Generative AI is reshaping Africa’s banking sector, addressing crucial challenges such as long wait times, limited access in rural areas, and diverse language needs. By leveraging unstructured data, banks are able to provide personalized services, utilize multilingual chatbots, enhance fraud detection, and simplify onboarding processes.

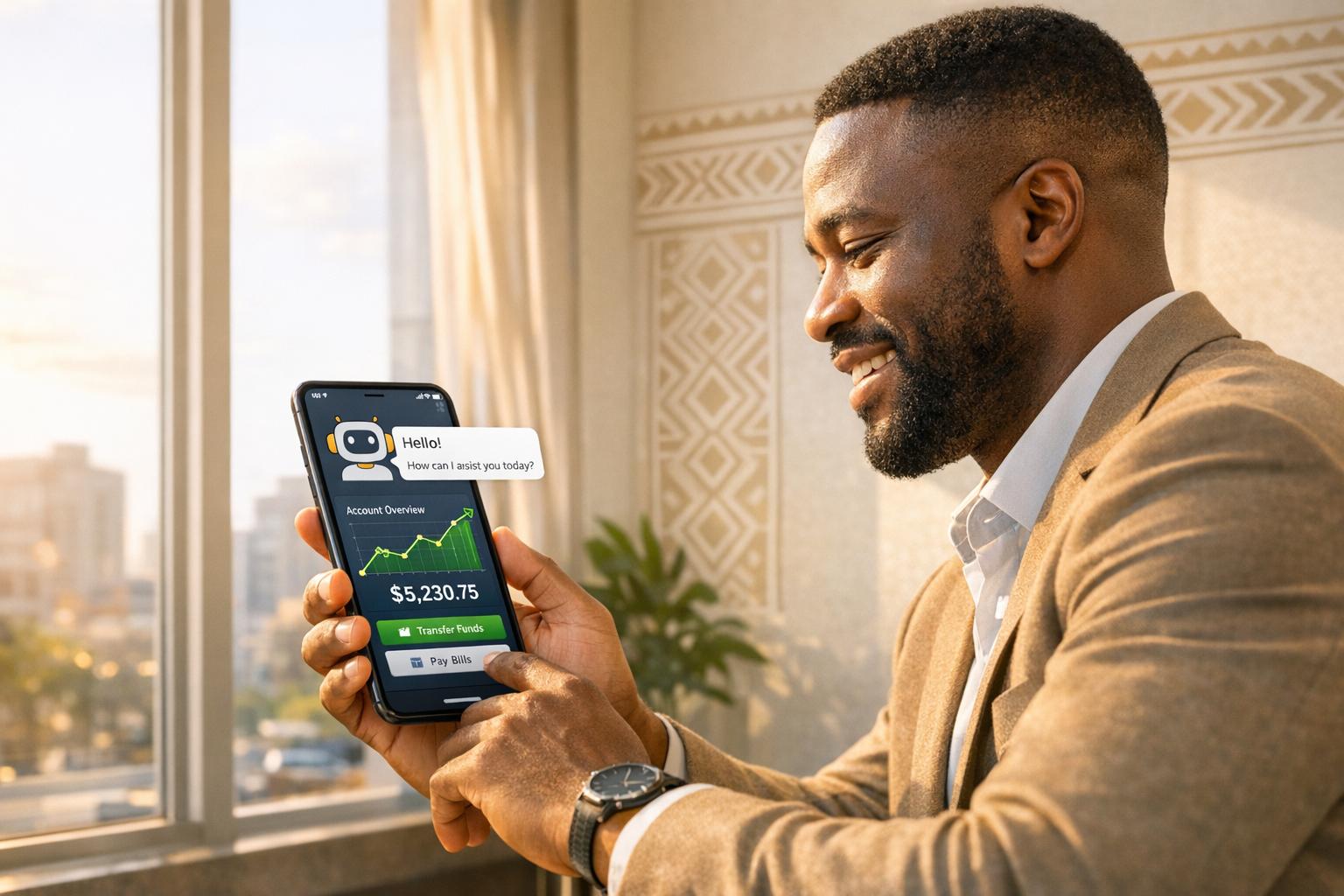

As of late 2023, a remarkable 82% of financial services firms worldwide have incorporated or are testing generative AI technologies. AI-driven chatbots are significantly reducing customer wait times and managing thousands of interactions daily. Moreover, innovative tools such as AI-driven credit scoring are opening doors for individuals without formal credit histories to secure loans. This technological advancement also supports multilingual communication, crucial for serving Africa’s varied linguistic landscape.

