Bridgewater Associates, one of the world’s largest hedge funds, has signaled that the surge in corporate spending on artificial intelligence (AI) is poised to reshape the global economy. In a client note published on January 26, 2026, the firm’s co-chief investment officers, Bob Prince, Greg Jensen, and Karen Karniol-Tambour, outlined their outlook on the implications of this escalating trend.

The note indicates that corporate investment in AI is rapidly becoming a primary driver of market momentum and capital allocation across various sectors. This trend is not merely a passing phase but a fundamental shift that could redefine long-term corporate strategies and economic landscapes.

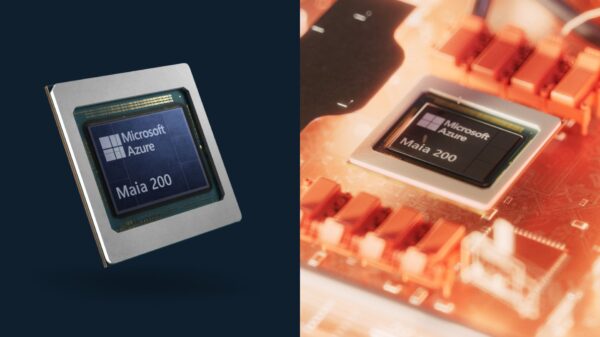

AI has increasingly taken center stage in corporate investment strategies, influencing decisions in sectors ranging from technology to manufacturing. Investment in AI infrastructure, including data centers, chips, and power systems, has contributed significantly to rising equity markets. However, this growth has also raised concerns about a potential AI market bubble, as the sustainability of such a rapid escalation in spending remains uncertain.

The Bridgewater CIOs expressed their belief that companies are under pressure to invest aggressively in AI due to competitive dynamics. “Straightforward game-theoretic calculations make it unacceptable for these companies to accept falling behind rivals by even a few months of progress,” they noted, highlighting the intense competitive environment that compels companies to increase their AI capital expenditures.

As global stocks experienced notable volatility in late 2025, fears over an AI stock bubble contributed to investor caution. Nevertheless, Wall Street’s main indexes closed the year with double-digit gains, largely driven by strong demand for AI-related stocks. The co-CIOs warned that this surge in AI spending could lead to inflationary pressures, as heightened demand may drive up prices across the AI ecosystem, including critical components such as semiconductors and electricity.

The latest analysis suggests that the current environment of easy monetary policy could further accelerate speculative activities in equity markets and intensify the frenzy surrounding AI investments. The Bridgewater team cautioned that such conditions could create a fertile ground for market overheating and bubble-like scenarios.

As the landscape of corporate investment evolves, the implications extend beyond financial markets. The growing reliance on AI technologies could change consumer behavior, influence regulatory frameworks, and affect job markets. With corporate giants increasingly prioritizing AI, the overall economic impact may be profound, necessitating vigilance from investors and regulators alike.

In conclusion, the trajectory of AI investment as outlined by Bridgewater Associates underscores a pivotal moment in the intersection of technology and finance. As companies navigate this rapidly changing landscape, the consequences of their investment choices will resonate through the broader economy, setting the stage for both opportunities and challenges in the years to come.

(Reporting by Manya Saini in Bengaluru; Editing by Tasim Zahid)

See also California Senate Passes SB 300, Restricting AI Chatbots from Accessing Explicit Content for Minors

California Senate Passes SB 300, Restricting AI Chatbots from Accessing Explicit Content for Minors Google’s DeepMind Reveals AI Drug Discovery System That Reduces Development Time by Years

Google’s DeepMind Reveals AI Drug Discovery System That Reduces Development Time by Years Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032