In a significant development for the financial technology landscape, the American Bankers Association (ABA) announced on October 3, 2026, a partnership with FactSet Research Systems Inc., aimed at enhancing market data accessibility for its members. This collaboration is designed to provide banks and financial institutions with advanced analytics and insights, improving decision-making processes in an increasingly complex economic environment.

The partnership, which involves the integration of FactSet’s extensive data offerings with the ABA’s resources, is expected to benefit a broad spectrum of financial entities, from community banks to larger institutions. With the growing need for real-time information and analytics, this initiative comes at a crucial time, as the financial sector grapples with rapid technological advancements and regulatory changes.

According to the ABA, the integration will allow members to access a wide range of financial data, including market trends, benchmarking information, and risk analytics. “This partnership underscores our commitment to providing our members with the tools they need to navigate today’s market efficiently,” said Rob Nichols, President and CEO of the ABA. The collaboration aims to enhance transparency in financial markets, particularly as institutions look to adapt to an ever-evolving landscape.

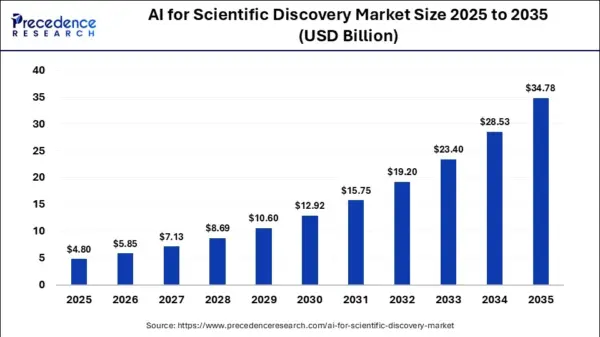

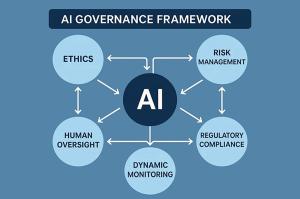

FactSet, a leading provider of integrated financial information, highlighted the potential for this partnership to streamline data access and improve operational efficiency for banking professionals. “We are excited to work alongside the ABA to deliver actionable insights that empower our clients to make informed decisions,” stated Phil Snow, CEO of FactSet. The integration is set to leverage advanced technologies, including artificial intelligence, to offer a more comprehensive view of market conditions and trends.

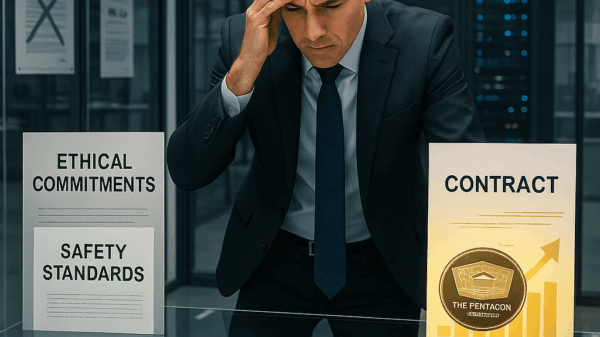

The move comes as banks are increasingly turning to technology to enhance their offerings and remain competitive. The financial services industry has faced pressures from digital disruption, regulatory scrutiny, and the need for improved customer experiences. By providing members with access to premium market data and analytics, both organizations hope to equip banks with the necessary tools to thrive in this challenging environment.

As the partnership unfolds, stakeholders within the banking sector will be watching closely to gauge its impact on operational efficiencies and customer service enhancements. The collaboration between the ABA and FactSet could be a pivotal moment for financial institutions, particularly those that have historically lagged in adopting new technologies.

This initiative also reflects a broader trend in the financial sector, where data-driven decision-making is becoming increasingly vital. Banks are now leveraging technology not only to improve internal operations but also to provide better services to their clients. The integration of advanced analytics and real-time data is expected to enhance risk management and regulatory compliance, areas of growing concern for financial institutions.

The ABA and FactSet’s collaboration sets the stage for further innovations in the financial technology space. As the sector continues to evolve, partnerships like this may signal a shift toward more interconnected ecosystems that prioritize data accessibility and analytics. This trend could redefine how financial institutions operate, making them more agile and responsive to market dynamics.

Looking ahead, the potential success of this partnership may encourage other organizations in the financial sector to explore similar collaborations aimed at enhancing their technological frameworks. As competition intensifies, the ability to access and interpret data effectively could become a defining characteristic of successful financial institutions in the coming years.

See also Walmart and Google Shift Retail Landscape with AI-Driven Commerce: Small Brands Face New Risks

Walmart and Google Shift Retail Landscape with AI-Driven Commerce: Small Brands Face New Risks AZIO AI and EVTV Launch Pilot to Validate High-Density Cooling for AI Data Centers

AZIO AI and EVTV Launch Pilot to Validate High-Density Cooling for AI Data Centers AI Cheating Scandals Threaten Korean Universities’ Global Rankings, QS Warns

AI Cheating Scandals Threaten Korean Universities’ Global Rankings, QS Warns