China appears poised to approve the import of Nvidia’s H200 AI chips, potentially ending nearly a year of negotiations and restrictions that have cast uncertainty over the company’s operations in one of its largest markets. Reports indicate that Nvidia is currently sitting on orders for more than 2 million chips from Chinese clients, a development that analysts believe could significantly boost the company’s stock value, providing much-needed optimism for shareholders.

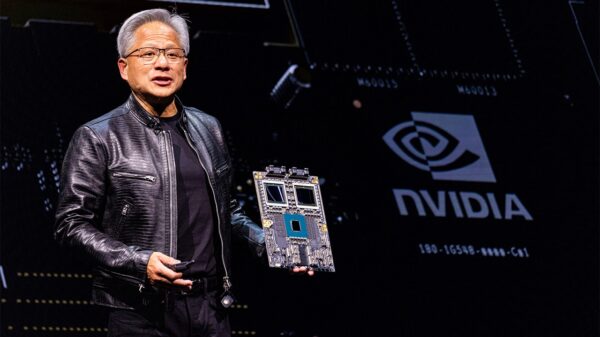

The last year has been challenging for Nvidia (NASDAQ: NVDA), which has been at the forefront of the AI revolution with its graphics processing units (GPUs) becoming the go-to choice for AI applications. However, the company’s performance was adversely impacted by U.S. restrictions on selling its advanced chips to China, a market that has been critical for its revenue growth. Recent reports suggest that this standoff may finally be nearing resolution, as Chinese regulators have reportedly directed several major technology firms, including Alibaba and Tencent, to submit orders for Nvidia’s H200 AI chips for official approval.

This move could represent a significant shift for Nvidia, which has previously faced hurdles in accessing this lucrative market due to stringent regulations. The conditional approval requires companies to purchase a certain percentage of domestic chips alongside their orders for Nvidia’s products, reflecting China’s ongoing push to bolster its semiconductor industry. Early reports indicate that the approval may also come with restrictions, limiting the use of these advanced chips in military, government, and critical infrastructure applications to alleviate security concerns.

The potential opportunity for Nvidia could be transformative. In 2024, sales of lower-quality AI chips to Chinese customers reached approximately $17.1 billion, even in light of the restrictions affecting the advanced H200 chips. Nvidia’s CEO, Jensen Huang, has expressed “very high” demand for these chips in China, suggesting that if imports are approved, annual sales could surpass $50 billion. A report from Reuters indicates that Nvidia has received orders for 2 million H200 chips, priced at $27,000 each, which could translate to an incremental revenue of $54 billion if these orders are fulfilled.

This figure, however, would be subject to a 25% export levy imposed by the Trump Administration, potentially reducing Nvidia’s revenue from these orders to about $40 billion. Notably, Nvidia has not factored any sales to China into its forecasts, indicating that approval could significantly enhance the company’s financial outlook. Huang previously stated that Nvidia has a backlog of AI chip sales amounting to $500 billion for the six quarters leading to early 2027, a figure that CFO Colette Kress has suggested is likely to increase.

Analysts currently estimate Nvidia’s revenue for fiscal 2027, beginning later this month, at around $320 billion. If the company can realize $40 billion in additional revenue from H200 chip sales at a net profit margin of 56%, this could push Nvidia’s earnings per share (EPS) to approximately $8.29. Given the company’s current price-to-earnings (P/E) ratio of about 46, this would imply a stock price of $385, representing a potential increase of 105% compared to its closing price on the previous Friday.

As investors await further developments, the decision on the approval of Nvidia’s imports could represent a crucial juncture for the company and its shareholders. However, prospective investors should tread carefully; a recent report from The Motley Fool’s Stock Advisor identified ten stocks they believe are more promising than Nvidia at this time. Historical data shows that timely investments in recommended stocks can yield substantial returns, exemplified by Netflix and Nvidia itself, which have produced impressive returns for early investors.

Ultimately, the dynamics surrounding Nvidia’s operations in China and the potential approval of its H200 chips could significantly reshape the company’s future trajectory, marking a pivotal moment in the ongoing AI landscape.

See also Michael Dell Unveils $6.25B Investment for Children and Predicts AI Breakthrough in 2026

Michael Dell Unveils $6.25B Investment for Children and Predicts AI Breakthrough in 2026 Google, OpenAI, and Anthropic Compete to Master Pokémon AI Challenges on Twitch

Google, OpenAI, and Anthropic Compete to Master Pokémon AI Challenges on Twitch Cal Al-Dhubaib Drives Ethical AI Adoption for Top Ohio Brands Post-Pandata Acquisition

Cal Al-Dhubaib Drives Ethical AI Adoption for Top Ohio Brands Post-Pandata Acquisition Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere 95% of AI Projects Fail in Companies According to MIT

95% of AI Projects Fail in Companies According to MIT