Equinix: A Hidden Gem in AI Investing

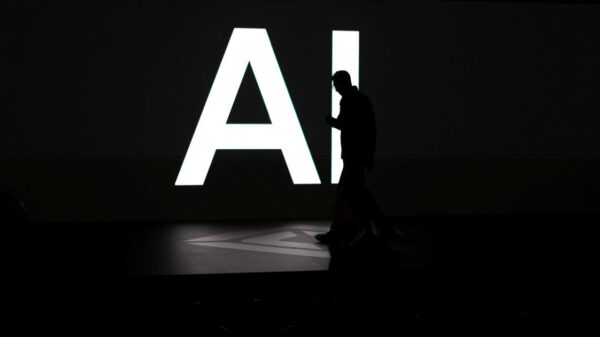

There’s no denying that artificial intelligence (AI) is one of the most transformative technological revolutions of our time, promising to reshape industries and create significant wealth for those who invest wisely. While many investors are focused on chipmakers and software companies, opportunities also lie in the often-overlooked data center sector. Equinix (NASDAQ: EQIX), the largest data center owner, presents a compelling option for those seeking exposure to the AI boom.

Data centers serve as the physical backbone of the internet and are essential for the operation of AI technologies. When users interact with generative AI applications like ChatGPT, the computing power required for those responses is housed in data centers. Equinix operates 273 data centers and leases space to over 10,000 customers, including major players like Nvidia and Adobe. Notably, more than 60% of Fortune 500 companies count Equinix among their service providers.

The demand for data centers has surged in recent years, fueled in part by the rapid growth of AI applications. In 2022, global AI data center spending reached $236 billion, with estimates projecting that annual spending could exceed $1 trillion by 2030—more than quadrupling current levels. This upward trajectory is further evidenced by Equinix’s recent quarterly results, which showed a 25% increase in bookings, indicating strong future revenue potential. The company is also well-positioned financially, with nearly 60 major data center projects in progress and approximately $7 billion in liquidity.

Equinix’s stock trades at around 20 times its funds from operations (FFO), a typical metric for evaluating real estate investment trusts (REITs). This valuation appears reasonable given the substantial market opportunity, particularly when some AI-related stocks are currently trading at higher multiples. For investors cautious about inflated valuations in the AI sector, Equinix offers a more grounded entry point.

Before making any investment decisions, it’s important to consider perspectives from other analysts. For instance, the Motley Fool Stock Advisor has not included Equinix in its current list of top stock recommendations, which features what they believe are the ten best stocks to buy at this time. Historical performance of the advisory service has shown outsized returns; if investors had placed $1,000 in Netflix on December 17, 2004, it would have grown to $464,439 by January 27, 2026. Similarly, a $1,000 investment in Nvidia on April 15, 2005, would have ballooned to $1,150,455 over the same period.

Equinix’s role in the burgeoning AI landscape cannot be understated. As AI technologies continue to evolve and integrate into various applications, the demand for robust, secure, and scalable data infrastructure will likely remain strong. With its extensive portfolio and strong financial standing, Equinix is poised to benefit from this trend, making it a noteworthy consideration for investors looking for alternatives to traditional AI stocks.

As the AI investment boom unfolds, the importance of reliable data infrastructure will only increase, and companies like Equinix are essential to this ecosystem. Investors seeking to tap into the AI revolution should consider how data centers, particularly Equinix, can play a critical role in their portfolios.

See also CGI and OpenAI Launch Global AI Alliance to Enhance Enterprise Transformation

CGI and OpenAI Launch Global AI Alliance to Enhance Enterprise Transformation Bridgewater CIOs Warn AI Spending Surge Risks Inflation, Limits GDP Impact in 2025

Bridgewater CIOs Warn AI Spending Surge Risks Inflation, Limits GDP Impact in 2025 Nvidia Invests €1.7B in Mistral, $600M in Quantinuum, and Backing for Revolut

Nvidia Invests €1.7B in Mistral, $600M in Quantinuum, and Backing for Revolut Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere

Germany”s National Team Prepares for World Cup Qualifiers with Disco Atmosphere