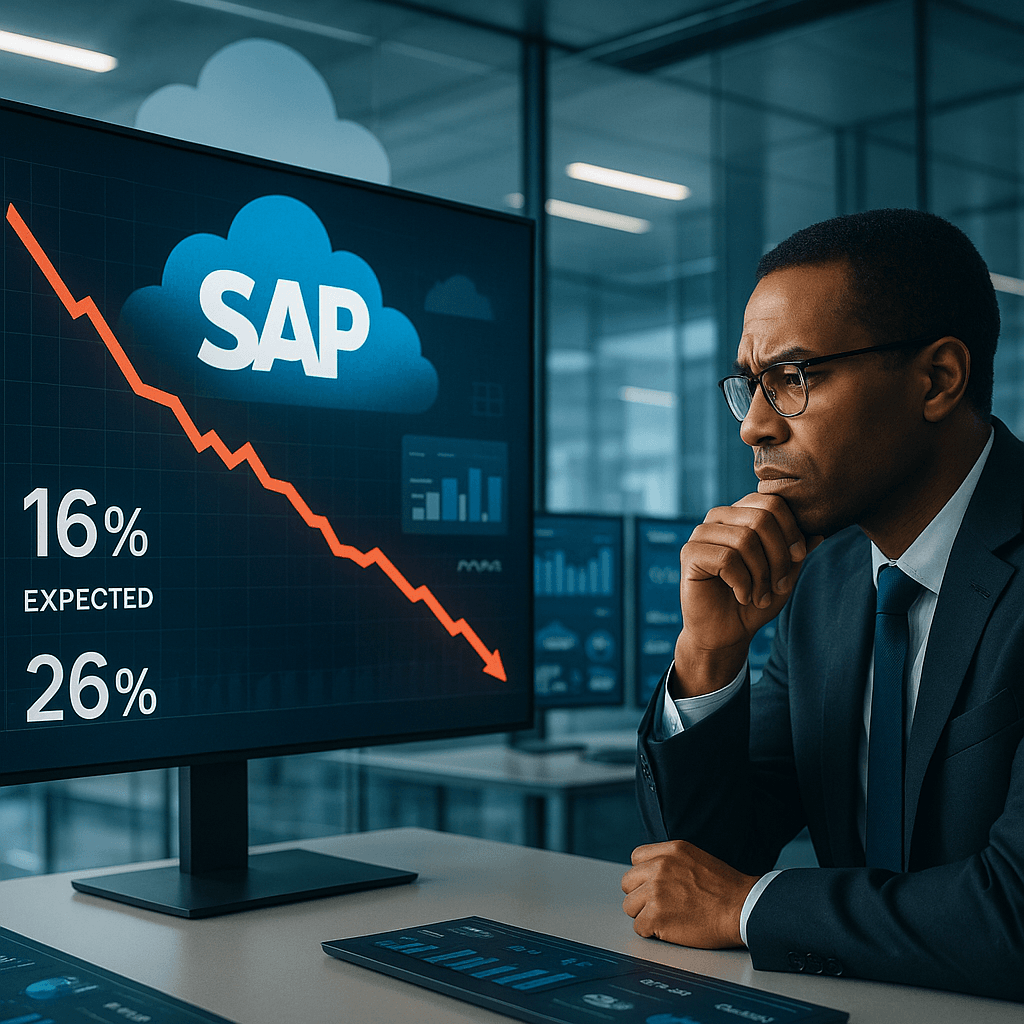

SAP shares plummeted 11% on Thursday, marking the company’s most significant trading loss in over four years, as investors reacted to disappointing fourth-quarter results that revealed a cloud backlog growth of just 16%, falling short of the 26% analysts had anticipated. The steep decline represents SAP‘s worst single-day performance since October 2020, when the stock fell 22% after another earnings miss. The downturn has raised concerns regarding SAP‘s cloud transformation strategy amid increasing competition in the enterprise software sector.

The German enterprise software giant reported a cloud backlog totaling €21.1 billion ($25.3 billion), a figure that, while substantial, did not meet the expectations of investors. The notable discrepancy—the 10-percentage-point shortfall in growth—has caused a ripple effect throughout the enterprise software industry, as market participants question whether SAP‘s multi-year initiative to transition customers from traditional on-premise systems to cloud-based subscriptions is losing steam.

In an effort to soften the impact of this disappointing news, SAP pointed to what it described as “large transformational deals” that involved complex revenue recognition issues. According to the company, these high-value contracts, which include significant revenue ramps in subsequent years and legally mandated termination clauses, reduced cloud backlog growth by about 1 percentage point. However, this explanation has done little to bridge the gap between actual performance and market expectations.

CEO Christian Klein attempted to maintain an optimistic outlook despite the figures, asserting that the fourth-quarter cloud backlog has established a “strong foundation” for revenue growth through 2027. Yet, the company also cautioned that cloud backlog growth is expected to “slightly decelerate” in 2026, presenting a mixed message that has failed to reassure anxious investors.

The ramifications of this underperformance extend beyond just stock prices; SAP is now facing heightened scrutiny as it navigates a competitive landscape increasingly dominated by agile cloud providers. The reaction from the market underscores the pressure on traditional software giants to innovate and adapt in an era where seamless cloud offerings are becoming the standard.

The current situation reflects a broader challenge for many companies in the enterprise software space struggling to keep pace with expectations set by their rapid growth in cloud services. As SAP endeavors to implement its ambitious cloud strategy, the misalignment between actual and expected growth raises critical questions about the viability and sustainability of its current trajectory.

With its stock heading towards its lowest close since mid-2024, SAP is forced to confront the reality that even established leaders in enterprise software are not immune to growth challenges. As investors continue to process the news, the implications for SAP and the wider industry could signal a recalibration of expectations and strategies moving forward.

See also Bank of America Warns of Wage Concerns Amid AI Spending Surge

Bank of America Warns of Wage Concerns Amid AI Spending Surge OpenAI Restructures Amid Record Losses, Eyes 2030 Vision

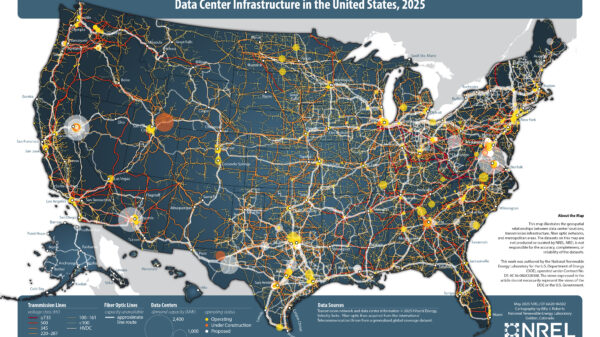

OpenAI Restructures Amid Record Losses, Eyes 2030 Vision Global Spending on AI Data Centers Surpasses Oil Investments in 2025

Global Spending on AI Data Centers Surpasses Oil Investments in 2025 Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge

Rigetti CEO Signals Caution with $11 Million Stock Sale Amid Quantum Surge Investors Must Adapt to New Multipolar World Dynamics

Investors Must Adapt to New Multipolar World Dynamics