Microsoft’s shift toward AI licensing is gaining momentum as publishers advocate for paid access to their content for training AI models. This transition from data scraping to licensing could significantly alter operational costs and margins, creating new revenue streams in the UK media landscape. Today, shares of Microsoft (MSFT) fell by 0.44%, yet analysts suggest that long-term exposure to AI remains essential for investors. According to a policy lead from the Financial Times, major tech firms, including Microsoft, Meta, and Amazon, are increasingly investing in marketplaces designed for trusted content, indicating a significant change in the business-to-business (B2B) segment.

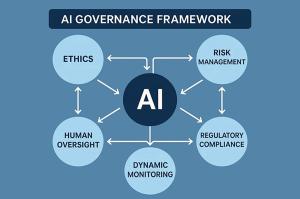

This policy shift from scraping towards paid access is crucial for the industry. The emphasis on licensing agreements not only mitigates legal risks associated with data usage but also enhances the quality of AI models. The Financial Times’ insights imply that this change will likely require platforms to prove consent and data provenance, thereby favoring licensed datasets over unconsented scraping. As UK regulators increasingly scrutinize AI crawlers, companies like Microsoft could find themselves under pressure to establish transparent audit trails and fair terms for data access.

The implications for earnings and margins are noteworthy. Licensing agreements may lead to increased operational expenses and potentially capitalized data rights, alongside existing capital expenditures in AI development. Microsoft’s current price-to-earnings (P/E) ratio of 33.99 and an operating margin of 46.27% suggest that while the company can absorb these additional costs, it may experience a slight contraction in margins in the near term. Investors should keep an eye on future disclosures related to data licensing and traffic acquisition as these elements will be critical in understanding how Microsoft navigates this evolving landscape.

Furthermore, the emergence of AI content licensing is expected to create new, recurring revenue streams tied to the quality and freshness of datasets. This could enhance pricing power for leading UK publishers through tiered access and usage limits. Consequently, Microsoft’s move towards AI licensing aligns with broader trends in the industry, rewarding reputable sources and fostering a more sustainable model for content utilization. As the media landscape shifts, Microsoft’s AI licensing strategy is likely to benefit both the company and content providers.

Despite a 1-day decline of 0.44%, Microsoft’s stock has seen a year-over-year increase of 14.38% and a remarkable three-year growth of over 100%. Current market indicators such as an RSI of 45.34 and an ADX of 18.24 indicate neutral momentum without a clear trend. Analysts’ consensus on Microsoft’s stock remains strong, with 45 buy ratings compared to only one sell. This ongoing focus on AI licensing is positioned as a central thesis for future growth.

For UK investors, the coming earnings report on January 28, 2026, will be pivotal. Key line items to watch include data licensing costs, traffic acquisition expenditures, and insights into partnerships with publishers. Guidance on how Microsoft plans to ground AI models using trusted sources could provide valuable information about potential revenue lifts from enhanced AI products. To navigate this changing landscape effectively, investors are encouraged to focus on platforms with strong return on equity (ROE) and cash generation capabilities that can absorb rising data costs. Microsoft currently boasts an ROE of 31.53% and a robust interest coverage ratio of 54.35, positioning it well for these challenges.

As the UK’s regulatory focus on AI and data scraping intensifies, Microsoft’s strategy for AI licensing appears set to standardize how tech firms access trusted content. While this may elevate operating costs, it also holds the promise of improved quality and safety in AI outputs, which could facilitate broader enterprise adoption. Investors should be vigilant, monitoring Microsoft’s earnings report for insights into licensing disclosures and developments in partnerships with major publishers. The ongoing evolution of AI content licensing not only impacts Microsoft but also has significant implications for its peers and the wider media ecosystem.

In summary, the shift from scraping to licensed data fundamentally changes the landscape for tech companies and publishers alike. As regulatory frameworks evolve and the focus on data provenance intensifies, Microsoft’s AI licensing strategy could set a new standard in the industry. Investors are advised to remain proactive in assessing the implications of these developments for their portfolios, particularly as the demand for high-quality, consented data continues to rise.

What is Microsoft AI licensing? It is Microsoft’s move to pay publishers for rights to use and reference trusted content in training, grounding, and retrieval for AI products. Contracts can include usage limits, watermarking, and indemnities. This reduces legal risk versus scraping, can improve model quality, and creates recurring costs and revenues for platforms and publishers.

How could licensing affect Microsoft’s margins? Licensing adds recurring opex and may shift some costs to partner payments. Microsoft’s operating margin is 46.27%, enough to absorb moderate content costs if AI revenue scales. Watch for explicit disclosures on data licensing and traffic acquisition in the next report. Improved data quality can boost conversion and offset some margin pressure.

What does the UK contribute to the AI scraping crackdown? UK competition scrutiny of search and AI crawlers is pressing platforms to prove consent and fair terms. That encourages licensed data access and auditability. Expect more agreements with UK publishers, clearer provenance controls, and standard clauses on usage. This backdrop supports Microsoft AI licensing and broader publisher AI deals across the market.

What should UK investors watch next for MSFT? Focus on the 2026-01-28 earnings call for commentary on data licensing costs, partner mix, and product adoption tied to trusted content. Track metrics like operating margin, cash flow, ROE, and enterprise AI wins. Also monitor new publisher AI deals and any changes to traffic acquisition or content safety spending.

See alsoDisclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes.

Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.

Life Sciences Fundraising Faces Structural Reset Amid Volatility and AI Expectations

Life Sciences Fundraising Faces Structural Reset Amid Volatility and AI Expectations AI’s Job Impact: Employment in High-Risk Roles Grows 1.7%, Defying Doomsday Predictions

AI’s Job Impact: Employment in High-Risk Roles Grows 1.7%, Defying Doomsday Predictions X Enables Grok AI Image Manipulation, Sparks Global Outcry Over Non-Consensual Content

X Enables Grok AI Image Manipulation, Sparks Global Outcry Over Non-Consensual Content India Joins US-Led Pax Silica Initiative to Secure AI and Semiconductor Supply Chains

India Joins US-Led Pax Silica Initiative to Secure AI and Semiconductor Supply Chains SK Hynix Invests $13B in South Korea’s Advanced AI Chip Plant to Meet Rising Demand

SK Hynix Invests $13B in South Korea’s Advanced AI Chip Plant to Meet Rising Demand