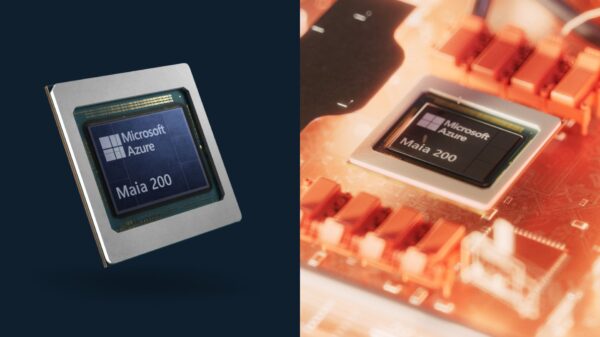

Microsoft (NASDAQ: MSFT) has unveiled its latest AI accelerator, the Maia 200, designed specifically for high-performance inference workloads within its Azure cloud platform. This announcement raises questions among investors regarding the potential implications for Nvidia (NASDAQ: NVDA), a leader in AI chip design whose graphics processing units (GPUs) and software solutions are critical to the current AI computing landscape. While the Maia 200 is a significant development, the primary concern for Nvidia stakeholders may not be the chip itself, but the broader trend of hyperscale cloud providers developing alternatives to Nvidia’s offerings.

Microsoft touts the Maia 200 as a “breakthrough inference accelerator,” claiming it will significantly enhance the economics of AI token generation. The chip purportedly outperforms its competitors, showcasing three times the FP4 performance of Amazon‘s third-generation Trainium and FP8 performance that surpasses Alphabet‘s seventh-generation TPU. The company asserts that the Maia 200 is the most efficient inference system it has deployed, achieving 30% better performance per dollar than the latest hardware in its fleet. This efficiency is further underscored by its capability to power the latest GPT models from OpenAI.

Despite these advancements, experts suggest Microsoft’s Maia 200 is more about improving Azure’s operational efficiency rather than completely replacing its reliance on Nvidia. Nvidia’s strength lies not only in its hardware but also in its comprehensive software ecosystem and networking capabilities, which are challenging for a single in-house chip like the Maia 200 to replicate across diverse workloads. During a recent earnings call, Nvidia CEO Jensen Huang addressed the rise of custom-designed AI chips, stating that while such solutions may reduce cloud providers’ dependence on Nvidia, they are typically tailored for specific tasks and do not encompass the versatility offered by Nvidia’s platform.

Nvidia continues to demonstrate robust growth. In the third quarter of fiscal 2026, which ended on October 26, 2025, the company reported revenue of $57.0 billion, reflecting a 62% year-over-year increase. The data center segment remains a key revenue driver, with data center revenue rising to $51.2 billion, an increase of 66% compared to the previous year.

However, the high valuation of Nvidia stock, currently priced at approximately 46 times earnings, raises concerns among investors, especially in light of the growing competition from major hyperscalers like Microsoft, Alphabet, and Amazon. While Nvidia is not expected to face immediate disruption, the increasing adoption of in-house technology by these cloud giants could gradually diminish Nvidia’s pricing power.

Ultimately, while the Maia 200 and similar custom solutions from other cloud providers may not dismantle Nvidia’s platform advantage, they do create a more competitive environment that could complicate Nvidia’s ability to justify its lofty valuation. Investors should exercise caution, as the potential for eroding pricing power may loom over Nvidia’s long-term market position.

Potential investors in Nvidia should weigh these factors carefully. The Motley Fool Stock Advisor analyst team has identified what they consider the ten best stocks to purchase currently, excluding Nvidia from this list. Given the historical performance of their recommendations, investors may want to consider alternatives before making a decision on Nvidia stock.

See also Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity

Tesseract Launches Site Manager and PRISM Vision Badge for Job Site Clarity Affordable Android Smartwatches That Offer Great Value and Features

Affordable Android Smartwatches That Offer Great Value and Features Russia”s AIDOL Robot Stumbles During Debut in Moscow

Russia”s AIDOL Robot Stumbles During Debut in Moscow AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse

AI Technology Revolutionizes Meat Processing at Cargill Slaughterhouse Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech

Seagate Unveils Exos 4U100: 3.2PB AI-Ready Storage with Advanced HAMR Tech