In an era marked by escalating geopolitical tensions, organizations are increasingly confronted with complex risks pertaining to data governance, cybersecurity, and artificial intelligence (AI). According to a recent analysis, these elements are interconnected in ways that are becoming more apparent, particularly as they relate to the rising prices of precious metals, including gold and silver.

A Bloomberg article highlights how geopolitical uncertainties surrounding nations like Venezuela, Greenland, China, and Russia have significantly influenced commodity markets. Notably, gold prices have surged by 71% and silver by 176% over the past year, their best annual performance since 1979. Analysts suggest that this volatility is indicative of a broader speculative frenzy driven by geopolitical tensions. As organizations navigate the intricate landscapes of data and AI regulation, the connections between these markets and their operational frameworks become increasingly relevant.

To illustrate the importance of seeing the broader context in regulatory developments, one can draw parallels with personal experiences. A golf lesson, for instance, serves as a metaphor for the need to consider all variables when evaluating risk. A golf pro, reflecting on a specific putt, urged the importance of recognizing the larger landscape rather than getting fixated on narrow details. Just as the golf pro emphasized the need to account for the entire green’s slope, data, cybersecurity, and AI professionals must adopt a similar mindset when guiding organizations through regulatory changes.

The U.S. Department of Justice’s Final Rule on Protecting Americans’ Sensitive Data from Foreign Adversaries serves as a pertinent example. This initiative marks a significant shift toward stringent cross-border transfer restrictions, driven by national security concerns. While this rule can be burdensome for organizations reliant on cross-border data flow, it is crucial to consider this development as part of a larger trajectory. The dynamics of U.S. and Chinese policies, as well as the geopolitical landscape, suggest that organizations may face increasingly stringent regulations.

Organizations must evaluate how rising cross-border data restrictions could affect their operations. This consideration hinges on their dependence on global data flows, especially in regions marked by geopolitical volatility. Companies might find it necessary to assess the viability of creating ‘data islands’—isolated data storage solutions that limit cross-border access while still achieving business objectives. By doing so, firms can better manage the risks associated with geopolitical tensions.

Another aspect that organizations should consider is the flexibility of third-party vendor relationships. Closer proximity of data and systems to operations that rely on them can reduce exposure to geopolitical risks. Establishing near-shore data management strategies may help mitigate some of the uncertainties tied to international regulatory landscapes.

Finally, it is essential for data, cyber, and AI professionals to communicate these risks effectively to senior leadership, while allowing decision-makers the latitude to explore potential opportunities amid uncertainty. Even as geopolitical tensions pose legitimate challenges, senior leaders may identify new avenues for growth that could be leveraged in the current environment.

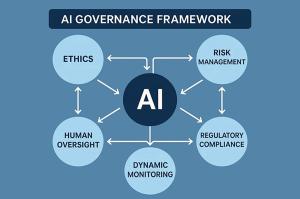

As organizations brace for an increasingly complex regulatory landscape, the necessity of adopting a holistic view of geopolitical risks becomes ever more apparent. Understanding how these elements interact will be critical for navigating the future of global data governance, cybersecurity, and AI.

For further insights, please refer to Bloomberg, the International Association of Privacy Professionals (IAPP), and governmental resources like the White House.

See also Anthropic Launches Claude Cowork to Simplify AI File Management for Non-Coders

Anthropic Launches Claude Cowork to Simplify AI File Management for Non-Coders Authentic Leadership: Key to Navigating AI’s Ethical Integration in Business

Authentic Leadership: Key to Navigating AI’s Ethical Integration in Business Microsoft AI Licensing Gains Traction as UK Publishers Shift to Paid Access Model

Microsoft AI Licensing Gains Traction as UK Publishers Shift to Paid Access Model Life Sciences Fundraising Faces Structural Reset Amid Volatility and AI Expectations

Life Sciences Fundraising Faces Structural Reset Amid Volatility and AI Expectations AI’s Job Impact: Employment in High-Risk Roles Grows 1.7%, Defying Doomsday Predictions

AI’s Job Impact: Employment in High-Risk Roles Grows 1.7%, Defying Doomsday Predictions