As Warren Buffett prepares to step down as CEO of Berkshire Hathaway at the end of the year, the legendary investor’s portfolio continues to draw attention for its remarkable performance. Spanning over six decades, Buffett’s leadership has cultivated a staggering 5,502,284% increase in Berkshire’s shares from 1965 to 2024, far surpassing the S&P 500 return of 39,054% during the same period. With a stock portfolio currently valued at $320 billion, Buffett’s choices remain influential for investors seeking ideas.

Though traditionally hesitant to invest heavily in technology stocks, Buffett’s portfolio does include several companies leveraging artificial intelligence (AI) to enhance their products and services. Notably, three of these companies constitute 27% of Berkshire’s portfolio.

1. Apple

Buffett initiated his investment in Apple (AAPL) in 2016, and it has since become the largest position in Berkshire’s portfolio, accounting for 23.9%. Although Apple has not been at the forefront of AI innovation, its integration of AI technologies has been notable. The company’s rollout of Apple Intelligence began in 2024, with some features now delayed until 2026. Nevertheless, Apple devices currently utilize AI for real-time text analysis, battery management optimization, and augmented reality enhancements.

Unlike other tech giants, Apple has not developed independent AI models. Instead, it has formed partnerships with AI innovators such as OpenAI, the creator of ChatGPT, and Alphabet. Reports suggest that Apple is set to pay Alphabet $1 billion annually to utilize a custom Gemini AI model for its Siri virtual assistant.

Amid concerns that tech sector spending on AI may be excessively high, Apple’s cautious approach may prove to be more economically sustainable, given the brand loyalty that continues to benefit its shareholders.

2. Chubb

In the insurance sector, Berkshire has made significant investments, including in Chubb (CB), a global provider of comprehensive insurance solutions. With Berkshire’s backing in 2023 and 2024, Chubb has distinguished itself through innovative uses of AI. The company employs AI to automate processes such as underwriting workflows, claims assessment, and fraud detection. Recently, Chubb launched an AI-powered optimization engine designed to analyze data and offer personalized insurance product recommendations.

Chubb currently represents 2.5% of Berkshire’s portfolio. Its impressive combined ratio of 86.6% for property and casualty insurance—significantly lower than the industry average of 96.6%—demonstrates its operational efficiency and profitability.

3. Visa

Visa (V) has been part of Buffett’s portfolio since 2011, making up nearly 1% of Berkshire’s holdings. Visa has a long history of AI adoption, having implemented AI in risk and fraud management as early as 1993. Its Visa Advanced Authorization platform now utilizes AI to prevent an estimated $28 billion in fraud annually.

Furthermore, Visa is enhancing the online shopping experience through the development of agentic AI tools, allowing for automated purchases based on user inquiries about products and services. Partnered with Mastercard, Visa dominates the payment processing industry, managing 90% of transactions outside China, thereby solidifying its status as a reliable investment.

As Warren Buffett prepares to retire, the intersection of his investment strategy and the evolving AI landscape continues to draw interest from both seasoned and novice investors. While his approach has often eschewed traditional tech stocks, the presence of companies like Apple, Chubb, and Visa within his portfolio underscores the growing significance of AI across industries.

See also xAI Announces Grok 5 Launch with 6 Trillion Parameters, A15 Chip to Drive AI Innovations

xAI Announces Grok 5 Launch with 6 Trillion Parameters, A15 Chip to Drive AI Innovations Peter Thiel Sells Entire Nvidia Stake, Cuts Tesla Holdings by 76% Over AI Bubble Concerns

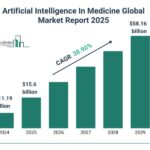

Peter Thiel Sells Entire Nvidia Stake, Cuts Tesla Holdings by 76% Over AI Bubble Concerns Artificial Intelligence in Medicine Market Projected to Reach $58.16 Billion by 2029

Artificial Intelligence in Medicine Market Projected to Reach $58.16 Billion by 2029 Google VP Shantanu Sinha Highlights Creative Student Uses of AI in Education

Google VP Shantanu Sinha Highlights Creative Student Uses of AI in Education Interior Designers’ AI Tool Adoption Triples to 29% in 2025, Survey Reveals

Interior Designers’ AI Tool Adoption Triples to 29% in 2025, Survey Reveals