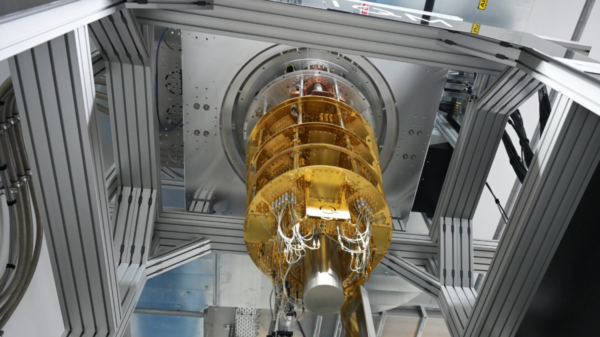

China is experiencing a renewed surge in technology-led optimism as it approaches 2026, driven by significant advancements in artificial intelligence and other high-tech sectors, resulting in a robust rally in tech stocks. This momentum comes despite broader economic challenges that continue to impact the country.

Nearly a year after DeepSeek‘s breakthrough in AI technology shocked global markets, China’s tech landscape is witnessing a fresh wave of innovation. Investor sentiment has surged, with Chinese technology shares starting the year on a strong note; an onshore Nasdaq-style tech index has risen nearly 13 percent so far this month, while an index tracking Hong Kong-listed Chinese tech firms has increased close to 6 percent. Both indices have outperformed the Nasdaq 100.

The optimism surrounding domestic technology has been a key driver of the equity rally since April of last year, even amid persistent challenges such as a prolonged downturn in the property sector and sluggish consumer demand. This momentum is expected to strengthen further as DeepSeek prepares to launch a new AI model, while Beijing gears up for a new five-year economic plan focused on technological self-reliance.

Mark Mobius, managing director of Mobius Emerging Opportunities Fund, stated, “The stock market is telling us that what China is doing in the technology sector is going to be very exciting going forward.” He pointed out that China’s objective is clearly aimed at overtaking the United States in advanced fields such as chips and AI, attracting capital towards these sectors.

Since DeepSeek’s market-shaking announcement on January 27 last year regarding affordable AI models that matched the performance of global competitors, other Chinese companies have enhanced their endeavors to develop their own technologies. Major internet firms, including Alibaba Group Holding and Tencent Holdings, have rapidly expanded their use of generative AI.

Beyond AI, Chinese robots are making waves by participating in marathons, boxing competitions, and cultural performances. In the manufacturing domain, large language models are being integrated into cutting-edge products like flying taxis and high-precision machine tools. These advancements are transforming perceptions of China, shifting its image from a low-cost manufacturing hub to a credible contender for technological leadership against the backdrop of a global search for new growth engines.

According to Jefferies Financial Group, a basket of 33 Chinese AI stocks has seen a combined market value increase of around $732 billion over the past year. The brokerage suggests there is still significant potential for growth, noting that China’s AI market capitalization remains at about 6.5 percent of that of the United States.

As the tech sector gains momentum, it may provide a much-needed boost to China’s economy, potentially setting the stage for a remarkable transformation. Investors are keenly watching as the landscape evolves, anticipating that the developments in technology could play a crucial role in overcoming the current economic hurdles.

For more information on China’s leading tech firms, visit Alibaba, Tencent, and DeepSeek.

See also AI-Powered MOSAIC Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds

AI-Powered MOSAIC Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds UAE Unveils AI-Powered Trade Platform to Transform Global Trade Dynamics

UAE Unveils AI-Powered Trade Platform to Transform Global Trade Dynamics China’s AI Investment Surges to $650B, Narrowing Tech Gap with U.S. Amid Power Shortages

China’s AI Investment Surges to $650B, Narrowing Tech Gap with U.S. Amid Power Shortages