AustralianSuper, which manages approximately $400 billion in assets, is closely examining how artificial intelligence (AI) and geopolitical tensions are shaping the global economy. Alistair Barker, the fund’s head of asset allocation, highlighted the ongoing AI arms race between the United States and China, suggesting that this competition currently presents favorable conditions for investors. As one of Australia’s largest superannuation funds, AustralianSuper is dedicated to securing retirement savings for its members, with its asset allocation team focusing on thematic issues, geopolitics, market strategy, risk management, and portfolio construction to guide investment strategies.

Barker noted that, despite the high valuations in the AI sector, they are not yet in bubble territory. He pointed out that several companies in this field are experiencing genuine earnings growth, although some private AI companies are still striving for full monetization. In contrast, publicly listed US tech companies have demonstrated significant improvements in their earnings profiles. Drawing parallels with historical industrial revolutions, Barker acknowledged the likelihood of pullbacks and inflection points in AI’s trajectory while asserting that the productivity benefits from AI adoption are expected to surface soon.

Moreover, Barker emphasized a potential risk: a decline in public trust toward AI, which he likened to events such as the Cambridge Analytica scandal. He also cited government policies, particularly concerning water and energy management, as factors that could influence AI and data center deployments. Despite these challenges, Barker remains optimistic about the opportunities for investors in an environment characterized by higher debt and persistent inflation, noting that returns on cash or fixed interest are comparatively higher than they were five years ago.

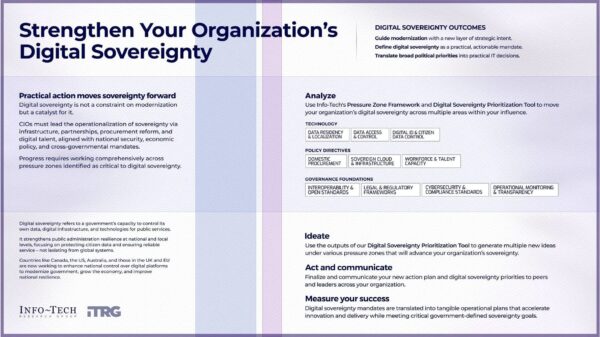

In addition to opportunities presented by the AI sector, Barker highlighted the prospects for investing in infrastructure due to stretched government balance sheets. He believes that as governments reach their spending limits, it will create avenues for private sector participation. Barker cautioned, however, against overreacting to policy shifts, suggesting that markets often overestimate the potential impacts of these changes.

The evolving landscape surrounding AI and geopolitical dynamics is expected to influence investment strategies significantly. As stakeholders navigate these complexities, the interplay between technological advancements and regulatory frameworks will play a critical role in shaping the future economic outlook. For institutions like AustralianSuper, these developments present both challenges and opportunities that will require careful analysis and strategic foresight.

See also AI to Displace 50% of Entry-Level Jobs by 2026, Warns Top Experts Amidst Economic Shifts

AI to Displace 50% of Entry-Level Jobs by 2026, Warns Top Experts Amidst Economic Shifts IAIS Reports Stable Insurance Sector Amid Rising AI, Geopolitical Risks and Private Credit Concerns

IAIS Reports Stable Insurance Sector Amid Rising AI, Geopolitical Risks and Private Credit Concerns 1min.AI Launches Advanced Business Plan for $74.97, Compare Top AI Models Instantly

1min.AI Launches Advanced Business Plan for $74.97, Compare Top AI Models Instantly Proximus Elevates Leadership with Key B2B and AI Appointments to Enhance Customer Focus

Proximus Elevates Leadership with Key B2B and AI Appointments to Enhance Customer Focus