Amazon.com, Inc. (NASDAQ: AMZN) has transitioned from being known as the “Everything Store” to what analysts now term a “planetary utility,” a crucial layer of global infrastructure as of January 19, 2026. This evolution reflects the company’s pivotal role in powering diverse sectors, from high-performance computing essential for generative AI to the logistics of everyday life. Under CEO Andy Jassy’s leadership, Amazon has undergone aggressive cost-cutting measures and organizational flattening, emerging with its highest operating margins in history.

The narrative surrounding Amazon has shifted dramatically, moving from a focus on “growth at any cost” to one centered on “efficiency at massive scale.” This repositioning comes as the company navigates through unprecedented regulatory scrutiny. Analysts are keenly observing the factors fueling Amazon’s impressive $2.6 trillion valuation and the potential risks that threaten its dominance.

Founded in 1994 by Jeff Bezos as an online bookstore, Amazon has exemplified radical diversification over its three-decade history. The company survived the dot-com bubble by prioritizing long-term market share over immediate profits. Significant milestones include the launch of Amazon Prime in 2005, which bolstered customer loyalty; the introduction of Amazon Web Services (AWS) in 2006, which reshaped the cloud industry; and the 2017 acquisition of Whole Foods, marking its entry into physical groceries.

By the time Jassy succeeded Bezos as CEO in 2021, Amazon was confronting a post-pandemic “hangover” characterized by overcapacity. The ensuing “Efficiency Era” from 2023 to 2025 saw the company regionalizing its shipping network and integrating advanced robotics, paving the way for the high-margin powerhouse it has become.

Amazon’s business model operates as a multi-layered ecosystem, with revenue streams derived from four primary pillars. Online stores and third-party seller services form the core retail engine; AWS serves as the profit engine; advertising services have grown into a $60 billion-plus annual business; and subscription services, driven by Prime, ensure recurring revenue while locking consumers into the ecosystem. In 2026, third-party sellers accounted for over 60% of total unit sales, enhancing Amazon’s margins.

In its fiscal year 2025, Amazon reported total annual revenue exceeding $660 billion, with notable expansion in operating margins stabilizing at 11%. This growth is largely attributed to its high-margin advertising business and a successful logistics network overhaul. AWS remained the crown jewel, experiencing a 20% year-over-year growth and contributing over 60% of the company’s total operating income. The rebound in free cash flow has positioned Amazon to self-fund its substantial investments in AI and satellite technology.

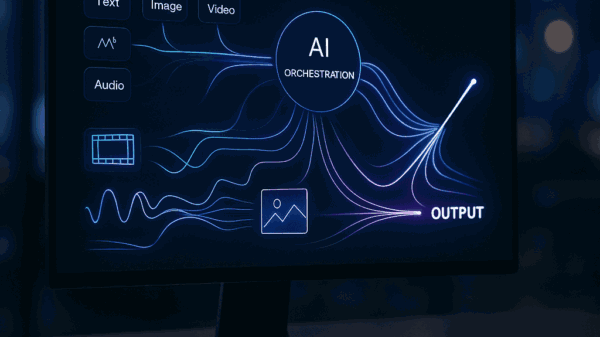

Jassy’s leadership represents a departure from Bezos’s visionary approach, favoring a disciplined, operationally focused strategy. The organization has seen a 15% increase in the ratio of individual contributors to managers, aimed at eliminating bureaucracy. In 2024, Matt Garman was appointed as AWS CEO, signaling a return to technical fundamentals. The leadership team is currently focusing on three main areas: the integration of AI across all business units, the global expansion of the logistics network, and the commercialization of Project Kuiper.

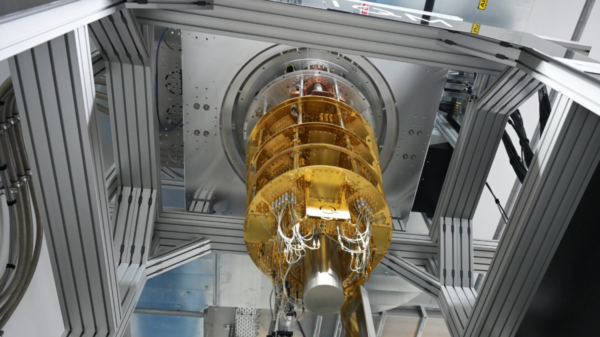

In 2026, Amazon is emphasizing “proprietary independence” in its innovations. The company launched custom AI silicon, Trainium3, which offers double the performance of its predecessor, allowing AWS to provide cost-effective AI training services. Furthermore, Amazon’s Project Kuiper satellite network has entered commercial trials, targeting global populations lacking high-speed internet access. In the healthcare sector, Amazon Pharmacy now offers one-hour prescription delivery in 20 major U.S. cities, positioning itself as a serious competitor to traditional retail pharmacies.

However, Amazon faces challenges on multiple fronts. In the cloud sector, while AWS remains a leader, competition from Microsoft and Alphabet is intensifying, particularly as they deepen AI integrations into their enterprise offerings. Domestically, Walmart leverages its extensive store network to compete directly with Amazon’s delivery capabilities. Additionally, lower-cost competitors such as Temu and Shein are putting pressure on Amazon’s lower-end segments.

The automation of physical labor and the regionalization of trade are significant industry trends in 2026. Amazon has deployed over 1 million robots in its warehouses, with the Proteus autonomous mobile robot and the Sparrow robotic arm handling around 65% of individual item sorting, which lowers costs and minimizes human error. Concurrently, the shift toward near-shoring has compelled Amazon to build localized supply chains, particularly in North America and India, to mitigate geopolitical risks.

Despite these advancements, Amazon’s “bull case” is tempered by considerable risks. A looming regulatory threat is the FTC’s monopoly trial scheduled for October 2026, which could result in structural changes to how Amazon manages third-party sellers. The company’s capital intensity is also a concern, as the $125 billion capital expenditure for 2025 could lead to depressed returns if the anticipated AI monetization lags. Furthermore, escalating automation may strain labor relations, raising tensions with unions and regulators over worker displacement.

Looking ahead, Amazon’s international segment has become consistently profitable, with significant investments in India offering long-term growth potential. The introduction of advertising on Prime Video and the potential integration of Amazon Pharmacy with Prime could herald a new era of revenue generation akin to AWS. Overall, Amazon’s ability to reinvent itself—from a bookstore to a cloud giant and now to a leader in AI and satellite technology—demonstrates that its “Day 1” philosophy remains relevant. Investors should closely monitor the outcome of the FTC trial and the launch of Project Kuiper as critical indicators of Amazon’s future trajectory.

See also AI-Powered MOSAIC Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds

AI-Powered MOSAIC Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds UAE Unveils AI-Powered Trade Platform to Transform Global Trade Dynamics

UAE Unveils AI-Powered Trade Platform to Transform Global Trade Dynamics China’s AI Investment Surges to $650B, Narrowing Tech Gap with U.S. Amid Power Shortages

China’s AI Investment Surges to $650B, Narrowing Tech Gap with U.S. Amid Power Shortages Yale’s MOSAIC AI Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds

Yale’s MOSAIC AI Platform Accelerates Drug Discovery by Synthesizing 35 New Compounds