Google parent Alphabet reported fourth-quarter earnings that exceeded Wall Street expectations, marking a milestone with full-year revenue surpassing $400 billion for the first time. Despite these strong results, shares experienced a decline in after-hours trading as investors reacted to projected increases in capital spending related to artificial intelligence.

In the fourth quarter, Alphabet’s revenue rose 18% year over year to nearly $114 billion, outpacing analyst forecasts. The company’s net income climbed 30% to $34.5 billion, with earnings per share increasing 31% to $2.82, also ahead of estimates. For the full year 2025, Alphabet reported revenue of $403 billion and profit of approximately $132 billion, driven largely by sustained growth in its advertising, cloud services, and subscription segments.

Google Cloud achieved a significant benchmark, reaching a $70 billion annual run rate. Fourth-quarter revenue for the cloud division approached $18 billion, reflecting a 48% increase from the previous year. Additionally, YouTube revenue exceeded $60 billion, driven by advertising and subscription services.

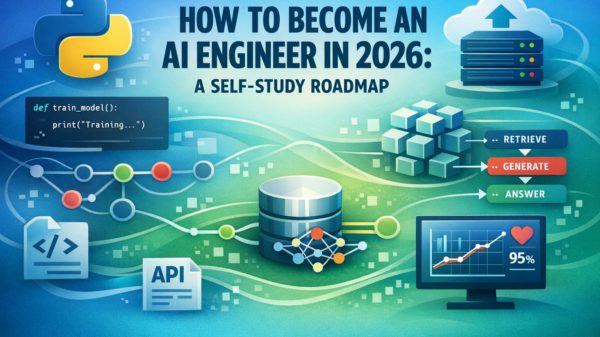

Alphabet underscored its momentum in artificial intelligence, noting that its Gemini AI app surpassed 750 million users following the November launch of Gemini 3, which alone added roughly 100 million users. This growth highlights the increasing consumer interest in AI-driven applications.

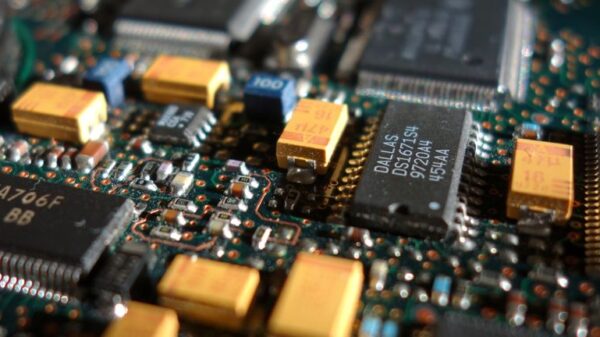

Investor focus quickly shifted to Alphabet’s ambitious spending plans, as the company announced expectations for capital expenditures between $175 billion and $185 billion in 2026. This would nearly double the $91 billion to $93 billion that the company spent in 2025, reflecting a serious commitment to investing in AI models and enhancing its data center infrastructure.

Following the earnings announcement, shares initially surged more than 4% in after-hours trading but later reversed course, ultimately falling about 1.2% to trade near $328, after closing around $333 during the regular session. This fluctuation indicates the market’s mixed response to the company’s financial performance and future investment strategies.

As Alphabet continues to navigate the rapidly evolving landscape of technology and artificial intelligence, its ability to balance innovation with prudent financial management will be crucial. With aggressive growth plans that emphasize AI and cloud computing, how the company executes these investments may significantly influence its market position in the coming years.

See also Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs Wall Street Recovers from Early Loss as Nvidia Surges 1.8% Amid Market Volatility

Wall Street Recovers from Early Loss as Nvidia Surges 1.8% Amid Market Volatility