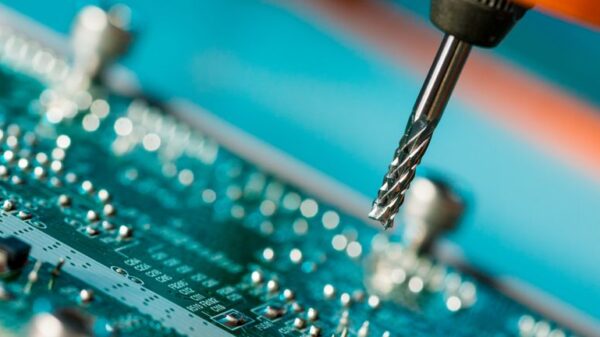

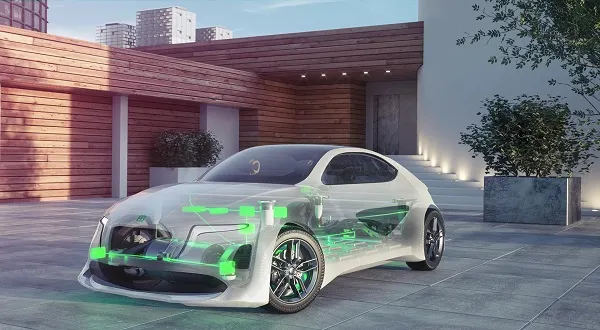

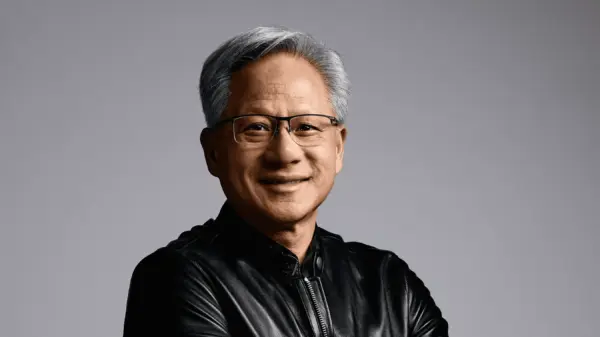

Nvidia Corp. (NASDAQ:NVDA) is encountering new challenges in its China operations as a global shortage of advanced memory chips threatens to restrict U.S. export licenses for its H200 AI processors. This situation raises immediate risks to Nvidia’s sales growth, even as demand for AI hardware continues to soar.

Tight supplies of advanced memory are likely to limit the number of export licenses Nvidia can secure for selling its H200 artificial intelligence processors to customers in China. According to Rep. John Moolenaar, the leading Republican on the House China committee, the ongoing shortage of DRAM—especially high-bandwidth memory used in AI accelerators—poses an “immediate challenge” under the new licensing regulations.

The new rule mandates that exporters certify that approved shipments to China will not contribute to shortages in the U.S. market, as reported by Bloomberg. In response, Nvidia stated that it regularly manages its supply chain and remains confident in its ability to fulfill all approved H200 orders without adversely impacting supplies for other products or customers.

High-bandwidth memory, essential for AI applications, is predominantly produced by Samsung Electronics Co. Ltd (OTC:SSNLF), SK Hynix, and Micron Technology Inc (NASDAQ:MU). Each of these companies has recently cautioned that supply remains constrained as demand from AI data centers surges.

Samsung, leveraging the global memory chip shortage, has implemented significant price hikes, increasing costs on key memory products by as much as 60% since September, according to Reuters. This price escalation is largely driven by panic ordering from companies expanding their AI infrastructure, which is straining available supply.

The ongoing shortage, primarily affecting DRAM, NAND, and high-bandwidth memory, is compelling organizations expanding their AI capabilities to absorb higher expenses. These rising costs could eventually influence consumer products, such as smartphones and PCs, which rely on these same components.

Investors are now faced with the complex decision of whether device manufacturers like Apple Inc (NASDAQ:AAPL) and HP Inc (NYSE:HPQ) can safeguard their profit margins or if they will need to pass on increased costs, potentially dampening consumer demand. Rob Thummel, a senior portfolio manager at Tortoise Capital, remarked, “They’re in a tough position. They basically have two options: They can take a hit to margins, which the market won’t like. Or they can raise prices to offset the higher memory costs, running the risk of hurting demand.”

Rising memory costs have also impacted chipmakers associated with smartphones, leading to recent downgrades for companies such as Qualcomm Inc (NASDAQ:QCOM) and Arm Holdings Plc (NASDAQ:ARM), which cited these risks in their forecasts. Meanwhile, manufacturers of memory and storage solutions have experienced a rally, with Sandisk Corp (NASDAQ:SNDK) leading the S&P 500 with a year-to-date increase of around 75%. Western Digital Corp (NASDAQ:WDC) and Micron have also performed well, capitalizing on trends established in 2025.

As the technology landscape evolves, the ramifications of the memory chip shortage extend beyond Nvidia and its immediate market. The increasing cost pressures are likely to reshape pricing strategies across the technology sector and could influence consumer behavior, altering the landscape for future AI and electronic device investments.

See also Google Chrome Empowers Users to Disable On-Device AI for Scam Detection Features

Google Chrome Empowers Users to Disable On-Device AI for Scam Detection Features UGI Leaderboard Launches to Rank AI Models Based on Censorship Levels and Response Quality

UGI Leaderboard Launches to Rank AI Models Based on Censorship Levels and Response Quality AI Study Exposes Firms Outsourcing Complex Tasks, Risking Skills and Quality

AI Study Exposes Firms Outsourcing Complex Tasks, Risking Skills and Quality Canada Engages Qatar for Major AI, Energy Funding to Accelerate Infrastructure Projects

Canada Engages Qatar for Major AI, Energy Funding to Accelerate Infrastructure Projects Elon Musk Warns Sam Altman: Trial Will Expose OpenAI’s $134B Controversy

Elon Musk Warns Sam Altman: Trial Will Expose OpenAI’s $134B Controversy