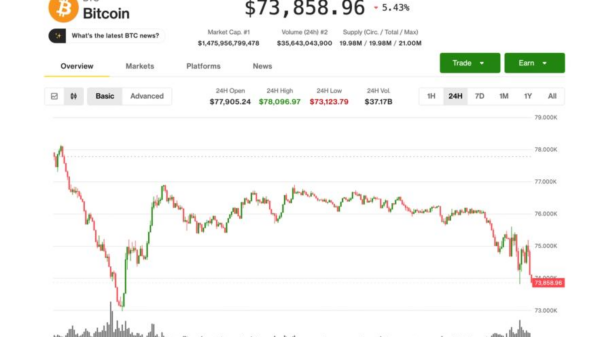

Bitcoin (BTC) fell back below $74,000 during the early hours of the U.S. trading session, as momentum from Tuesday’s lows dissipated amid a broader decline in technology stocks. The cryptocurrency, which had previously shown signs of recovery, is now being weighed down by negative sentiment in the tech sector.

The Nasdaq 100 index dropped by 1%, following a 1.5% decline the day before. The software sector has been particularly hard hit, with the iShares Expanded Tech-Software ETF (IGV) experiencing a decline of 4%, bringing its losses to 17% over the past week. This downturn reflects growing concerns that advancements in artificial intelligence (AI) may bring significant disruptions.

As the turmoil in tech stocks unfolds, crypto miners are also facing steep declines, correlating their fortunes with the ongoing development of AI infrastructure. Companies such as Cipher Mining (CIFR), IREN, and Hut 8 (HUT) each saw their stock prices drop by more than 10%. The negative momentum can be traced back to AMD, a chipmaker whose stock fell by 14% after it issued a disappointing outlook for 2026, which failed to meet analysts’ expectations.

Gold, too, fell prey to the selling pressure, rapidly reversing an overnight surge that had taken its price to $5,113 per ounce, before slipping back below the $5,000 mark.

Meanwhile, U.S. economic indicators present a mixed picture. The ISM Services PMI for January held steady at 53.8, matching December’s revised reading and slightly exceeding expectations. This suggests continued expansion in the services sector, which remains a critical engine of the economy.

However, private job growth has sharply decelerated, with only 22,000 jobs added according to an ADP report. This figure falls significantly short of forecasts that anticipated 48,000 new jobs and follows December’s already weak total of 37,000. The release of the government’s January job report has been postponed to next week due to a temporary government shutdown, further contributing to uncertainty in the labor market.

“Manufacturing has lost jobs every month since March 2024 (Main Street recession), but this month professional and business services and large employers joined the weakness,” said Quinn Thompson, Chief Investment Officer at Lekker Capital. Thompson believes that markets are underestimating the potential for significant Federal Reserve stimulus that could come in 2026.

As market participants analyze these developments, the interplay between the tech sector and cryptocurrency remains a focal point. With economic indicators pointing in different directions, investors face a challenging landscape characterized by volatility and uncertainty.

See also DeepMind Launches AlphaGenome, a Tool Decoding 98% of Non-Coding DNA for Disease Insights

DeepMind Launches AlphaGenome, a Tool Decoding 98% of Non-Coding DNA for Disease Insights UN Chief Guterres Commends India’s Leadership at AI Impact Summit, Boosting Global Collaboration

UN Chief Guterres Commends India’s Leadership at AI Impact Summit, Boosting Global Collaboration Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032