In a significant move for the financial services sector, the American Bankers Association (ABA) has announced the introduction of a new database designed to enhance transparency in the banking industry. Set to launch in early 2026, this initiative aims to provide access to critical financial information, including CUSIP identifiers, which are essential for identifying and tracking securities. The database, developed in collaboration with FactSet Research Systems Inc., will serve as a vital resource for financial professionals, regulators, and investors alike.

The ABA’s decision comes amid growing calls for greater accountability within the financial sector. With increasing scrutiny from regulators and the public, institutions are under pressure to provide clear and accessible data regarding their operations. The new database is expected to play a key role in this effort, offering comprehensive reference data that helps users understand the complexities of financial products and services.

“This database represents a major step forward in our commitment to transparency,” said a spokesperson for the ABA. “By providing detailed information on securities, we are empowering our members and the broader financial community to make more informed decisions.”

The ABA has partnered with ICE Data Services to curate select market data, ensuring that users gain access to reliable and up-to-date financial information. This partnership underscores the association’s dedication to leveraging technology for the advancement of the banking industry. The integration of advanced data analytics will also allow for richer insights into market trends and emerging risks.

Starting in 2026, users will be able to access the database through a digital platform that aims to streamline the search for securities information. As the financial landscape evolves, the demand for quick and accurate data has never been greater. The ABA’s initiative is expected to address this need, making it easier for users to navigate the intricacies of various investment options.

Furthermore, the CUSIP database will be provided exclusively by FactSet Research Systems Inc., known for its robust financial data solutions. This partnership will ensure that the information is not only comprehensive but also adheres to the highest standards of accuracy. The integration of SEC filings and other crucial documents, sourced through Quartr, will enhance the database’s utility, enabling users to conduct thorough due diligence.

The move has been met with positive responses from industry stakeholders, many of whom see it as a long-overdue enhancement to the financial services framework. In an era where technological advancements are reshaping how financial data is accessed and analyzed, this new resource is anticipated to foster a culture of transparency and trust among consumers and investors.

Looking ahead, the ABA’s database is expected to set a new standard in the industry, potentially influencing how other financial entities approach data transparency. As banks and financial institutions continue to navigate a complex regulatory environment, the ability to access accurate and comprehensive data will be critical in maintaining consumer confidence and fostering a more resilient financial system.

As the launch date approaches, the ABA is likely to engage with stakeholders to ensure that the database meets the diverse needs of its users. Continued feedback from financial professionals will be essential in refining the platform and ensuring that it delivers on its promise of enhanced transparency. In a rapidly changing financial landscape, the ABA’s initiative may very well shape the future of banking transparency.

See also Surge in AI and Auto Demand Positions Monolithic Power Systems for Major Earnings Upswing

Surge in AI and Auto Demand Positions Monolithic Power Systems for Major Earnings Upswing Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

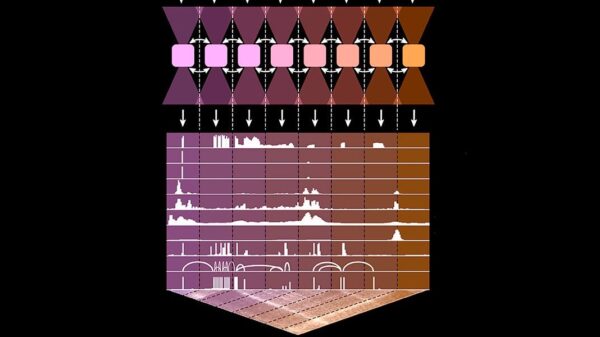

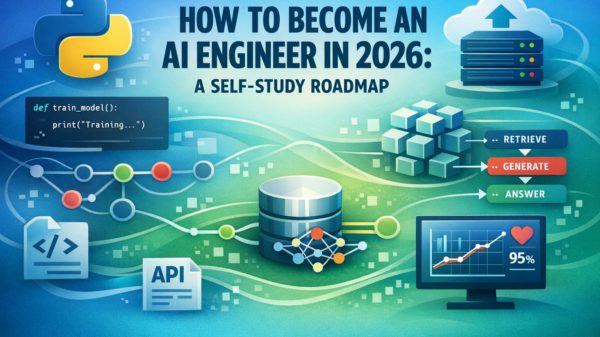

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032 Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs

Satya Nadella Supports OpenAI’s $100B Revenue Goal, Highlights AI Funding Needs