Despite these advancements, numerous challenges persist, including outdated systems, regulatory constraints, and inconsistent internet access. Nevertheless, banks investing in AI are reaping rewards such as faster services, increased customer trust, and enhanced financial inclusion. With Africa’s fintech revenue projected to increase to $65 billion by 2030, the role of AI in the banking sector is anticipated to be pivotal.

African banks confront a myriad of obstacles that hinder the delivery of seamless customer experiences. Long wait times at physical branches, especially in rural areas, remain a significant issue. According to recent data, 57% of adults in Sub-Saharan Africa are unbanked, resulting in a staggering $330 billion gap in untapped credit demand. The lack of formal credit histories for many potential borrowers complicates access to traditional banking services, while language diversity across the continent and low digital literacy levels further exacerbate the situation. Additionally, online fraud is a growing concern, with the global banking sector losing over $3.6 billion annually due to such activities, which diminishes customer trust in digital channels.

To combat these challenges, African banks are increasingly turning to AI-powered solutions. Absa Bank, for instance, has successfully implemented an AI chatbot that handles more than 10,000 customer interactions each day, significantly cutting down wait times. The growth trajectory of digital banking in Sub-Saharan Africa is evident, with account ownership through formal banks or mobile money services surging from 34% in 2014 to 58% in 2024. In a notable case, United Bank for Africa (UBA) has rebranded its analytics division to focus exclusively on AI, reflecting a strategic pivot towards leveraging technology for operational efficiency.

While AI adoption rates vary across the continent, many institutions are prioritizing internal AI applications to enhance operational efficiency. A 2024 KPMG survey found that 73% of retail banking customers in Nigeria rarely use bank chatbots, leading banks to focus on summarizing customer feedback and automating document processing. Employees at major banks are utilizing tools like ChatGPT and Microsoft Co-Pilot to streamline processes, effectively reducing the time needed to handle complex tasks.

Regulatory and infrastructural challenges remain significant hurdles in AI implementation. Data protection laws, such as Nigeria’s NDPR, require banks to navigate intricate privacy issues while addressing potential algorithmic bias. In South Africa, systemic issues such as frequent electricity disruptions and high inflation further complicate the landscape. Legacy systems present additional barriers, with many banks operating on outdated architectures that inhibit a unified view of customer data. Furthermore, the skills gap in areas like AI management and data governance hampers progress.

Generative AI is not only enhancing convenience but also revolutionizing the way financial advice is delivered. By analyzing data such as transaction histories and spending habits, AI can provide personalized investment options and savings plans tailored to individual needs. Key initiatives, such as Nedbank’s exploration of AI and data analytics use cases, underscore the growing reliance on machine learning and data science for intelligent decision-making within the financial sector.

As Africa’s fintech landscape evolves, generative AI is set to play an increasingly critical role in bridging financial gaps and enhancing customer experiences. By leveraging local languages and dialects through multilingual AI chatbots, banks can better serve underbanked communities, ensuring that financial services are accessible to a broader audience. Dr. Olumide Okubadejo emphasizes that companies that invest in localized data modeling will thrive in this competitive environment.

Looking ahead, the integration of generative AI holds immense promise for African banks, but success will depend on their ability to navigate regulatory frameworks, enhance infrastructure, and fully embrace the transformative potential of technology. The companies that can effectively balance innovation with regulatory compliance are poised to lead the charge in redefining banking for Africa’s diverse population.

See also OpenAI Reveals Top AI Tools for Digital Marketing: Best Picks for Beginners and Beyond

OpenAI Reveals Top AI Tools for Digital Marketing: Best Picks for Beginners and Beyond McDonald’s Embraces AI to Boost Order Accuracy to 95% with New Tech Initiatives

McDonald’s Embraces AI to Boost Order Accuracy to 95% with New Tech Initiatives AI Enhances Social Media Management, But Human Insight Remains Essential for Success

AI Enhances Social Media Management, But Human Insight Remains Essential for Success