China is intensifying its initiatives to bolster domestic chip design and manufacturing capabilities, aiming to achieve long-term self-sufficiency and reduce reliance on foreign suppliers. This strategic shift, articulated by industry analyst Zeng, underscores the nation’s focus on developing a robust domestic semiconductor ecosystem, particularly in the training chip sector.

However, the situation could become more intricate if authorities were to mandate that imported chips be deployed alongside domestically produced accelerators. Reuters has reported that such a requirement might be on the horizon, which could lead to significant operational challenges.

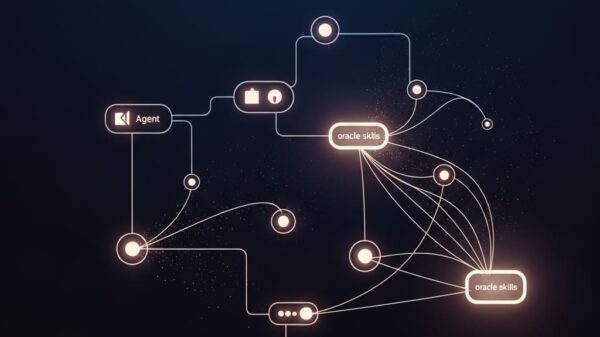

Zeng expressed concerns regarding the implications of a mandated bundling requirement, stating, “A mandated bundling requirement would create a heterogeneous computing environment that significantly increases system complexity.” He elaborated that variations in performance and discrepancies in communication protocols across different chip architectures would likely inflate operations and maintenance overhead while introducing additional network latency.

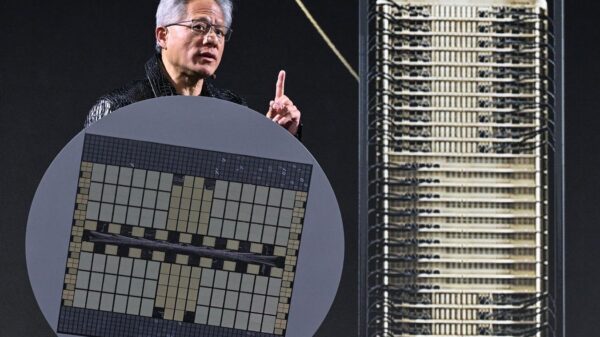

Despite these developments, Zeng indicated that current approvals for domestic chip production are unlikely to bridge the technological gap with U.S. hyperscalers. He noted that the H200 chip, although recently approved for use, still lags a generation behind Nvidia’s Blackwell architecture, and the approved production volumes fall short of meeting China’s substantial demand for advanced chips.

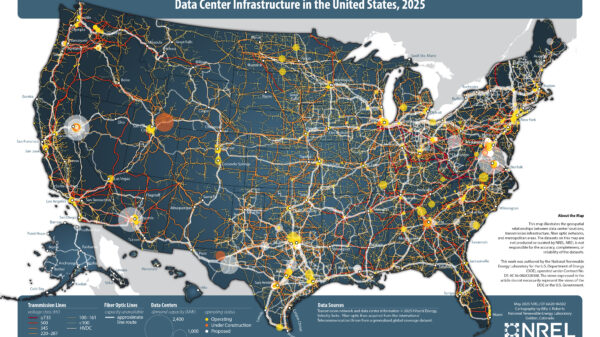

The implications of these developments extend beyond China, particularly for global enterprise IT and network leaders. The ongoing evolution of China’s semiconductor landscape adds another variable to long-term AI infrastructure planning for companies operating internationally.

As the potential for expanded sales of Nvidia’s H200 chips increases, it could enable the company to scale production more effectively. Neil Shah, Vice President for research at Counterpoint Research, suggested that this scaling might create opportunities to ease pricing for Western enterprises looking to implement H200-based AI infrastructure. Such shifts could further alter the competitive landscape in AI technology deployment worldwide.

As China accelerates its efforts to enhance its semiconductor capabilities, the global technology community will be closely monitoring the evolving dynamics and their impact on international supply chains and technological advancement. The push for self-sufficiency in chip production reflects broader trends in global tech competition, where nations are increasingly aware of the strategic importance of advanced technologies.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech