By Medha Singh and Sruthi Shankar

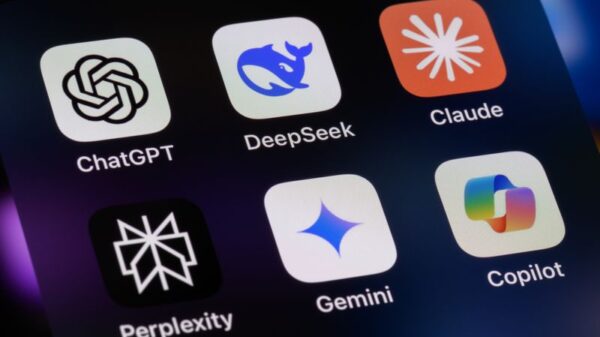

Feb 13 (Reuters) – Wall Street is facing a wave of disruption fears stemming from advancements in artificial intelligence (AI). Initially, investors reacted by offloading shares of software companies, but the unease quickly spread to sectors perceived as vulnerable to automation, leading to significant losses in U.S. stocks this week.

The selloff affected various industries, including private credit, real estate brokers, data analytics, legal services, and insurers. The turmoil began after Anthropic unveiled a legal AI plug-in, which heightened investor anxiety, especially following a series of AI model upgrades and new product launches.

“With fear driving market sentiment, investors remain in ‘sell first think later’ mode, asking ‘who is next’ and showing no mercy for anything remotely seen as an AI loser,” said Emmanual Cau, an equity strategist at Barclays.

The impact on the software sector has been particularly severe. The S&P 500 Software & Services index has lost approximately $2 trillion in value since its peak in October, with half of the losses occurring in the past two weeks as concerns mount that rapidly evolving AI tools could disrupt traditional subscription and enterprise software models. Among the worst performers in the Nasdaq 100 this year are Atlassian, down 47%, Intuit, which has fallen 40%, and Workday, down a third of its value.

Meanwhile, Salesforce has seen its stock tumble around 30% in 2026, Adobe is down 25%, and CrowdStrike has lost 12%. “There’s this idea that AI is somehow going to replace built-out models in the near term – models that have been in place for many years and from which companies have profited strongly,” noted Robert Pavlik, senior portfolio manager at Dakota Wealth.

The downturn in the U.S. software sector has also negatively impacted shares of alternative asset managers, compounded by fears over their exposure to leveraged loans tied to struggling software companies. Firms like Ares, Blackstone, Blue Owl, Apollo, TPG, and KKR have seen their stocks fall between 13% and 24% this year. According to estimates from BNP Paribas, about a fifth of the private credit market is linked to the software sector.

The financial industry also faced severe repercussions, particularly in brokerage and data analytics segments. Concerns heightened after wealth management firm Altruist rolled out AI-enabled tax planning features, prompting fears that AI could disrupt traditional business models. On Tuesday, shares of firms such as LPL Financial, Raymond James Financial, and Charles Schwab plunged more than 7%.

Index provider S&P Global issued a pessimistic earnings forecast for 2026, resulting in a drop of over 25% in February, marking its worst month since 2009. Other firms, including Moody’s, FactSet Research, and MSCI, also faced steep declines.

The real estate sector was not spared, as commercial real estate and investment managers suffered a blow. Analysts at KBW noted that investors were shifting away from high-fee, labor-intensive business models perceived as vulnerable to AI disruption. Shares of CBRE Group and Jones Lang LaSalle both dropped about 12%, while Cushman & Wakefield fell nearly 14%. CoStar Group, which owns Apartments.com and Homes.com, declined by 5.9%.

“We view market concerns as overstated due to a combination of fragmented commercial real estate end markets and the non-core nature of real estate activities for many clients,” commented Sean Sunlop, an analyst at Morningstar.

Insurance stocks also experienced a downturn. Brokers and underwriters on both sides of the Atlantic reported significant losses after the online platform Insurify launched an AI-powered comparison tool on ChatGPT, enabling users to compare car insurance rates. The S&P 500 insurance index slumped 3.9% on Monday, marking its largest single-day drop since mid-October.

Shares of insurance broker Willis Towers Watson plummeted 15% this week, facing its worst performance since the pandemic sell-off in March 2020. Aon fell 9% while Arthur J. Gallagher dropped 15%. “Ultimately, we believe brokers will bifurcate. Simpler insurance products could see significant AI disruption over the next five years,” asserted Bob Jian Huang, an equity strategist at Morgan Stanley.

Unexpectedly, the trucking and logistics sector also saw heavy losses. Despite not being considered a primary target for AI disruption, stocks of firms like Landstar System and C.H. Robinson were negatively affected after AI-focused logistics firm Algorhythm Holdings reported that its SemiCab unit boosted customers’ freight volumes by 300% to 400% without a corresponding increase in operational headcount. The Dow Jones Transportation Average fell 4.4% in response.

Analysts at Jefferies observed that this market reaction appeared disconnected from fundamentals, noting that “proprietary freight data and physical networks remain durable moats.”

The recent upheaval underscores the profound impact AI is having across multiple sectors, raising pressing questions about the future of traditional business models and prompting investors to reassess their strategies in an increasingly automated landscape.

See also AI’s Rise Challenges Radio’s Human Connection as UNESCO Warns of Voice Replacement Risks

AI’s Rise Challenges Radio’s Human Connection as UNESCO Warns of Voice Replacement Risks ByteDance Launches Viral Seedance 2.0 AI Model, Garnering 10M Views on Weibo

ByteDance Launches Viral Seedance 2.0 AI Model, Garnering 10M Views on Weibo Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032