Over the past two years, Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL) have taken distinctly different positions on a pivotal question in technology: where should artificial intelligence (AI) reside—in the cloud or on devices? This divide now shapes the ongoing debate between these two giants, reflecting broader concerns about how future tech ecosystems will be constructed, monetized, and controlled.

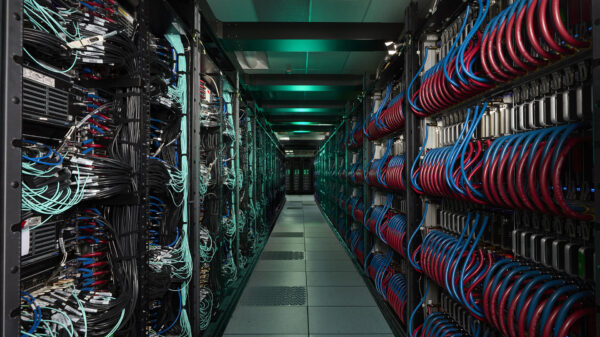

Microsoft’s strategy increasingly hinges on the integration of AI within its cloud infrastructure. In fiscal year 2025, the company reported $281.7 billion in revenue, marking a 15% increase year over year. Central to this growth was Azure, whose annual revenue surpassed $75 billion, representing a 34% year-over-year increase due to heightened enterprise demand for cloud-based AI solutions. This momentum was particularly evident in fiscal Q4 2025, where Microsoft achieved $76.4 billion in quarterly revenue, an 18% rise, while Azure and related cloud services surged by 39% amid uneven broader IT spending.

Rather than presenting AI as a standalone product, Microsoft has embedded it throughout its infrastructure—from Azure AI services to Copilot tools across Windows, Microsoft 365, and GitHub. This infrastructure-first approach defines Microsoft’s AI strategy, treating AI as a scalable service layer rather than a feature linked to specific hardware. Analysts are increasingly characterizing Microsoft as an AI-infrastructure platform rather than a traditional software vendor, a perspective that has become central to discussions surrounding its market position relative to Apple.

In contrast, Apple’s strategy is firmly rooted in its integrated hardware ecosystem. Rather than aggressively shifting AI workloads to the cloud, Apple focuses on embedding intelligence directly into the user experience across its devices, including the iPhone, Mac, iPad, and wearables. This approach reinforces Apple’s broader strategy of creating a cohesive ecosystem centered around its hardware. For fiscal year 2025, Apple reported approximately $416 billion in total revenue, a new record for the company. Notably, the services segment has also grown, with about $28.8 billion generated in Q4 2025 and total annual services revenue exceeding $109 billion, up roughly 13-15% year over year.

This trajectory underscores the increasing significance of services for Apple. Unlike hardware, services require less capital investment, offer higher margins, and scale more effectively with the installed base rather than unit sales. The growth in Apple’s services revenue has become a critical element of its investment narrative, showcasing the company’s ability to convert hardware users into long-term service subscribers.

These divergent strategies influence how investors evaluate the market dominance of each company. Microsoft’s valuation reflects confidence in its enterprise AI and cloud monetization strategies, while Apple’s valuation relies on consumer loyalty and its capacity to convert hardware users into committed service subscribers. This contrast is evident in market performance; over the 12 months leading up to mid-December 2025, Microsoft’s stock rose approximately 15%, compared to a 9.3% increase for Apple, indicating a stronger investor appetite for exposure to cloud and AI infrastructure.

The valuation comparison between Apple and Microsoft highlights two distinct business models. Microsoft benefits from recurring revenue derived from enterprise cloud consumption, while Apple monetizes its control over the end-user experience. This rivalry is fundamentally about leverage: Microsoft is building AI for scalability, integrating intelligence into the cloud infrastructure that enterprises depend on, whereas Apple is focusing on AI for control, keeping computation and intelligence close to the user, which reinforces the stickiness of its devices.

As the debate over AI’s role in technology ecosystems continues, the critical question for investors shifts from which company delivers the most advanced AI features to which ecosystem can compound value more reliably as AI becomes increasingly embedded in both work and daily life. This evolving landscape will ultimately define the ongoing rivalry between Microsoft and Apple and shape the future trajectory of technology ecosystems.

See also Vista AI Secures $29.5M Series B Funding to Expand Automated MRI Scanning Capabilities

Vista AI Secures $29.5M Series B Funding to Expand Automated MRI Scanning Capabilities Quantum Computing Market Projected to Surge to $72 Billion by 2035, Says McKinsey

Quantum Computing Market Projected to Surge to $72 Billion by 2035, Says McKinsey China’s AI Chip Firms Dominate 2025 Rankings with Seven in Top Ten, Hurun Report Reveals

China’s AI Chip Firms Dominate 2025 Rankings with Seven in Top Ten, Hurun Report Reveals