Meta Platforms has appointed Dina Powell McCormick, a former Goldman Sachs executive and ex-board member, as its president and vice-chairman. Her role will be pivotal in advancing the company’s long-term AI infrastructure, establishing capital partnerships, and securing financing for data centers. This move comes as Meta continues to make significant investments in clean energy and power purchase agreements.

Simultaneously, Meta is reallocating resources from its Reality Labs unit, which has focused heavily on the metaverse, towards the development of AI-enabled wearables and smart glasses. This strategic shift underscores the company’s commitment to artificial intelligence as its central technology and hardware focus.

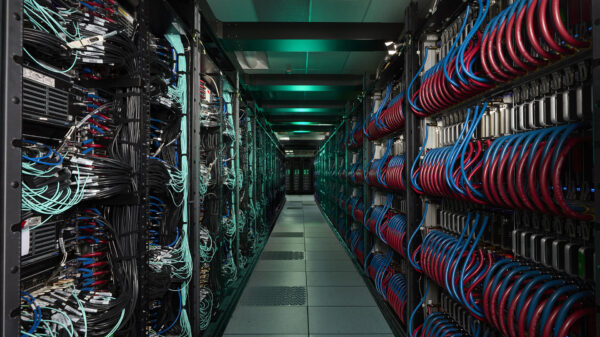

Investors are closely monitoring how Meta’s multi-year AI data center and clean energy initiatives could alter its investment narrative and risk profile. To invest in Meta today, shareholders must believe that its substantial spending on AI infrastructure and data center capabilities will bolster long-term earnings without severely impacting profit margins. A key short-term catalyst involves the success of AI-driven advertising tools and engagement metrics, which must continue to offset rising capital expenditures. However, there remains a significant risk that the company’s extensive investments in AI and hardware may not yield quick returns.

Among Meta’s most notable recent commitments are long-duration clean energy and nuclear power agreements, including 20-year power purchase contracts with Vistra. These agreements highlight the importance of reliable and large-scale energy sources for Meta’s AI data center expansion and relate directly to investors’ concerns regarding whether such infrastructure investments can generate sustainable returns before potential regulatory, cost, or execution challenges arise.

Despite the promising opportunities, analysts caution that soaring capital expenditures in AI may outstrip revenue growth, thereby constraining free cash flow. This dichotomy presents a complex landscape for investors who are weighing the potential for enhanced engagement and revenue against the risks associated with increased spending.

Meta Platforms projects a revenue of $275.9 billion and earnings of $92.1 billion by 2028. To achieve this ambitious forecast, the company must maintain a yearly revenue growth rate of 15.6% and increase earnings from the current $71.5 billion by approximately $20.6 billion. Analysts suggest that these projections yield a fair value estimate of $835.54 per share, representing a potential upside of 35% from its current market price.

Members of the Simply Wall St Community have a diverse range of fair value estimates for Meta, with projections varying between $538 and $1,053 across 100 individual assessments. This range highlights the varying assumptions and expectations regarding the company’s future performance, particularly in light of its heavy investments in AI infrastructure and clean energy.

For investors who may disagree with prevailing narratives, there are tools available to craft a personalized investment perspective on Meta Platforms. A comprehensive analysis that highlights four key rewards can serve as a foundation for informed decision-making regarding investments in the company. Additionally, a free research report offers a visual summary of Meta’s overall financial health, making it easier for prospective investors to evaluate its viability.

As the tech landscape continues to evolve, Meta’s strategic focus on AI and clean energy positions it uniquely within the industry. However, the successful navigation of these ambitious initiatives will largely determine the company’s financial trajectory in the coming years. Stakeholders will be keenly observing how Meta balances its capital expenditures with revenue generation, as the outcomes will significantly influence its market standing and investment appeal.

See also ServiceNow Integrates Biometric Security, Enhancing AI Workflows for 8,400 Contact Centers

ServiceNow Integrates Biometric Security, Enhancing AI Workflows for 8,400 Contact Centers TikTok Shop Launches AI Tools to Boost Merchant Sales and Enhance Product Listings

TikTok Shop Launches AI Tools to Boost Merchant Sales and Enhance Product Listings Meta Cuts Metaverse Spending, Invests in AI Smart Glasses Amid Valuation Shift to $723.11

Meta Cuts Metaverse Spending, Invests in AI Smart Glasses Amid Valuation Shift to $723.11 Formulary Secures $4.6M Seed Round Led by Khosla to Revolutionize Fund Administration with AI

Formulary Secures $4.6M Seed Round Led by Khosla to Revolutionize Fund Administration with AI Machine Learning Tool Enhances Osteoporosis Screening Accuracy Using SHAP Method

Machine Learning Tool Enhances Osteoporosis Screening Accuracy Using SHAP Method