The financial services industry is witnessing a significant transformation as generative AI and agentic AI systems reshape credit evaluation processes. Financial institutions are increasingly adopting AI-driven technologies to enhance predictive accuracy and automate complex workflows, particularly in lending decision-making. This evolution aims to improve efficiency while addressing governance, risk, and compliance considerations in credit evaluation.

Data enrichment has become essential in credit evaluation. Financial institutions traditionally rely on a range of logistical and heuristic models to assess vast amounts of data. However, with the advancement of generative AI, this process has evolved significantly. Generative AI models now enable the evaluation of unstructured data, producing insights that were previously difficult to obtain. These models can also generate synthetic data for scenario simulation, providing a robust framework for modeling and validation.

By transforming unstructured information into structured data, generative AI can extract vital attributes such as income consistencies, payment behaviors, employment history, and discretionary spending. This capability offers critical insights that enhance underwriting evaluations. Moreover, the generation of synthetic data helps mitigate data sparsity, particularly in edge cases, allowing AI models to define nuanced criteria like liquidity buffers and income volatility, thereby preserving privacy while enhancing model resilience.

Simultaneously, multi-modal generative AI systems can identify inconsistencies between declared income, tax records, and bank statements, streamlining time-consuming manual processes. This capability not only improves compliance but also enhances data integrity in the credit assessment process.

In addition to data enrichment, agentic AI plays a critical role in orchestrating autonomous workflows. While generative AI focuses on data integrity, agentic AI facilitates the autonomous execution of discrete tasks. This agentic mesh comprises specialized agents capable of performing multiple tasks simultaneously, such as identity verification, document retrieval, credit bureau checks, and psychometric analysis. Each agent operates under defined objectives, which enhances speed and accuracy in the credit evaluation process.

The agentic mesh enforces business logic, invokes predictive models, and routes applications based on confidence thresholds, thereby automating workflows dynamically. For instance, low-confidence decisions or flagged anomalies can be escalated to human underwriters, ensuring that alerts are sent for timely action. Furthermore, agentic systems can proactively monitor applications, detect discrepancies, and initiate remediation mechanisms, enhancing overall process resilience. A notable example includes a large global bank that implemented a fully automated case management process for customer inquiries, significantly reducing processing time.

The natural language processing capabilities of agentic AI also allow for real-time conversations with applicants, clarifying ambiguities and collecting missing data in multiple languages. This feature reduces friction for underserved customer segments, ultimately improving completion rates.

The integration of generative and agentic AI technologies leads to a hybrid architecture that optimizes both accuracy and explainability in credit evaluation outcomes. By combining these AI models, financial institutions can enhance predictive power through richer data and improve regulatory transparency. The collaboration between generative and agentic systems also promotes adaptive self-learning, which refines loan eligibility evaluation processes by curating edge cases and initiating retraining cycles.

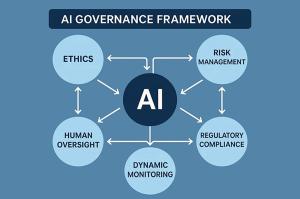

As financial institutions navigate the complexities of loan eligibility assessment, the integration of AI presents both opportunities and challenges. Some recommendations for developing effective AI systems include implementing a human-in-the-loop architecture to enhance decision-making transparency, mapping decision outcomes to associated features for improved interpretability, and establishing operational safeguards such as role-based access controls.

Credit decision-making is at a pivotal juncture, with generative and agentic AI redefining business processes within the lending ecosystem. Financial institutions that invest in thoughtful design, robust governance, and sophisticated data models will lead the way in the next era of intelligent underwriting. As technology continues to evolve, the potential for more accurate and efficient credit evaluation processes could significantly enhance customer experiences and foster long-term business relationships.

For more insights, visit JPMorgan, Coinbase, and Blackrock.

See also AI Adoption Surges: 1 Billion Users Shift Focus to Responsible Governance and Sustainability

AI Adoption Surges: 1 Billion Users Shift Focus to Responsible Governance and Sustainability Jimmy Joseph’s AI Breakthrough Cuts Healthcare Payment Anomalies by 35% and Wins Global Award

Jimmy Joseph’s AI Breakthrough Cuts Healthcare Payment Anomalies by 35% and Wins Global Award China’s Fashion Industry Transforms with AI: Key Innovations Propel $1.75B Market Growth by 2025

China’s Fashion Industry Transforms with AI: Key Innovations Propel $1.75B Market Growth by 2025 Malaysia Blocks Elon Musk’s Grok Chatbot Over Inadequate Safeguards Against AI Pornography

Malaysia Blocks Elon Musk’s Grok Chatbot Over Inadequate Safeguards Against AI Pornography Former Isro Chief Urges Ethical AI Leadership at GM University’s Inaugural Convocation

Former Isro Chief Urges Ethical AI Leadership at GM University’s Inaugural Convocation