure. The United States excels in AI-driven exploration and production optimization, backed by substantial investments in digital oilfield initiatives. Europe follows, driven by regulatory pressures aimed at reducing emissions and enhancing operational efficiency through intelligent automation. The Asia-Pacific region is expected to experience the fastest growth, fueled by increasing energy demand and expanding upstream activities. Meanwhile, the Middle East and Africa are leveraging generative AI to improve production efficiency in large-scale oil and gas projects.

The outlook for the Generative AI in Oil and Gas market remains optimistic, with expectations that AI will evolve into a core component of digital energy ecosystems. Over the next decade, generative AI is set to be integral in autonomous operations, predictive decision-making, and sustainable energy management. Continued advancements in model training and real-time analytics will further bolster adoption, establishing generative AI as a vital tool for resource utilization and risk mitigation in an increasingly data-driven industry landscape.

See also Tim Sweeney Clarifies Comments on X’s AI Tool Amid Controversy Over Nonconsensual Images

Tim Sweeney Clarifies Comments on X’s AI Tool Amid Controversy Over Nonconsensual Images Google Launches Veo 3.1 with Vertical Video Creation and 4K Upscaling Features

Google Launches Veo 3.1 with Vertical Video Creation and 4K Upscaling Features Natera Partners with NVIDIA to Enhance AI Models for Precision Medicine

Natera Partners with NVIDIA to Enhance AI Models for Precision Medicine MCMC Files Lawsuit Against X Corp. and xAI for Grok AI User Safety Violations

MCMC Files Lawsuit Against X Corp. and xAI for Grok AI User Safety Violations Study Reveals AI Image Tools Can Be Manipulated to Generate Political Propaganda

Study Reveals AI Image Tools Can Be Manipulated to Generate Political Propaganda