The global semiconductor landscape underwent a significant transformation this week as the U.S. government enacted a 25% ad valorem tariff on high-end artificial intelligence processors. Effective January 15, 2026, this measure—known informally as the “Silicon Surcharge” among industry professionals—specifically targets advanced chips crucial for large language models and generative AI training. This policy marks a strategic shift from mere export bans to a revenue-capture model aimed at supporting the domestic reshoring of American manufacturing.

Framed by the administration as a necessary measure for national security, the tariffs have sparked immediate concern in financial markets. Investors are now weighing the long-term advantages of a revitalized U.S. manufacturing base against the short-term reality of heightened capital expenditures for major technology firms worldwide. The initiative has effectively drawn a “Silicon Curtain” across the global supply chain, necessitating a high-stakes recalibration of how AI computing is acquired, sold, and produced.

The tariffs arise from a national security proclamation by the White House, signed on January 14, 2026, under Section 232 of the Trade Expansion Act of 1962. This legal framework permits the president to modify imports deemed a threat to national security. Following a nine-month investigation, the Department of Commerce determined that the U.S. dependence on foreign semiconductor manufacturing—producing only 10% of its requirements—constituted a critical vulnerability.

The order particularly focuses on high-performance processors, naming Nvidia (NASDAQ: NVDA) and its H200 AI processor, as well as Advanced Micro Devices (NASDAQ: AMD) and its Instinct MI325X accelerator as primary examples of “covered products.” A controversial element of the policy, dubbed the “Testing Trap,” mandates that any advanced chips intended for international markets—including previously restricted markets like China—must now pass through U.S. territory for third-party laboratory verification. This requirement activates the 25% tariff on the transaction value, converting what used to be a total ban into a lucrative tax for the U.S. Treasury.

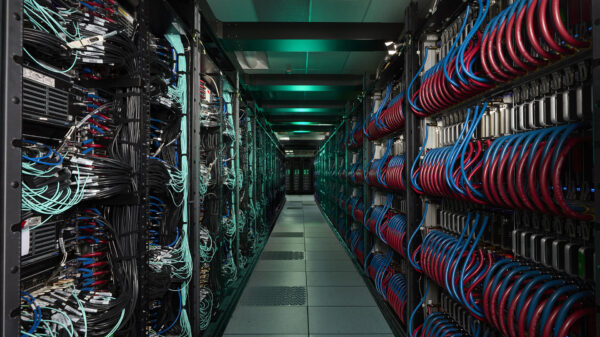

Market reactions were swift, with the CBOE Volatility Index (VIX) surging 15% on the day of the announcement, reflecting deep uncertainty surrounding the “Domestic Use” exemptions. While chips imported for U.S.-based data centers and research are exempt, the global nature of AI development presents a structural cost increase for cloud providers with international operations, a scenario few had anticipated for the 2026 fiscal year.

The Silicon Surcharge has delineated a clear divide in equity markets, favoring domestic manufacturers while penalizing international firms. Intel (NASDAQ: INTC) positioned itself as a principal “national champion,” witnessing its stock rise 10% following the tariff announcement. Analysts regard the policy as enhancing Intel’s competitive edge, particularly for its 18A process node, rendering U.S. silicon more cost-effective than foreign alternatives. Likewise, Micron Technology (NASDAQ: MU) saw stock performance outpace the broader market, as its High Bandwidth Memory components—integral to AI accelerators—are largely excluded from the initial focus of the tariffs.

Conversely, hyperscale cloud providers and international startups are bracing for adverse effects. Microsoft (NASDAQ: MSFT) experienced a drop to a six-month low, with analysts at Morgan Stanley cautioning that the company’s aggressive international data center expansion now faces a 25% cost increase for its latest H200 and Blackwell clusters. Amazon (NASDAQ: AMZN) also felt selling pressure and responded by accelerating investments in its AWS GovCloud while enhancing internal development of its proprietary “Trainium” chips to circumvent the “Silicon Surcharge.”

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) initially saw its stock decline but rebounded following the announcement of a landmark “$250 Billion Silicon Pact.” This agreement provides TSMC with duty-free quotas in exchange for a commitment to establish five additional fabrication plants in Arizona, aligning with U.S. goals to bring half of the world’s leading-edge capacity to American soil by the end of the decade.

The introduction of the tariffs signifies a decisive shift toward “Silicon Nationalism,” reminiscent of the semiconductor trade wars of the 1980s between the U.S. and Japan. However, unlike the earlier conflicts that centered on memory chip “dumping,” the 2026 tariffs position high-end computing as a sovereign asset akin to oil or steel. The global technology ecosystem is now bifurcating into a “Trusted Tier” of security-aligned partners and a “Taxed Tier” encompassing adversarial nations and their dependencies.

The long-term implications extend beyond hardware to software standards and the movement of skilled professionals. In response to the U.S. measures, China is poised to leverage its control over rare earth elements and High Bandwidth Memory components, crucial for the Nvidia and AMD chips targeted by U.S. policies. Meanwhile, European Union officials have expressed alarm, perceiving the tariffs as a form of “economic blackmail” and contemplating their own “Anti-Coercion Instrument” to restrict U.S. access to public tenders.

The current 25% tariff is merely the initial phase of a multi-year strategy. The White House has indicated that if domestic manufacturing benchmarks, particularly the groundbreaking of “mega-fabs” in Ohio and Arizona, are not met, tariffs on advanced AI chips could escalate to 100% by mid-2026. This “Phase Two” threat aims to maintain pressure on companies like TSMC and Samsung to relocate their most advanced nodes to the United States.

Additionally, a “Phase Three” expansion is scheduled for June 2027, which will incorporate “legacy” chips into the tariff regime. This timeline is intended to provide a “glide path” for the automotive and medical device sectors to identify domestic alternatives. For investors, the next 18 months will be characterized by a “Great Infrastructure Rotation,” where capital will favor large-cap firms capable of absorbing these surcharges or possessing the vertical integration necessary to navigate around them.

The January 2026 AI chip tariffs represent a pivotal moment in the digital age. While the policy seeks to revitalize the American industrial base and secure future technology, it has permanently heightened the cost of global computing. The transition from “just-in-time” efficiency to “just-in-case” resilience has led to duplicated supply chains and a fragmented AI research community. Investors should closely monitor advancements in U.S. fabrication construction and any signs of retaliatory material shortages from China in the coming months. The market is evolving toward a reality where geopolitical considerations are as crucial to a technology company’s success as its engineering capabilities. While volatility may prevail in the short term, the enduring winners will be those firms—such as GlobalFoundries (NASDAQ: GFS) and Amkor Technology (NASDAQ: AMKR)—that provide the indispensable domestic infrastructure required for a self-sufficient American silicon ecosystem.

See also China’s AI Chip Firms Dominate 2025 Rankings with Seven in Top Ten, Hurun Report Reveals

China’s AI Chip Firms Dominate 2025 Rankings with Seven in Top Ten, Hurun Report Reveals Salesforce Enhances AI Strategy to Tackle Last-Mile Adoption Challenges in Enterprises

Salesforce Enhances AI Strategy to Tackle Last-Mile Adoption Challenges in Enterprises NVIDIA Stock Drops 3% as China Blocks H200 AI Chip Shipments Amid Trade Tensions

NVIDIA Stock Drops 3% as China Blocks H200 AI Chip Shipments Amid Trade Tensions Trump Launches ‘Pax Silica’ Initiative to Secure AI Supply Chains and Greenland’s Minerals

Trump Launches ‘Pax Silica’ Initiative to Secure AI Supply Chains and Greenland’s Minerals