NEW YORK, Jan. 15, 2026 /PRNewswire/ — The New York Stock Exchange (NYSE) kicked off Thursday’s trading session with a notable pre-market update, highlighting significant movements in the tech sector. The update, delivered by Kristen Scholer, emphasized gains led by NYSE-listed Taiwan Semiconductor, which reported strong financial results and announced increased capital spending plans. The company also projected a more optimistic sales outlook, largely driven by rising demand for artificial intelligence technology.

In addition to the positive sentiment surrounding Taiwan Semiconductor, the NYSE and MSCI have entered into a new agreement to list U.S. options on MSCI benchmark indexes at NYSE Arca and NYSE American. During an appearance on NYSE Live, George Harrington, Global Head of Fixed Income and Derivatives at MSCI, discussed the timing of this new initiative, hinting at potential benefits for market participants.

Further insights and market analysis are expected later today when Chris Edmonds, President of Fixed Income & Data Services at ICE, shares his outlook for 2026 during a segment on NYSE Live. Edmonds is expected to underscore anticipated “resiliency” in fixed income markets amid shifting economic conditions.

As the trading day approaches, the NYSE will also celebrate a couple of notable milestones. The Opening Bell will mark the launch of Truth Social Funds at the NYSE, while the Closing Bell will commemorate Carlisle Companies Incorporated marking 66 years of trading on the exchange.

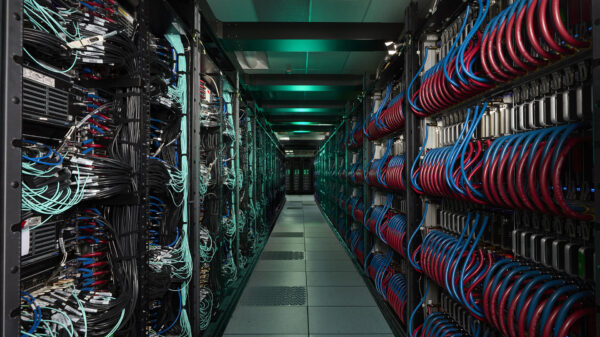

Today’s market activities come at a time when the technology sector is experiencing a renaissance, buoyed by advances in AI and semiconductor capabilities. Investors will be keen to monitor how these developments impact broader market dynamics in the weeks to come.

For more in-depth discussions, you can access the entire conversation featuring George Harrington on the implications of the NYSE-MSCI partnership here.

See also Hudson Williams Opens Dsquared2 Runway with AI-Enhanced Carly Simon Classic

Hudson Williams Opens Dsquared2 Runway with AI-Enhanced Carly Simon Classic Peter Thiel Shifts Investment from Nvidia to Apple and Microsoft Amid AI Evolution

Peter Thiel Shifts Investment from Nvidia to Apple and Microsoft Amid AI Evolution Peter Thiel Sells Nvidia, Invests in Apple and Microsoft Amid AI Market Shifts

Peter Thiel Sells Nvidia, Invests in Apple and Microsoft Amid AI Market Shifts OpenAI Introduces Ads in ChatGPT for U.S. Users, Aims to Expand AI Accessibility

OpenAI Introduces Ads in ChatGPT for U.S. Users, Aims to Expand AI Accessibility