This week, the Orient Securities electronics team, led by Xue Hongwei, issued a report highlighting the escalating demand for AI inference, which is driving a significant increase in requirements for AI computing power. This surge is resulting in imbalances in the supply and demand of related hardware, transitioning from isolated incidents to wider systemic issues within the industry.

In the upstream semiconductor foundry and packaging/testing sectors, the report noted that heightened AI-related power demands, coupled with production cuts by major manufacturers, are prompting wafer fabs to hike prices for certain mature process nodes. Concurrently, the robust demand for AI computing has led several packaging and testing companies to initiate price increases due to rising raw material costs. In the memory sector, AI continues to propel memory demand. TrendForce forecasts that the memory industry’s output value will reach $551.6 billion by 2026, marking a 134% increase year-over-year. Expectations are that price hikes for DRAM and NAND Flash contract prices will persist into 2027.

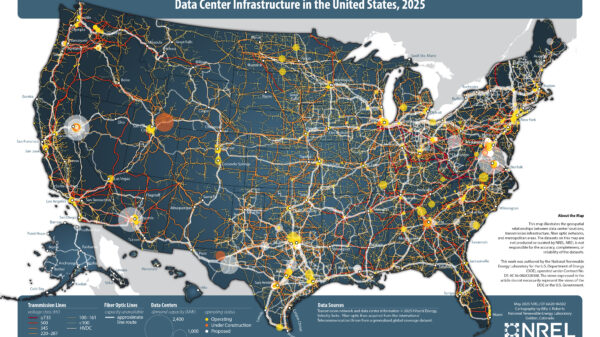

The CPU segment is also feeling the pressure as growing demand for general computing capabilities from AI agents and the renewal cycle for general servers are driving up server CPU prices. In passive components, areas such as power management for AI servers are pushing leading manufacturers to continue implementing price increases for high-end passive components. Notably, Yageo raised prices for certain tantalum capacitors used in AI servers and automotive electronics in November 2025. Furthermore, the easing of U.S. regulatory restrictions on NVIDIA’s H200 chip exports to China could boost demand for domestic server manufacturing, while AI computing demand for server PCBs, data center optical modules, and other interconnect hardware is expected to remain robust, maintaining tight supply-demand conditions for essential materials like high-end copper foil and photonic chips.

Domestically, advancements in computing power-related hardware continue to break through technological bottlenecks, deepening localization efforts. Companies such as **Cambricon**, **Hygon**, and **Moore Threads** are emerging as significant players in the computing chip sector, while major internet firms like **Alibaba** and **Baidu** are progressing in their development of self-designed computing chips. The report suggests that domestic chip manufacturers are likely to continue narrowing the gap with their overseas counterparts.

In the packaging arena, domestic manufacturers are reportedly making strides in advanced packaging technologies. **JCET** has announced significant advancements in optoelectronic co-packaging technology, with silicon photonics engine products based on the XDFOI multi-dimensional heterogeneous integration advanced packaging platform successfully passing client site tests. In the memory segment, **Changxin Memory Technologies** launched DDR5 products in November 2025, achieving mainstream technical specifications at competitive international levels. Meanwhile, **Yangtze Memory Technologies** has enabled a notable development in 3D NAND technology through its independently developed Xtacking architecture. The outlook remains positive, with domestic hardware expected to continue overcoming technological hurdles and advancing localization efforts.

Orient Securities anticipates that AI implementation at the device level will accelerate in 2026, leading to deeper integration into various hardware products and industrial scenarios, thereby presenting investment opportunities across the value chain. In traditional consumer electronics like PCs, TVs, and smartphones, AI is expected to enhance functionalities, creating value-added opportunities for system-on-chips (SoCs), edge storage, thermal management, and sensor-related hardware. The report highlights that leading technology companies, including **OpenAI** and **Apple**, are expected to launch innovative devices such as AI headphones and AI pins, while the smart glasses industry is poised for rapid growth, potentially generating new growth opportunities for enterprises within the value chain.

In terms of investment targets, the report identifies several key areas: for AI computing power-related hardware, notable wafer manufacturers include **SMIC** and **Huahong Semiconductor**; semiconductor equipment firms like **Advanced Micro-Fabrication Equipment (AMEC)**, **NAURA Technology**, **Hwatsing Technology**, and **Coreturn Microelectronics** are also highlighted. Additionally, companies in edge storage such as **GigaDevice** and **BIWIN Storage**, as well as terminal manufacturers and brand vendors like **Hikvision**, **Lenovo Group**, **Lens Technology**, and **Xiaomi Group**, are expected to be significant players in the evolving landscape.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech