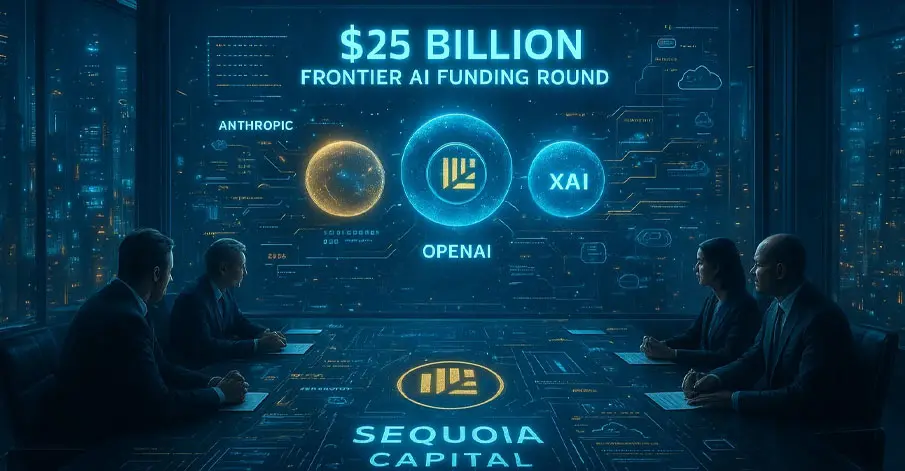

Sequoia Capital is reportedly poised to participate in a significant funding round for Anthropic, the AI firm behind the Claude language model, according to the Financial Times. This development is attracting considerable attention in Silicon Valley as it appears to challenge long-standing norms in venture capital. Sequoia, already an investor in OpenAI and Elon Musk‘s xAI, suggests a shift towards backing multiple leaders in the competitive AI landscape, rather than placing bets on a single frontrunner.

The timing of Sequoia’s potential investment is particularly noteworthy, especially following remarks made by OpenAI CEO Sam Altman during a legal dispute with Musk last year. Altman, testifying under oath, addressed speculation regarding restrictions that OpenAI might impose on investors interested in rival companies. He denied the existence of a blanket ban on such investments but indicated that continued access to OpenAI’s confidential information would be revoked if investors pursued active roles in competing firms. He characterized this practice as “industry standard” protective measures against the misuse of sensitive data.

Reports suggest that the funding round for Anthropic is being led by Singapore’s sovereign wealth fund GIC and the US-based firm Coatue, each committing approximately $1.5 billion. Anthropic is aiming to raise $25 billion or more, at a valuation estimated around $350 billion—more than double its reported valuation of $170 billion from just four months prior. Earlier estimates from sources like the Wall Street Journal and Bloomberg had predicted the round would be closer to $10 billion. Notably, Microsoft and Nvidia are reported to have jointly committed up to $15 billion, with additional contributions expected from venture capital firms and other investors.

Sequoia’s relationship with Altman dates back several years, having initially backed his first startup, Loopt, after he left Stanford. Altman went on to serve as a scout for Sequoia, introducing the firm to Stripe, which became one of its most valuable investments. Sequoia’s current co-leader, Alfred Lin, has also publicly supported Altman during his brief removal from OpenAI in November 2023, further solidifying their connection.

While Sequoia’s investment in xAI has blurred traditional conflict lines, it has generally been perceived as part of the firm’s long-standing ties to Musk rather than a direct competitive stake against OpenAI. Sequoia has previously invested in several of Musk’s ventures, including SpaceX, Neuralink, The Boring Company, and X.

This potential backing of Anthropic is particularly striking given Sequoia’s historical stance on conflicts of interest. In 2020, the firm notably exited its $21 million investment in payments startup Finix after determining that it competed with Stripe. Against this backdrop, Sequoia’s apparent readiness to invest in multiple AI leaders indicates a significant evolution in how leading venture firms are navigating the rapidly changing AI landscape.

As the competition in the generative AI sector intensifies, the implications of Sequoia’s investments could reshape the strategic approaches of venture capital firms. By supporting various key players, Sequoia may be setting a new precedent for investment strategies in an industry where collaboration and competition are increasingly intertwined.

See also China’s AI Sector Surges Post-DeepSeek: $142M Funding Boom & 39% Job Applications Rise

China’s AI Sector Surges Post-DeepSeek: $142M Funding Boom & 39% Job Applications Rise Thoughtworks Launches AI/works™ to Transform Legacy Systems and Accelerate Software Development

Thoughtworks Launches AI/works™ to Transform Legacy Systems and Accelerate Software Development Google’s Gemini 3 Doubles API Calls to 85 Billion, Boosting Cloud Revenue Significantly

Google’s Gemini 3 Doubles API Calls to 85 Billion, Boosting Cloud Revenue Significantly China’s MiniMax CEO Yan Junjie Meets Premier Li Qiang, Strengthening AI Industry Confidence

China’s MiniMax CEO Yan Junjie Meets Premier Li Qiang, Strengthening AI Industry Confidence US Chip Export Controls Fuel AI Development Bottleneck for China’s Tech Firms

US Chip Export Controls Fuel AI Development Bottleneck for China’s Tech Firms