Masayoshi Son’s $50 billion plan to take over Switch has collapsed. The SoftBank founder had been negotiating for months to buy the U.S. data center operator, hoping it would power the $500 billion Stargate AI project being launched with the Trump administration, OpenAI, Oracle, and MGX in Abu Dhabi. That deal is now dead, according to Bloomberg’s claims. No full acquisition. No January rollout. No direct control of the energy-hungry data center network Masa was counting on to make Stargate real.

SoftBank has now pulled out of the deal completely, according to insiders, and canceled plans to announce the buyout earlier this month. While talks are still ongoing, the new direction appears to be smaller in scope. Masa is considering a partial investment or some sort of partnership with Switch, although nothing is confirmed yet. The only significant move this month was SoftBank’s $3 billion acquisition of DigitalBridge, a major backer of Switch, yet this does not provide the hardware control Masa desired.

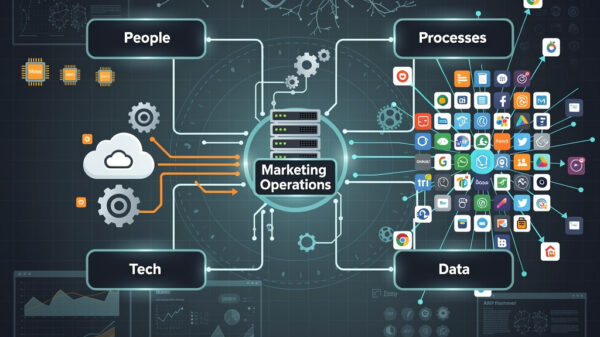

If this deal had gone through, it would have marked one of the largest acquisitions for the Japanese firm. Masa was planning to spend $100 billion immediately to establish U.S. data centers with his new partners. The objective was to gain a foothold in the global AI race, controlling physical infrastructure rather than merely funding it. However, some SoftBank executives raised concerns about managing extensive data campuses from Las Vegas to Atlanta, as well as the hefty $50 billion price tag.

Analysts Kirk Boodry and Chris Muckensturm commented, “The end of SoftBank’s deal talks with Switch leaves its data center plans in limbo, as Stargate announcements remain few and far between.” They noted that a partial stake would not afford Masa the level of control he typically exercises in transactions involving chips and physical AI systems, emphasizing that simply writing checks is not equivalent to operating machinery.

Meanwhile, Switch isn’t stagnating. The company’s backers are now considering an IPO, which could value the firm at $60 billion, including debt. Any potential deal with SoftBank would likely face scrutiny from the Committee on Foreign Investment in the U.S., potentially delaying proceedings further, especially under Trump’s second term, which has taken a tougher stance on strategic tech transactions.

Despite the collapse of the Switch buyout, Masa remains committed to his AI ambitions. Over the past year, SoftBank acquired an 11% stake in OpenAI, investing $22.5 billion just last month. Additionally, he purchased Ampere Computing for $6.5 billion and ABB’s robotics business for another $5.4 billion. These substantial investments necessitated asset sales; SoftBank divested its Nvidia shares, reduced its T-Mobile holdings, and increased margin loans using Arm stock as collateral.

However, this aggressive spending in AI is beginning to raise alarms. SoftBank’s credit is under pressure, with S&P Global warning that failure to divest assets or restructure soon could adversely impact credit scores. Analysts Kei Ishikawa and Makiko Yoshimura remarked, “If it does not take prompt easing measures, such as liquidation of held assets, pressure will intensify on the credit ratings.”

S&P added that it would reclassify SoftBank’s notes as having no equity content when the period remaining to effective maturity shortens to less than 15 years, as long as SoftBank’s long-term issuer credit rating remains in the ‘BB’ category. This means the company must maintain or refinance its hybrid securities, which are complex financial instruments that count as loss-absorbing capital.

Looking ahead, Switch remains a target, but the prospect of a full takeover appears closed. Masa has previously navigated similar situations, waiting years before eventually acquiring Arm Holdings in 2016. Discussions of a smaller partnership have emerged, potentially modeled after the Ohio site SoftBank operates with Taiwan’s Hon Hai. However, even that arrangement would not grant Masa the level of Stargate power he sought.

SoftBank has been attempting to capitalize on the AI wave since its inception. Although its early investments were substantial, it missed out on the hardware gold rush, with major gains going to chipmakers like Nvidia and TSMC. Stargate was intended to rectify this disparity.