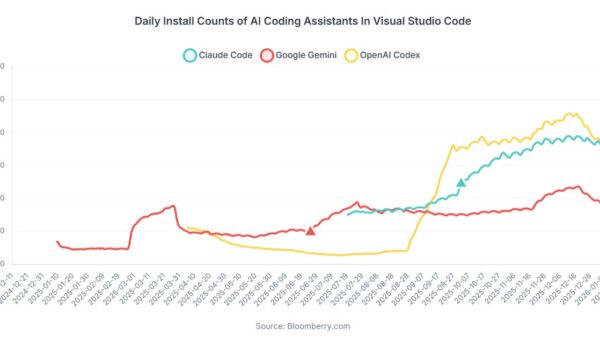

Investors have recently found success by focusing on niche stocks within the rapidly evolving AI sector. As earnings reports from some of the largest technology companies approach, the market will soon gauge whether this strategy remains viable well into 2026.

The so-called Magnificent Seven tech giants—Alphabet Inc., Amazon.com Inc., Apple Inc., Meta Platforms Inc., Microsoft Corp., Nvidia Corp., and Tesla Inc.—have significantly influenced stock market trends over the past three years. However, this momentum faltered at the end of 2025, as Wall Street expressed skepticism regarding the hundreds of billions of dollars these companies are investing in AI and the timeline for achieving returns on those investments.

An index tracking this group peaked on October 29 before a downturn, leading to declines in five of the seven stocks, which are now trailing the S&P 500 Index. During this period, Alphabet surged nearly 20%, while only Amazon joined it in the green.

In light of this, investors have begun to pivot toward companies benefiting from Big Tech’s spending. Sandisk Corp. has seen its stock rise more than 130% since the Magnificent Seven index hit its all-time high and then retreated. Similarly, Micron Technology Inc. and Western Digital Corp. have experienced stock increases of 76% and 67%, respectively. Firms in power generation and materials have also shown strong performance, buoyed by expectations of economic growth and attractive valuations.

“Tech has become more of a show-me story,” noted Darrell Cronk, chief investment officer at Wells Fargo, which manages $2.3 trillion in assets. “If Big Tech can continue to deliver, I think capital will start flowing in tech’s direction again.”

Earnings reports from Microsoft, Meta Platforms, and Tesla are scheduled for release on Wednesday, with Apple following on Thursday. Alphabet, the top performer among the Magnificent Seven last year, will report on February 4, while Nvidia’s results are due on February 25, and Amazon.com’s on February 5.

These earnings will provide insight into the health of various sectors, including cloud computing, electronic devices, software, and digital advertising. The group is projected to report 20% profit growth for the fourth quarter, marking the slowest growth rate since early 2023, according to data from Bloomberg Intelligence. With significant capital expenditures on the line, these companies face pressure to demonstrate robust returns.

“We’re no longer in an environment where companies can beat by 1% to 2% and continue spending on capex and get rewarded,” said Chris Maxey, managing director and chief market strategist at Wealthspire, which handles $580 billion in assets. “They need to show they’re accelerating growth and beating the bar by a pretty evident edge.”

The impact of AI is most pronounced in cloud services, particularly within Microsoft’s Azure platform, which has benefited from an upswing in demand from corporate clients utilizing AI capabilities. In Microsoft’s fiscal first quarter ending in September, Azure revenue surged 39% as demand continued to outpace supply. Analysts anticipate 36% growth for Azure in the upcoming fiscal second quarter.

However, scaling cloud infrastructure is costly. Microsoft, Amazon, Alphabet, and Meta are collectively expected to invest approximately $475 billion in capital expenditures by 2026, a substantial increase from $230 billion in 2024. Investors are eager for early signs of a return on these investments, as failure to meet growth targets could lead to severe market punishments, cautioned Clayton Allison, portfolio manager at Prime Capital Financial, which oversees $40 billion in assets.

“If they don’t hit their growth targets, they’re going to get hit hard,” Allison stated. “If we do start to see an ROI, increased profitability despite increased capex, that would start to massage some of these fears.”

On October 29, investors witnessed the potential consequences of poor forecasts when Meta projected “notably larger” capital expenditures for 2026 without clarifying how these would translate into profits, resulting in an 11% stock drop the following day. As of now, Meta’s stock is down 17% from its August peak.

Despite the challenges, many investors find it difficult to sidestep the tech giants due to their significant positions within the S&P 500. Including Alphabet’s dual shares, these companies represent eight of the nine largest weights in the index, accounting for more than a third of its total value.

Moreover, there is a strong inclination among shareholders to remain invested in these tech titans, given their capacity to generate profits at a faster rate compared to the broader market. The remaining 493 companies in the S&P 500 not included in the Magnificent Seven are expected to post a mere 8% earnings growth in the fourth quarter, as per Bloomberg Intelligence, significantly trailing the growth anticipated for Big Tech.

Despite the current uncertainties, the Magnificent Seven are not historically overvalued. The index trades at 28 times profits projected over the next 12 months, which is consistent with its average over the past decade, according to Bloomberg data. For instance, Nvidia shares have soared 1,184% since the end of 2022, yet they are priced at 24 times anticipated profits, slightly above the S&P 500’s multiple of 22.

As the earnings season unfolds, investors are keenly awaiting signs of growth that could revive their fortunes in these tech companies. “I don’t know that this is the quarter when those questions have to be answered,” concluded Wells Fargo’s Cronk. “But the market will look at this earnings season as an important progress milestone.”

For further details, refer to the official websites of Microsoft, Meta, and Amazon.

See also Influencer Agencies Prioritize AI Strategy as 48% Shift in Client Expectations Emerges

Influencer Agencies Prioritize AI Strategy as 48% Shift in Client Expectations Emerges WhatsApp Unveils Advanced Meta AI ‘Thinking Mode’ to Enhance User Interaction

WhatsApp Unveils Advanced Meta AI ‘Thinking Mode’ to Enhance User Interaction Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032

AI in Food & Beverages Market to Surge from $11.08B to $263.80B by 2032