AI-focused cloud stocks Arista Networks (ANET) and CoreWeave (CRWV) have experienced a significant rally as investors return to AI infrastructure plays, buoyed by major chipmakers like Nvidia (NVDA) indicating stronger long-term demand for data center capacity. After a challenging period during the late-year AI bubble scare in 2025, CoreWeave shares have surged approximately 40% in the past month, rebounding sharply following the announcement of a new partnership with Nvidia. Meanwhile, Arista’s stock has also risen by about 10% monthly, positioning it among the better performers in 2026.

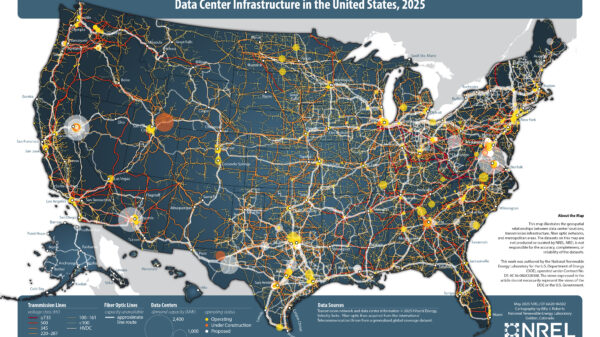

Arista has forged significant AI cloud partnerships, including deep collaborations with privately held VAST Data and Nvidia, enhancing its integration across hyperscale cloud and AI-cluster environments. As broader market dynamics shift, investors are increasingly focusing on companies integral to the physical infrastructure of AI, which includes GPUs, cloud capacity, and networking.

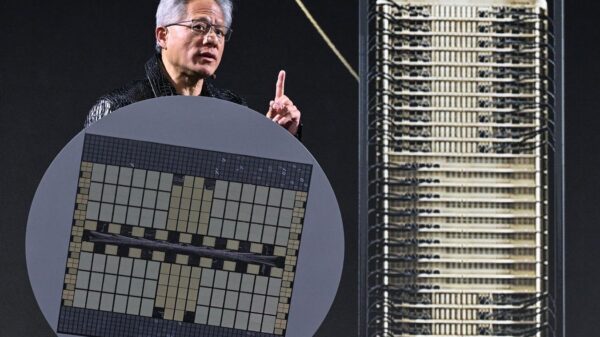

CoreWeave’s trading volume has surged 55% above its three-month average, indicating heightened market activity and renewed institutional interest, as investors reassess economic data and look beyond short-term volatility. This renewed focus on AI infrastructure comes as CoreWeave solidifies its position as a key player in the AI sector, with Nvidia’s substantial investment now totaling roughly $2.1 billion. This includes Nvidia’s original $100 million stake alongside a recent $2 billion equity infusion aimed at establishing large-scale AI “factories” with more than 5 gigawatts of capacity by 2030.

This investment makes Nvidia CoreWeave’s second-largest shareholder and underscores the chipmaker’s commitment to expanding AI compute capacity through specialized cloud partnerships. CoreWeave, utilizing Nvidia’s advanced architectures, is pivotal in helping scale Nvidia’s “AI factory” strategy while efficiently managing demanding AI workloads. The partnership is strategic, positioning CoreWeave as both a customer and an operational extension of Nvidia’s AI-infrastructure ambitions.

Investors are encouraged by CoreWeave’s AI-specific cloud servers and its impressive triple-digit revenue growth. Since going public in March of last year, CoreWeave has released three quarterly reports, the most recent indicating an adjusted loss of $0.08 per share on revenues of $1.36 billion for Q3. The company is expected to report Q4 results on February 9, with FY25 earnings projected to reflect an adjusted loss of $1.31 per share, while annual sales are anticipated to grow by 168% to $5.1 billion compared to $1.9 billion reported in 2024.

Arista Networks is also well-positioned within this landscape, with its 400G/800G high-speed switches serving as critical hardware for hyperscalers and AI data center builders. This leadership in AI networking, backed by strong revenue growth, has contributed to Arista’s recent stock resurgence. The company’s partnerships with Nvidia and VAST Data are focused on delivering high-bandwidth, low-latency networking—essential elements for training and deploying large AI models. In its most recent Q3 earnings report, Arista noted a 27% increase in revenue to $2.3 billion and a 25% rise in EPS to $0.75.

Arista is scheduled to release Q4 results on February 12, with FY25 sales and EPS expected to rise nearly 27%, forecasted at $8.87 billion and $2.88 per share, respectively. The positive market sentiment surrounding both companies reflects a broader resurgence in investor confidence toward AI infrastructure, with CoreWeave benefiting from Nvidia’s backing and Arista gaining traction through its financial fundamentals and diversified partnerships.

CoreWeave’s relationship with Nvidia serves as a testament to its credibility and the potential for future profitability, while Arista’s stock increase is anchored in its strong fundamentals and diversification beyond Nvidia. Currently, Arista Networks holds a Zacks Rank of #2 (Buy), while CoreWeave is rated #3 (Hold). The renewed interest in AI-driven infrastructure indicates a growing recognition of the essential role these companies play in the evolving landscape of artificial intelligence.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech