Lumen Technologies (LUMN) is regaining investor attention following its receipt of ISO 42001 certification for its Artificial Intelligence Management System. This achievement underscores the company’s commitment to ethical AI governance and risk management, positioning it favorably within the competitive tech landscape.

The announcement of the certification coincides with a notable uptick in Lumen’s stock price, which climbed 7.65% in a single day and has risen 15.98% over the past week. Over the last 30 days, shares have surged by 20.81%, recovering from a 90-day slump that saw a decline of 15.55%. Despite these promising figures, the company’s total shareholder return remains strong at 82.87% over the past year and 76.95% over the last three years. This recent momentum suggests a shift in market sentiment, even as the five-year total shareholder return reflects a slight downturn.

While these developments may spark interest in Lumen’s growth potential, the company has reported mixed long-term financial results. Lumen posted a net loss of $1.652 billion against revenues of $12.69 billion, raising questions about the sustainability of its recent stock performance. Currently trading above the average analyst target price of $7.78, investors are left to consider whether the market is already factoring in future growth, or if a buying opportunity exists.

A prevailing narrative suggests Lumen Technologies may be overvalued, with its last closing price at $9.29 compared to a fair value estimate of $7.23. This perspective indicates that the current market valuation may not align with the company’s underlying fundamentals. The shift away from legacy voice and copper services, coupled with a focus on cost reductions, is seen as a strategy to channel resources into high-growth, higher-margin enterprise and digital segments. This pivot aims to stabilize EBITDA and set the stage for earnings growth as Lumen transitions from decline to expansion.

However, this analysis could falter if revenue from legacy services continues to decline sharply or if significant debt and refinancing needs pressure cash flow, limiting operational flexibility. Analysts caution that ongoing risks could undermine Lumen’s turnaround narrative.

In contrast, a discounted cash flow (DCF) analysis reinforces the view of potential overvaluation. The DCF model estimates a fair value of $6.75 per share, suggesting that Lumen’s stock is priced ahead of its projected cash flows. If both the narrative and the DCF model indicate overvaluation, the market will be watching closely to see what changes might be necessary to bridge this gap.

For those who may arrive at different conclusions based on their analysis, resources are available for investors to construct their own narratives about Lumen Technologies. A comprehensive analysis highlights one key reward and three significant warning signs that could influence investment decisions.

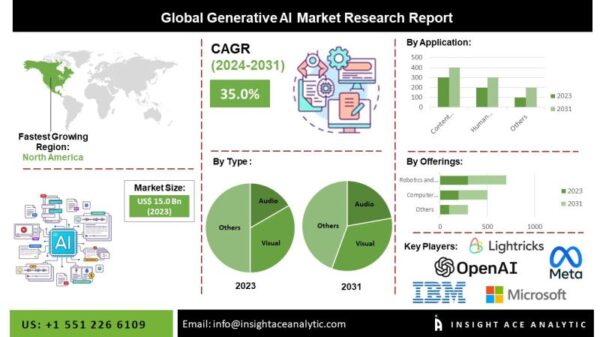

As interest in Lumen Technologies grows, investors are encouraged to explore additional opportunities in the tech sector. High-growth tech and AI stocks may present alternative avenues for potential gains as market dynamics evolve. With the Lumen certification reflecting a broader trend towards responsible AI development, the implications for the company and its shareholders could extend beyond immediate financial metrics, signaling a shift in the industry’s approach to technology governance.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech